Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »Keith Weiner, PhD, CEO & Founder of Monetary Metals

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion. [embedded content] Related posts: Keith Weiner Gets Interviewed Is Keith Weiner an Iconoclast? Report 28 Apr Monetary Metals Leases Silver to Money Metals Exchange Monetary Metals...

Read More »More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops. “OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!” The National Balance Sheet In the first part of this series, we introduce some concepts from...

Read More »In defense of Switzerland

Prof. Angelo M. Codevilla An interview with Prof. Angelo M. Codevilla Following decades of the propagation of a false historical narrative regarding Switzerland’s role during WWII, an entire generation, especially in the West, has grown up with a distorted version of events, based on unfounded and unsubstantiated claims. To set the record straight, Claudio Grass interviewed Professor Codevilla, whose book “Between The...

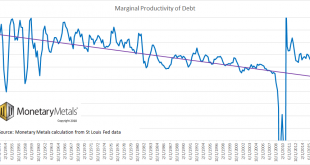

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail,...

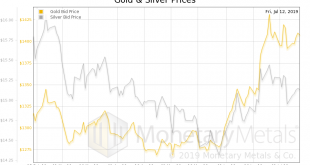

Read More »Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years. Gold is overbought and may go lower or higher in the short term, but the many financial, geopolitical and monetary risks in the world are issues which are here to stay. This bodes well for the price of gold and should...

Read More »Keith Weiner Gets Interviewed

Our economic views and unique product are generating buzz. There have been a number of interviews recently (more will be posted soon). Lobo Tiggre interviewed Keith Weiner (video) about the unique Monetary Metals business model to pay interest on gold. Silver Bullion interviewed Keith Weiner (video) when he visited Singapore, about the belief that Basel III regulations are good for the price of gold. Claudio Grass...

Read More »GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth. Borrowing to Consume Today,...

Read More »Gold is the secret knowledge of the financial universe

Interview with Chris Powell Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research. This is why I have personally been following the work of...

Read More »Big Tech, Big Banks Push for “Cashless Society”

The War on Cash isn’t a conspiracy theory. It’s an open agenda. It’s being driven by an alignment of interests among bankers, central bankers, politicians, and Silicon Valley moguls who stand to benefit from an all-digital economy. Last week, Facebook – in partnership with major banks, payment processors, and e-commerce companies – launched a digital currency called Libra. Unlike decentralized, free-floating...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org