For first time in over 16 years, palladium futures settle at a premium to gold futures Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S. Caution among traders had deepened “ahead of a no-confidence vote on British Prime Minister Theresa May’s government and other...

Read More »The Strongest Season for Silver Has Only Just Begun

Commodities as an Alternative Our readers are presumably following commodity prices. Commodities often provide an alternative to investing in stocks – and they have clearly discernible seasonal characteristics. Thus heating oil tends to be cheaper in the summer than during the heating season in winter, and wheat is typically more expensive before the harvest then thereafter. Precious metals are also subject to seasonal...

Read More »Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies – Physical demand for gold coins and bars has picked up in the UK and Ireland,...

Read More »Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC

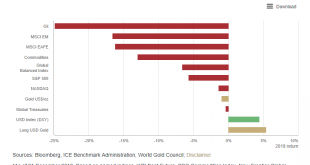

Gold Outlook 2019 – World Gold Council As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability monetary policy and the US dollar structural economic reforms. Against this backdrop, we believe that gold has an increasingly relevant role to...

Read More »Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager Global Allocation Fund adding to gold exposure through ETFs Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising” Gold bullion has been a “store of value for a very long time” by Bloomberg News Gold may extend gains as global growth slows, equity market volatility remains elevated and the Federal Reserve is expected...

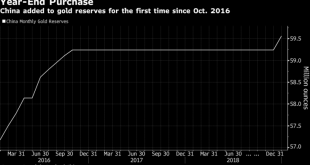

Read More »China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

China increases gold holdings by large 320,000 ounces Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces Gold climbed 5% in December on equity rout, growth concerns by Bloomberg:...

Read More »Change is in the Air – Precious Metals Supply and Demand

Fundamental Developments: Physical Gold Scarcity Increases Last week, the price of gold rose $25, and that of silver $0.60. Is it our turn? Is now when gold begins to go up? To outperform stocks? Something has changed in the supply and demand picture. Let’s look at that picture. But, first, here is the chart of the prices of gold and silver. Gold and Silver Price(see more posts on gold price, silver price, )Gold and...

Read More »The Recline and Flail of Western Civilization and Other 2019 Predictions

The Recline and Flail of Western Civilization and Other 2019 Predictions “I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018 Darts in a Blizzard Today, as we prepare to close out the old, we offer a vast array of tidings. We bring words of doom and despair. We bring words of contemplation and reflection. And we also bring words of hope...

Read More »Are Stocks Overvalued, Report 24 Dec 2018

We could also have entitled this essay How to Measure Your Own Capital Destruction. But this headline would not have set expectations correctly. As always, when looking at the phenomenon of a credit-fueled boom, the destruction does not occur when prices crash. It occurs while they’re rising. But people don’t realize it, then, because rising prices are a lot of fun. They don’t realize their losses until the crash. So we...

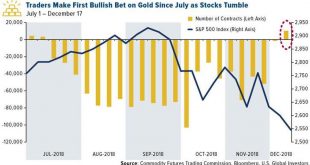

Read More »Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data. As many of you know, December has historically been a strong...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org