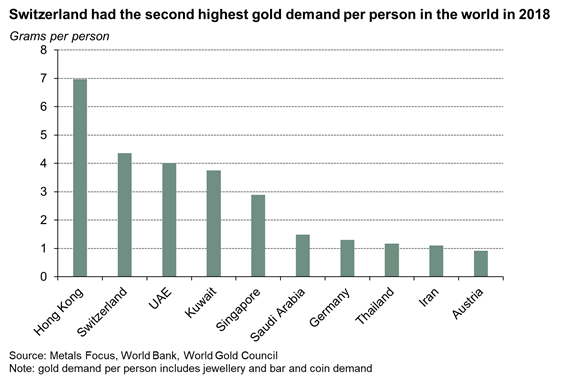

Investors in Switzerland like gold and it is the second most popular investment after property or real estate 20% plan to invest in gold in the next 12 months Almost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the world, a significant over-the-counter gold trading market and is home to the some of the world’s largest, most technologically advanced gold refiners. And the Swiss central bank holds a lot of gold too – 1,040t all told – the eighth largest central bank gold holding in the world. Now, courtesy of a

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

by Alistair Hewitt of the World Gold Council There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the world, a significant over-the-counter gold trading market and is home to the some of the world’s largest, most technologically advanced gold refiners. And the Swiss central bank holds a lot of gold too – 1,040t all told – the eighth largest central bank gold holding in the world. Now, courtesy of a research team at the University of St Gallen, we have insights into how Swiss investors think about gold and other precious metals. In April, the research team surveyed 2,300 adults from German-, French- and Italian-speaking regions. Standout stats include:

|

Switzerland gold demand |

| These insights resonate strongly with research we conducted in 2016 assessing the attitudes of 2,000 German retail investors and illustrate the shared affinity that German and Swiss investors have with gold. And, as an aside, it is interesting that Austria also features in the top ten countries when ranked by gold demand per person. While it is easy to focus on India and China – the world largest gold markets – Europe is home to three countries with significant per capita gold demand. You can find the full report on the University of St Gallen’s website here.

And you can find gold demand per capita data in our supply and demand statistics here. What do Swiss investors think of gold? Access WGC Blog Here Everything that you need to know about storing gold in Switzerland: |

Tags: Daily Market Update,Featured,newsletter