Incrementum Advisory Board Discussion Q3 2018 with Special Guest Kevin Duffy “From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it...

Read More »Jim Rogers and the World’s New Reserve Currency

Today we’re bringing you another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and “Adventure Capitalist”, Jim Rogers. In this clip Jim tells us what he thinks about the long-term safe-haven status of the US dollar and what he sees as the future for the Euro currency. Jim also give us his opinion on what he suspects might be the currency to emerge as the only viable but necessary...

Read More »Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

By: Rachel Koning Beals – News Editor Marketwatch Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated...

Read More »Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner “Gold is going to enter a new bull market” “The first cycle will bottom after the summer” “$1,212 per ounce is our downside target” “It’s going to top $2,500 per ounce . . . in about two years or so” “Gold is in a bull market even though it came down from $1,900 per ounce” In our featured video today, Greg Hunter interviews Charles Nenner, President of The Charles Nenner...

Read More »Separating Signal from Noise

Claudio Grass in Conversation with Todd “Bubba” Horwitz Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide...

Read More »A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far. Few economists...

Read More »Valuing Gold In A World Awash With Dollars

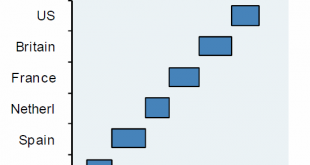

In this article I point to the pressures on the Fed to moderate monetary policy, but that will only affect the timing of the next cyclical credit crisis. That is going to happen anyway, triggered by the Fed or even a foreign central bank. In the very short term, a tendency to moderate monetary policy might allow the gold price to recover from its recent battering. Unlike the last credit crisis when the dollar rose...

Read More »A Scramble for Capital

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously...

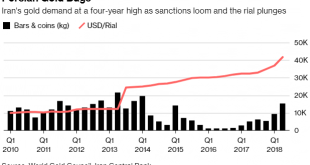

Read More »Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars” As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week We’ve always said that you should have a bit of physical gold in your portfolio (about 5%-10%, depending). And note that, by gold, we do mean gold, not gold miners. If you...

Read More »Crying Wolf – Precious Metals Supply and Demand

Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents last week. Perspective: if you are waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the market price of gold is at a 7.2% discount to the fundamental price vs. 4.6% last week). If you wanted to sell, this wasn’t a good week to wait. Which is your...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org