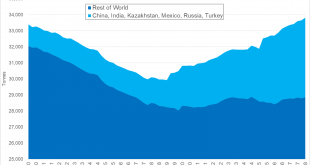

– There has been a recent change for the better in central bank attitudes to gold – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification” – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics – Little in the current global economic and political environment to support any...

Read More »We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops. It wants lower rates (so the government can borrow more, more cheaply)...

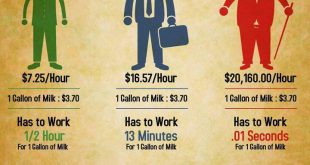

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

Read More »Trump’s Backdoor Power Play to Rein In the Fed

“Just run the presses – print money.” That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House. Trump disputes many of the anecdotes Woodward assembled. But regardless of whether the President used those exact words, they do reflect an “easy money”...

Read More »US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established. The chart below illustrates the situation – it compares the...

Read More »Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance. Netflix is spending money (well Federal Reserve Notes) producing its own...

Read More »Rep. Alex Mooney: Bring Back Gold!

This article originally appeared here. Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long...

Read More »Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued....

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org