Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We’re accustomed to three basic templates for system-wide solutions or improvements: 1. an individual “builds a better mousetrap” and starts a company to exploit this competitive advantage; 2. a company invents something that spawns a new industry (the photocopier, the web browser, for example)...

Read More »Getting Their Pound of Flesh – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

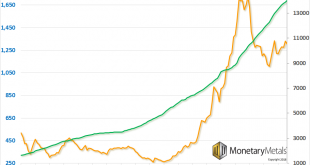

Read More »Chinese Gold Market: Still in the Driving Seat

With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world. For various reasons such as cross-border trade rules, VAT rules and deep liquidity, nearly all physical...

Read More »Bitcoin — when mainstream?

Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns. The crypto market is still mainly populated by private investors. Institutional investors, especially Wall Street, are not...

Read More »US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

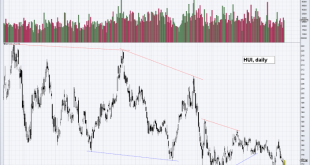

US Money Supply Growth Stalls Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a...

Read More »The Great Gold Upgrade, Report 15 July 2018

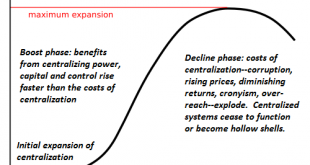

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed...

Read More »Learn about Crypto’s true revolutionary potential

The publication of the Bitcoin white paper immediately after the outbreak of the global financial crisis in 2008 is hardly a mere coincidence. The financial collapse especially touched on one crucial question: Money talks, but who talks money if you will? According to Satoshi Nakamoto, the pseudonym behind Bitcoin, it’s the world’s central and commercial banks which rule over our money. As a careful analysis of the...

Read More »The Gold Sector Remains at an Interesting Juncture

Technical Divergence Successfully Maintained In an update on gold and gold stocks in mid June, we pointed out that a number of interesting divergences had emerged which traditionally represent a heads-up indicating a trend change is close (see: Divergences Emerge for the details). We did so after a big down day in the gold price, which actually helped set up the bullish divergence; this may have felt...

Read More »Gold – Macroeconomic Fundamentals Improve

A Beginning Shift in Gold Fundamentals A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm. The eternal popularity contest… - Click to...

Read More »The Great Reset, Report 8 July 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org