A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature. That is, volatility in the upward direction was loved by everyone who said that bitcoin is money, in their desire to make money. In...

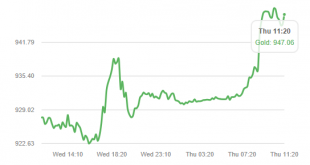

Read More »Pound Falls 2.5 percent Against Gold as UK Government in Turmoil Over Brexit

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit. The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms. The pound slumped the most in more than 17 months as several U.K. ministers resigned...

Read More »The Failure of a Gold Refinery, Report 12 Nov 2018

So this happened: Republic Metals, a gold refiner, filed bankruptcy on November 2. The company had found a discrepancy in its inventory of around $90 million, while preparing its financial statements. We are not going to point the Finger of Blame at Republic or its management, as we do not know if this was honest error or theft. If it was theft, then we would not expect it to be a simple matter of employees or...

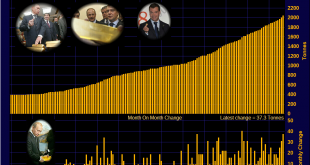

Read More »Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy Strong central bank and store of value coin and bar demand offset the gold ETF outflows in Q3 Central bank gold reserves grew 148.4t in Q3, up 22% yoy Gold coin and...

Read More »Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe...

Read More »Pushing Past the Breaking Point

Schemes and Shams Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make...

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

Read More »Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

(by Reuters from BOSTON, LBMA) The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium. Spot gold has had a difficult few months, falling from a high of $1,366.07 in...

Read More »Smart Valor tackles cryptocurrency volatility problem

Pegging cryptocurrencies to traditional currencies is seen by some to be the answer to price volatility. Cryptoasset trading platform Smart Valor plans to launch a new cryptocurrency pegged to the Swiss franc. The CHFt coin will join a growing list of so-called ‘stable coins’ designed to dampen the huge price swings of cryptocurrencies, such as bitcoin, which limits their everyday use. Smart Valor said on Monday that it...

Read More »What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / <insert favorite bugaboo here>. When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org