There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the highest quarterly level since Q4 of 2015. True, there have been a number of ‘new’ central banks announcing gold purchases recently, such as India, Poland and Hungary, central banks that had not been buying gold for a long time until now, but as the World Gold Council admits in its Q3 report, “Russia, Turkey

Topics:

Ronan Manly considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Bank of England, Bank of Russia, Central Banks, Featured, gold demand, gold price, Hungary, India, LBMA, marginal demand, Mongolia, newsletter, Poland, Reserve Bank of India, Ronan Manly (Bullionstar), Uncategorized, World Gold Council

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the highest quarterly level since Q4 of 2015.

True, there have been a number of ‘new’ central banks announcing gold purchases recently, such as India, Poland and Hungary, central banks that had not been buying gold for a long time until now, but as the World Gold Council admits in its Q3 report, “Russia, Turkey and Kazakhstan continue to account for the lion’s share of purchases“.

And to what extent if any does this central bank gold buying affect the overall gold demand, gold demand at the margin, and by extension does central bank gold buying have any impact on the international gold price? Much of the gold accumulation that the World Gold Council refers to is executed by countries, such as Russia and Kazakhstan, that buy their own gold mining output in a closed-loop. Much of the other central bank gold transacting, such as by India, Hungary and Poland, has been done via central bank trading desks / the London Gold Market where the entire market is opaque with no trade reporting and no information on trade counterparties. Since in general the central bank gold market is ultra secretive and exempt from all manner of reporting, there is often not even any proof of anything much in the central bank gold market nor even any evidence in a lot of cases that the claimed trades have even taken place.

There is also no evidence that this central bank gold buying has any effect on the international gold price despite what, for example an article such as “Buying by central banks & ETFs set to propel gold prices higher” claims. So its instructive to look at some of this central bank gold buying and ask to what extent it could impact overall gold demand and could it have any impact on the gold price.

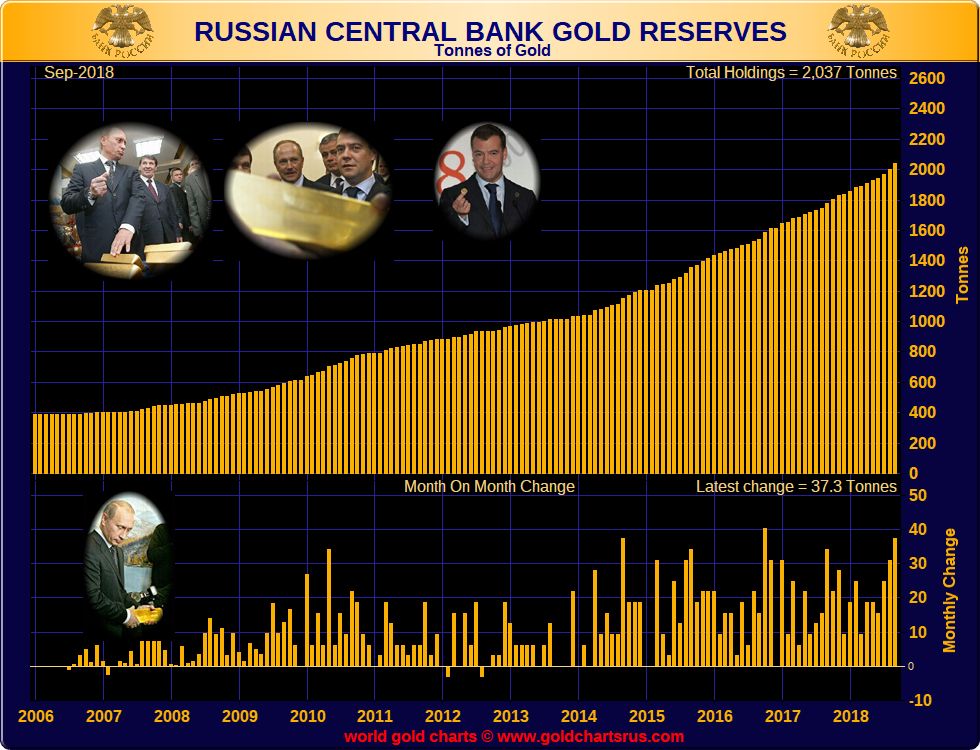

Russia – From the Mines to the VaultsIn all of the recent financial media commentary about central bank gold buying, the Bank of Russia (the Russian Federation’s central bank) has taken center-stage as the main official sector gold buyer that has both boosted the global central bank net gold buying numbers, and that has been the poster child to back up claims that central bank gold buying will boost the gold price. For the 9 months to the end of September, the Bank of Russia added 199.4 tonnes of gold to its reserves, and now claims to hold 2037 tonnes of gold in its strategic reserves. And for the full year to the end of 2018, the Bank of Russia is now on target to add over 230 tonnes of gold. This would exceed the 224 tonnes of gold it purchased in 2017, the 199 tonnes it bought in 2016, and the 208 tonnes of gold is purchased in 2015. However, the often overlooked but important points about Russian State gold buying, are that a) it’s a long-standing strategic policy in the public domain that the Russians have been pursuing for a number of years now which means that the ‘market’ knows about it , and b) the Bank of Russia sources its gold from Russian gold mines using Russian banks to intermediate. This second point gets almost no attention from anyone in the financial media, but is important since Russian gold buying more or less exists in a closed-loop from Russian gold mines to Bank of Russia gold vaults. Briefly put, a small number of Russia’s large commercial banks (such as VTB Bank, Bank Otkritie, Sberbank, MDM, and Gazprombank) are licensed by and have been appointed by the Russian government to intermediate between the Russian gold producers (mines) and the Bank of Russia by buying gold from the miners under long-term sales agreements with the producers, and then selling this gold on the Russian central bank (after its been refined). |

Bank of Russia gold reserves accumulation 2006 – 2018. Source: www.goldchartsrus.com - Click to enlarge |

If this system did not exist, a lot of this gold would probably still be in the ground within the gold mining regions of the Russian Federation instead of in the Bank of Russia’s vaults in Moscow and St Petersburg. True, the Russian State wants this gold in its strategic gold reserves and has developed this system by which to procure its own national in-ground gold reserves, but as a closed-loop operation from Russian mines to the Russian central bank and as a long-standing publicly signaled policy, is this the same as central banks suddenly entering the gold market and buying after years of inactivity? And is the Russia State gold buying even affecting the international gold price?

I would argue no on both counts. Firstly, the international gold price is not determined in the physical gold markets but is determined in the synthetic cash-settled unallocated paper gold market of London and in the equally synthetic and derivative based COMEX gold futures trading run out of New York. See Bullionstar article here for a full discussion.

Secondly, the Russian State is accumulating gold as a strategic reserve primarily because it is lucky to have this gold in relatively large quantities as a natural resource within its national borders. The Russian State gold accumulation system is most importantly a closed loop which has no impact on gold demand on any international gold market. The argument could be made that the Russians might buy gold on the international market if they did not have their own domestically mined gold, but equally they might not. The same goes for Kazakhstan whose central bank, the National Bank of Kazakhstan, now holds 335 tonnes of gold, and which has been routinely accumulating significant quantities of gold over the last number of years by buying its own domestically mined gold.

Mongolia – A Closed-LoopThe Mongolian central bank is has also been referenced recently by the World Gold Council as a gold buyer of its nation’s gold reserves, but like the Russian Federation, Mongolian gold buying exists in a closed loop within the domestic economy where the central bank draws in locally mined gold under an initiative called the “National Gold to the Fund of Treasures” which encourages gold miners and individuals to sell domestically mined gold. For the first 10 months of 2018, the Bank of Mongolia, Mongolia’s central bank, announced that it had bought 17.7 tonnes of gold for the national ‘Treasury Fund’, with 7.1 tonnes accumulated in the six months to the end of June, and another 10.6 tonnes purchased from July to October, a time frame which coincides with the peak gold mining season in Mongolia. All of this gold was purchased within Mongolia from ‘legal entities and individuals’. This follows 2017 when the Bank of Mongolia bought 20 tonnes of gold, again from local gold producers. The central bank has a full year target to buy 22 tonnes of gold, which would mean it needs to procure another 4.3 tonnes in the fourth quarter. Like the case of the Bank of Russia and the case of Kazakhstan, the Bank of Mongolia has been incentivising its domestic gold mining sector to mine and sell this gold to the central bank. This buying has no effect on gold demand in the international markets and no effect on the international gold price. |

India – Gold Transactions at the BoE and BIS

The Reserve Bank of India also emerged as a central bank gold buyer in 2018, buying 8.1 tonnes of gold in the first half of the year, mostly in March and June, and then more significantly announcing that it had bought another 13.7 tonnes of gold in July and August, bringing its claimed gold purchases for the year to date (end of August) to 21.8 tonnes.

Prior to 2018, the last time the RBI claims to have bought gold (apart from 0.3 tonnes in December 2017) was in November 2009 when the RBI says it purchased 200 tonnes of gold from the International Monetary Fund (IMF).

Analysing where these recent gold purchases might have been made, the RBI’s 2018 annual report is helpful in that it states that during the financial year to end of June 2018, the RBI bought 8.46 tonnes of gold bringing its total gold reserves holdings to 566.23 tonnes. Prior to that the RBI’s gold holdings totalled 557.77 tonnes. The 8.46 tonnes purchased in the financial year to the end of June 2018 is held abroad since of the 557.77 tonnes of gold held since 2009, 265.49 tonnes had been stored at the Bank of England and with Bank for International Settlements, and 292.30 tonnes stored domestically in the RBI gold vaults in Nagpur.

In its latest annual report, the RBI says that the same 292.30 tonnes of gold are “held as backing for notes issued as an asset of Issue Department” while “the balance of 273.93 metric tonnes” (which is 265.49 + 8.46 tonnes) is “treated as an asset of Banking Department.” Therefore the 8.46 tonne addition of gold that was added from December 2017 to June 2018 is not part of the 292.30 tonnes but is held outside India with the 265.49 tonnes, most likely at the gold vaults of the Bank of England. This means that the 13.7 tonnes of gold the RBI bought in July and August is also most likely also held outside India, i.e. at the Bank of England in London.

Since there are no details from the RBI as to what form its recent gold purchases took and who the counterparties were nor on whether the gold is held in custody or whether this gold has been lent out, swapped, or put in short-term rolling gold deposits, then it’s not clear at all if the RBI gold purchases have had any net impact on gold demand in the market.

Poland – Gold out on Loan

According to Poland’s central bank, Narodowy Bank Polski (NBP) and IMF data, the NBP purchased 13.7 tonnes of gold in recent months, adding 1.9 tonnes in July, 7.5 tonnes in August, and another 4.4 tonnes in September. Following these purchases the NBP now claims to hold 116.7 tonnes of gold in its reserves.

Given that the 103 tonnes of gold that the NBP held before these recent purchases was held at the Bank of England and most importantly was loaned out as short-term gold deposits with bullion banks, (see ‘Poland section’ here), then Poland’s recently purchased gold (i.e. 13.7 tonnes) has most likely also been loaned out to bullion banks, and the transactions would have been those of buying the gold and immediately lending it out to the London Gold Market, at which point it could have been sold again by the borrower.

Therefore in Poland’s case, it’s possible that the recently purchased gold has not, on a net-net basis contributed anything to real demand for physical gold.

Hungary – Bringing it All Back HomeIn what was probably the most surprising development in this spate of recent central bank gold purchases, Hungary’s central bank, Magyar Nemzeti Bank (MNB), announced in October that it had boosted its gold reserve holdings by 1000% or 10 fold, from 3.1 tonnes up to 31.5 tonnes. In a press release to coincide with the announcement,the MNB said that it had purchased the gold (28.4 tonnes) in ‘physical form’ (gold bars), and most interestingly, that it had repatriated all of this newly purchased gold back to Hungary. See BullionStar article ‘In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves‘ for full details. In March of this year, the MNB had also repatriated its original 3.1 tonnes of gold from the Bank of England in London back to Hungary. See the MNB’s March announcement on the MNB website here (in Hungarian language). While the latest MNB announcement during October did not specifically say where the 28.4 tonnes of newly purchased gold was repatriated from, we can assume that it was repatriated from London since the original 3.1 tonnes from also repatriated from London. |

By extension, this would most likely mean that the Hungarian central bank bought its 28.4 tonnes of gold bars in London, either using the services of the Bank of England or a London-based bullion bank, or both. This purchase transaction would on a standalone basis create net new demand for physical gold unless the other side of the transaction had been another central bank selling the same gold. One candidate for this sale could be the central bank of Morocco which in August sold 18.8 tonnes of gold and shrunk its gold holdings from 22 tonnes to just 3.3 tonnes.

Some or all of Hungary’s gold purchase could have contributed to a net increase in the demand for physical gold in the secondary market and might have to have been sourced from gold-backed ETFs, bullion bank inventory stocks, or gold borrowed from other central banks. Equally, the Hungarian gold could have been sourced from another central bank selling at the Bank of England, a seller who as of now has still not revealed that they were a seller. As the central bank gold market is ultra-secretive, its impossible to know one way or the other.

Conclusion

Central banks hold gold as a reserve asset for a number of reasons including portfolio diversification, as a hedge against fiat currencies, as a safe haven or form of financial insurance (stability), and as a way of earning a return through active management. The current spate of increased central bank interest in gold is definitely a positive development and in some cases is signalling that various central banks have less confidence in the current monetary system and might see a role for gold in a future international monetary system.

But it is dangerous for the media and the World Gold Council to group all central bank gold purchases into the same basket, since the motivations of individual central banks are not the same and the manner in which they accumulate gold is not identical. It is also erroneous for media articles to claim that central bank gold buying will boost overall global gold demand or boost the gold price when in some cases the gold accumulation is from mines direct to central banks and in other cases it’s not even clear (due to market secrecy) what type of transactions the central banks used to ‘acquire’ their gold.

It would be far more effective if the World Gold Council and the financial news agencies reported on what type of transactions a lot of these central bank gold trades (such as by India and Poland) actually are, as well as started to ask real questions to the Bank of England and the LBMA about why there is no detailed and transparent reporting of all central bank gold trades in the market including gold loans, gold swaps and the real state of central bank physical gold holdings excluding gold loans.

Tags: Bank of England,Bank of Russia,central banks,Featured,gold demand,gold price,Hungary,India,LBMA,marginal demand,Mongolia,newsletter,Poland,Reserve Bank of India,Uncategorized,World Gold Council