For the first time since we began publishing this Report, it is a day late. We apologize. Keith has just returned Saturday from two months on the road. Unlike the rest of the world, we define inflation as monetary counterfeiting. We do not put the emphasis on quantity (and the dollar is not money, it’s a currency). We focus on the quality. An awful lot of our monetary counterfeiting occurs to fuel consumption spending....

Read More »How Faux Capitalism Works in America

Stars in the Night Sky The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes. The short-term significance of the DJIA’s 8 percent decline...

Read More »The Big Picture: Paper Money vs. Gold

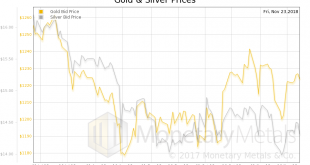

Numbers from Bizarro-World The past few months have been really challenging for anyone invested in gold or silver; for me personally as well. Despite serious warning signs in the economy, staggering debt levels and a multitude of significant geopolitical threats at play, the rally in risk assets seemed to continue unabated. In fact, I was struggling with this seeming paradox myself. As I kept looking at the state of...

Read More »Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

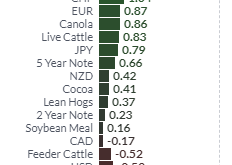

Close Gain/Loss On Week Gold $1248.40 +$10.10 +2.19% Silver $14.63 +$0.25 +3.25% XAU 67.94 +2.40% +5.40% HUI 153.93 +2.58% +6.13% GDM 560.05 +2.34% +5.32% JSE Gold 1201.13 -0.09 +9.31% USD 96.60 -0.14 -0.61% Euro 114.10 +0.24 +0.80% Yen 88.80 +0.01 +0.67% Oil $52.61 +$1.12 +3.30% 10-Year 2.856% -0.031 -4.86% Bond 143.90625 +0.34375 +2.27% Dow 24388.95 -2.24% -4.50% Nasdaq 6969.25 -3.05% -4.93% S&P 2633.08 -2.33%...

Read More »The Prodigal Parent, Report 9 Dec 2018

The Baby Boom generation may be the first generation to leave less to their children than they inherited. Or to leave nothing at all. We hear lots—often from Baby Boomers—about the propensities of their children’s generation. The millennials don’t have good jobs, don’t save, don’t buy houses in the same proportions as their parents, etc. We have no doubt that attitudes have changed. That the millennials’ financial...

Read More »A Global Dearth of Liquidity

Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details). The liquidity drought is not confined to the US – it is fair to say that it is a global...

Read More »Why Buy Gold Now? Because Of The “I Don’t Knows”…

From 2000 through 2012, the price of gold increased every year, rising from around $280 an ounce to nearly $1,700. It was an unprecedented run. Then, in 2013, gold took a nose dive, losing over 27% of its value. It was widely reported that the Swiss National Bank, the former bastion of monetary conservatism, lost $10 billion that year just on its gold holdings. As you probably know, central banks hold a portion of their...

Read More »Inflation, Report 2 Dec 2018

What is inflation? Any layman can tell you—and nearly everyone uses it this way in informal speech—that inflation is rising prices. Some will say “due to devaluation of the money.” Economists will say, no it’s not rising prices per se. That is everywhere and always the effect. The cause, the inflation as such, is an increase in the quantity of money. Which is the same thing as saying devaluation. It is assumed that each...

Read More »A Golden Renaissance, Report 25 Nov 2018

A major theme of Keith’s work—and raison d’etre of Monetary Metals—is fighting to prevent collapse. Civilization is under assault on all fronts. The Battles for Civilization There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist Khashoggi killed. New Zealand now can force travellers to...

Read More »The Interesting Seasonal Trends of Precious Metals

Precious Metals Patterns Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well. Although gold and silver are generally perceived...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org