Gold ETFs saw inflows in volatile October as investors again hedged risk Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of USB in inflows Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy Strong central bank and store of value coin and bar demand offset the gold ETF outflows in Q3 Central bank gold reserves grew 148.4t in Q3, up 22% yoy Gold coin and bar investors took advantage of the price dip and demand for gold coins and bars rose 28% yoy - Click to enlarge The latest research from the World Gold Council on gold demand trends in Q3 and demand for gold ETFs in October are must reads and point to strong ongoing demand which bodes well for

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

|

| The latest research from the World Gold Council on gold demand trends in Q3 and demand for gold ETFs in October are must reads and point to strong ongoing demand which bodes well for the gold market in the coming months.

According to the World Gold Council, gold demand was 964.3t in Q3 which was 6.2t higher y-o-y. Gold coin and bar demand jumped 28% to 298.1t as investors and store of value buyers took advantage of the lower gold price and sought protection against currency weakness and tumbling stock markets. |

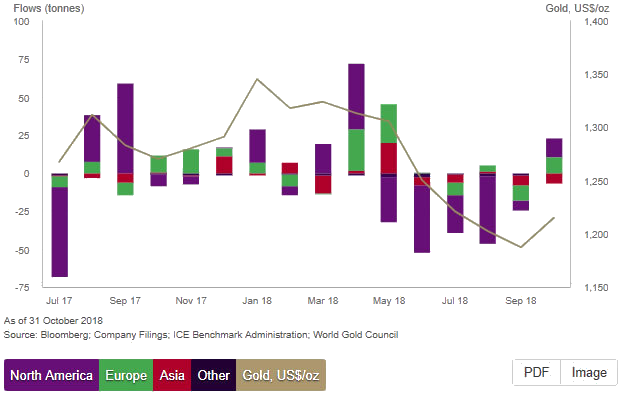

Gold Demand, Jul 2017 - Nov 2018 |

| Jewellery demand rose 6% in Q3 as lower prices seem to have caught Asian consumers’ attention. Technology registered its eighth consecutive quarter of y-o-y growth, up 1%.

Central bank gold buying was robust again as a growing number of central bank buyers saw demand in this sector rise 22% y-o-y to 148.4t, the highest level of quarterly net purchases since 2015. The 13% rise in global gold demand offset large ETF outflows, primarily from the U.S. market. However, those gold ETF outflows reversed in a very volatile October and global gold ETFs and similar products rose in October by 16.5 tonnes(t) to 2,346t which was the equivalent to US$1.0bn in inflows |

|

| Excellent research, data and charts from WGC here:

Positive inflows in gold-backed ETFs as investors hedge risk (Gold.org) |

Learn More and Watch Direct Access Gold Video & Podcast Here |

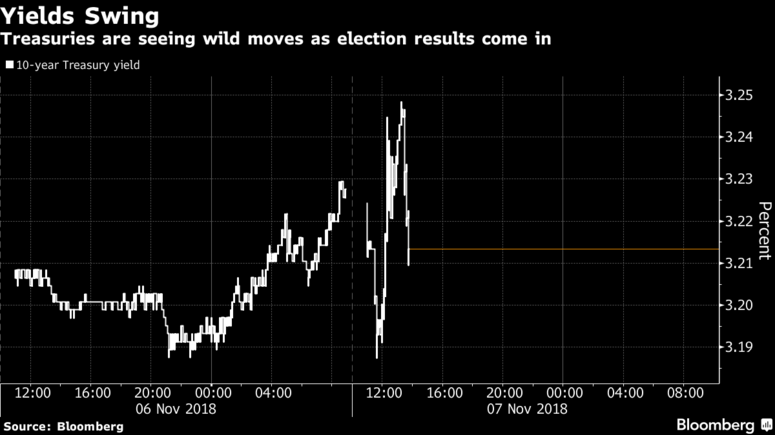

U.S. Treasuries Moves Election Results |

Tags: Daily Market Update,Featured,newsletter