There is a name for this institutionalized, commoditized fraud: moral decay. Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It’s hard to keep current…), and we’re suitably indignant when non-partisan corruption is discovered in supposed...

Read More »America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities

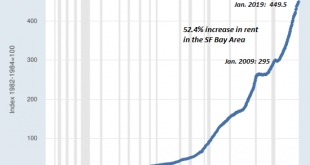

The forced flight from unaffordable and dysfunctional urban regions is as yet a trickle, but watch what happens when a recession causes widespread layoffs in high-wage sectors. For hundreds of years, rural poverty has driven people to urban areas: cities offer paying work and abundant opportunities to get ahead, and these financial incentives have transformed the human populace from largely rural to largely urban in the...

Read More »China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in. The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest...

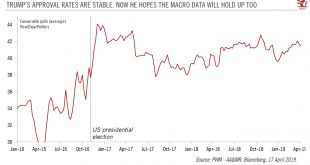

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices. As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting...

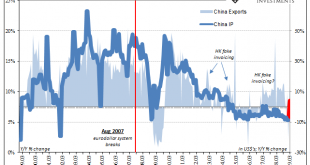

Read More »China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in...

Read More »The Next Financial Crisis Won’t Be Caused by Fraud: This Time Will Be Different

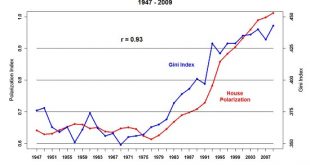

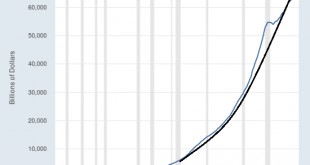

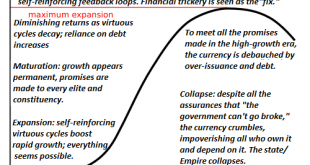

Extreme levels of debt and overvaluation characterize the entire global economy, and are not limited to any one nation or sector. Financial crises come in two flavors: fraud and credit-valuation over-reach.Fraud-based financial crises may differ in particulars, but they share many traits: perverse incentives are institutionalized; the perverse incentives reward figuring out how to evade oversight via fraud,...

Read More »Green Shoot or Domestic Stall?

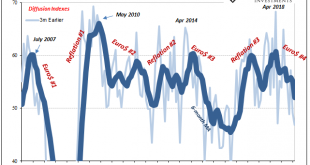

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

Read More »Coloring One Green Shoot

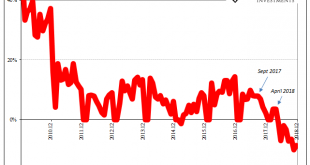

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018. For decades, there was just one way for China’s car market: up. Once the trend abruptly reversed...

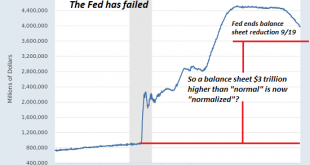

Read More »No Fix for Recession: Without a Financial Crisis, There’s No Central Bank Policy Fix

There are no extreme “fixes” to secular declines in sales, profits, employment, tax revenues and asset prices. The saying “never let a crisis go to waste” embodies several truths worth pondering as the stock market nears new highs. One truth is that extreme policies that would raise objections in typical times can be swept into law in the “we have to do something” panic of a crisis. Thus wily insiders await (or trigger)...

Read More »Assange and the Unforgivable Sin of Disemboweling Official Narratives

The entire global status quo is on the cusp of the S-Curve decline phase. There is really only one unforgivable sin in the political realm, and that’s destroying the official narrative by revealing the facts of the matter. This is why whistleblowers who make public the secret machinery of the elaborately artful lies underpinning all official narratives are hounded to the ends of the Earth. Employees of state entities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org