In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More »The Hidden Cost of Losing Local Mom and Pop Businesses

What cannot be replaced by corporate chains is neighborhood character and variety. There is much more to this article than first meets the eye: In a Tokyo neighborhood’s last sushi restaurant, a sense of loss “Eiraku is the last surviving sushi bar in this cluttered neighborhood of steep cobblestoned hills and cherry trees unseen on most tourist maps of Tokyo. Caught between the rarified world of $300 omakase dinners...

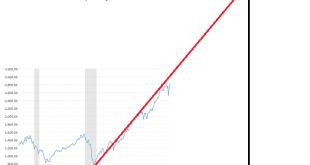

Read More »The Fed Guarantees No Recession for 10 Years, Permanent Uptrend for Stocks and Housing

Those who own stocks and housing now will continue getting richer, those who don’t will be priced out of these markets. A classified Federal Reserve memo sheds new light on the Fed’s confidence in its control of the economy and the stock and housing markets. In effect, the Fed is guaranteeing that there will be no recession for another 10 years, and that stocks and housing will remain in a permanent uptrend....

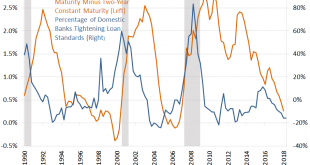

Read More »Monthly Macro Monitor – March 2019 (VIDEO)

Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it. [embedded content] Related posts: Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – January 2019 Monthly Macro Chart Review – March (VIDEO) Monthly...

Read More »Apple’s Rotten Core

Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales. Apple has always been equally an enterprise and a secular religion. The Apple Faithful do not tolerate heretics or critics, and non-believers “just don’t get it.” So the first thing any critic must do is establish their credentials as a...

Read More »Is the World Becoming Wealthier or Poorer?

There is nothing intrinsically profitable about either robotics or AI. At the request of colleague/author Douglas Rushkoff (his latest book is Team Human), I’m publishing last week’s Musings Report, which was distributed only to subscribers and patrons of the site.) The core assumption of Universal Basic Income (UBI) and other plans to redistribute wealth and income more broadly is that the world is becoming wealthier,...

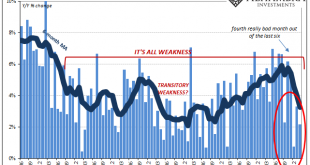

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More »When Are We Going to Tackle the For-Profit Monopolies Which Censored RussiaGate Skeptics?

We either take down Facebook and Google and turn them into tightly regulated transparent public utilities available to all or they will destroy what little is left of American democracy. The RussiaGate Narrative has been revealed as a Big Con (a.k.a. Nothing-Burger), but what’s dangerously real is the censorship that’s being carried out by the for-profit monopolies Facebook and Google on behalf of the status quo’s Big...

Read More »The Media, Mueller, the Big Con and the Democratization of Narrative

Falling for a con is painful. The first reaction is to deny being conned, of course. The second is to blame skeptics for being correct in their skepticism. Here’s the fundamental “story” of the Mueller Investigation: elites don’t like “the little people” democratizing public narratives. The elites–who reckon their right to rule is self-evident–want to set the narrative and the context, because that’s the foundation of...

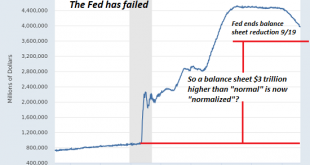

Read More »Politics Has Failed, Now Central Banks Are Failing

With each passing day, we get closer to the shift in the tide that will sweep away this self-serving delusion of the ruling elites like a crumbling sand castle. Those living in revolutionary times are rarely aware of the tumult ahead: in 1766, a mere decade before the Declaration of Independence, virtually no one was calling for American independence. Indeed, in 1771, a mere 5 years before the rebellion was declared,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org