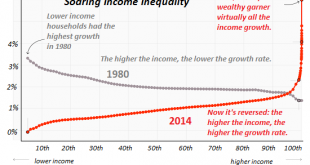

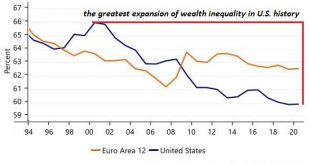

Ironically, their ample compensation allows them to avoid the poor-quality services they’ve designed for everyone below them. If we define middle class by the security of household income and what that income can buy rather than by an income level, what do we conclude? We have little choice but to conclude the middle class is decaying, both in the percentage of the workforce that qualifies as “middle class” according to...

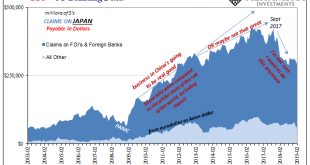

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »The Erosion of Everyday Life

Working hard and doing what you’re told is no longer yielding the promised American Dream of security, agency and liberty. Volume One of Fernand Braudel’s oft-recommended (by me) trilogy Civilization & Capitalism, 15th to 18th Century is titled The Structures of Everyday Life. The book describes how life slowly became better and freer as the roots of modern capitalism and liberty spread in western Europe, slowly...

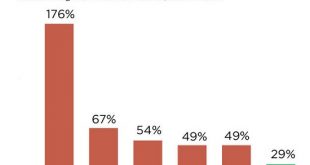

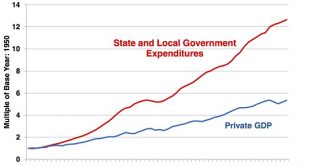

Read More »There Are Two Little Problems with “Taxing the Rich” to Pay for “Free Everything”

No super-wealthy individual or household is going to pay billions in additional taxes when $10 to $20 million will purchase political adjustments. The 2020 election cycle has begun, and a popular campaign promise is “free everything” paid for by new taxes on the super-wealthy. Who doesn’t like free stuff? Who will vote for whomever offers them free stuff? No wonder it’s a popular campaign promise. As even the most...

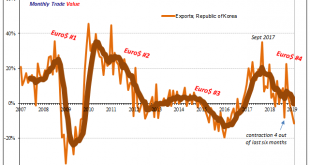

Read More »Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

Read More »Durably Sideways

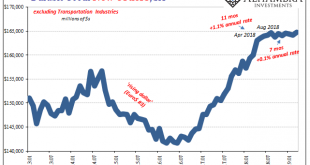

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted. None of this, apparently, will include any information gleaned from the comprehensive 2017 Economic Census. I haven’t closely followed the progress of the latter,...

Read More »Push Them Hard Enough and the Productive Class Will Opt Out of Servitude

People love their big paychecks, but they also value their sanity. One of the most astonishing manifestations of disconnected-from-reality hubris is public authorities’ sublime confidence that employers and entrepreneurs will continue starting and operating enterprises no matter how difficult and costly it becomes to keep the doors open, much less net a profit. The average employee / state dependent reckons that the...

Read More »The Feedback Loop of Doom: When Mobile Creatives and Capital Abandon Unaffordable, Dysfunctional Cities

When the 4% who generate the jobs and tax revenues have had enough and leave, the effects quickly impact the 64%. At the end of any trend, everyone’s a true believer: this trend is so enduring, so broad-based, so based on unchanging fundamentals that it will never ever reverse. One such trend is the white-hot growth of housing, employment, tax revenues, etc. in major urban magnets for global capital and talent: you know...

Read More »If “Getting Ahead” Depends on Asset Bubbles, It’s Not “Getting Ahead,” It’s Gambling

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one’s...

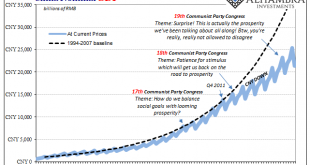

Read More »The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return. Before August 2007, everywhere there was believed (far) more return than risk. It’s the nature...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org