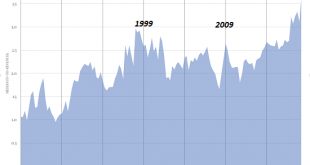

There is more than a little “let them eat brioche” in the blind faith that the masses’ patience for pillage is infinite. We’ve reached an interesting moment in history where we each have a simple choice: we either go with blind faith or we go with the bottom line, i.e. the facts of the matter. So far, 2019 is the year of Blind Faith, as the charts below illustrate: the bottom line no longer matters. Let’s start with...

Read More »Monthly Macro Chart Review – April 2019 (VIDEO)

Alhambra CEO Joe Calhoun discusses the charts from the past month and what they indicate. [embedded content] Related posts: Monthly Macro Chart Review: April 2019 Monthly Macro Chart Review – March (VIDEO) Monthly Macro Monitor – March 2019 (VIDEO) Monthly Macro Monitor – February (VIDEO) Monthly Macro Chart Review – March Monthly Macro Monitor –...

Read More »Why 2011

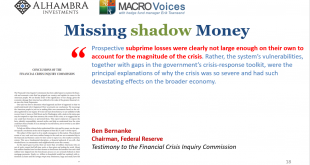

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »Here’s What It’s Like To Be a Bear in a Rigged Market

Central bankers and media handlers must be laughing at how easy it is to slaughter the Bears and doubters with another fake-news round of trade-deal rumors and another Fed parrot being prompted to repeat some dovish mumbo-jumbo. It’s not just tough being a Bear in a market rigged by trade deal rumors, Federal Reserve dovishness, a tsunami of Chinese liquidity and $270 billion in stock buy-backs in the first quarter–it’s...

Read More »Trade Deal Follies: The U.S. Has Embraced the World’s Worst Negotiating Tactics

The world’s worst negotiating strategy is to make a crazy tulip-bubble stock market rally dependent on a trade deal that harms the interests of the U.S. The world’s worst negotiating tactics, the equivalent of handing the other side a loaded gun while waving a squirt gun around, are: 1. Declare a de facto political deadline for a deal. Constantly tweet that a deal is imminent. This gives the other side unparalleled...

Read More »Monthly Macro Chart Review: April 2019

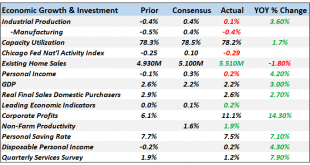

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed. On a more positive note, housing seems to have found its footing with lower rates and employment is still fairly robust....

Read More »China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing. Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report...

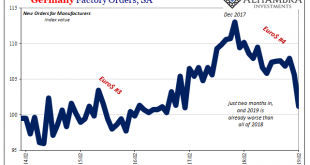

Read More »External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance. Shaktikanta Das, a career bureaucrat with...

Read More »The Japanification of the World

Zombification / Japanification is not success; it is only the last desperate defense of a failing, brittle status quo by doing more of what’s failed. A recent theme in the financial media is the Japanification of Europe.Japanification refers to a set of economic and financial conditions that have come to characterize Japan’s economy over the past 28 years: persistent stagnation and deflation, a low-growth and...

Read More »Are the Rise of Social Media and the Decline of Social Mobility Related?

Social media offers hope of achieving higher online social status without having to succeed financially in a winner-take-most economy. I’ve often addressed the decline of social mobility and the addictive nature of social media, and recently I’ve entertained the crazy notion that the two dynamics are related. Why Is Social Media So Toxic? I have long held that the decline of social mobility–broad-based opportunities to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org