There are no extreme “fixes” to secular declines in sales, profits, employment, tax revenues and asset prices. The saying “never let a crisis go to waste” embodies several truths worth pondering as the stock market nears new highs. One truth is that extreme policies that would raise objections in typical times can be swept into law in the “we have to do something” panic of a crisis. Thus wily insiders await (or trigger) a crisis which creates an opportunity for them to rush their self-serving “fix” into law before anyone grasps the long-term consequences. A second truth is that crises and solutions are generally symmetric: a moderate era enables moderate solutions, crisis eras demand extreme solutions. Nobody calls

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| As expanding credit no longer generates real-world growth, growth slows.Over time, marginal borrowers default as revenues and profits erode, and this triggers a corresponding erosion in employment and wages.

This erosion is so gradual, it doesn’t qualify as a crisis, and therefore central banks can’t unleash crisis-era fixes. Not only do they lack the political will to launch extreme policies in a moderate decline, it would be unwise to empty the tool bag of extreme fixes at the first hint of trouble; what’s left for the crisis to come? Even worse, if the extreme policies fail to restore rapid growth and more importantly,confidence in future rapid growth, then ramping up extreme policies will be correctly interpreted as the desperate acts of clueless authorities. This will crush confidence and trigger the very crisis the authorities sought to forestall. There are no extreme “fixes” to secular declines in sales, profits, employment, tax revenues and asset prices. Moderate stagnation will not be reversed with moderate fixes (lowering interest rates a quarter of one percent, etc.), and any attempt to institute extreme policies will expose authorities’ desperation right when confidence is vulnerable to collapse. The Fed and other central banks are trapped in more ways than one. |

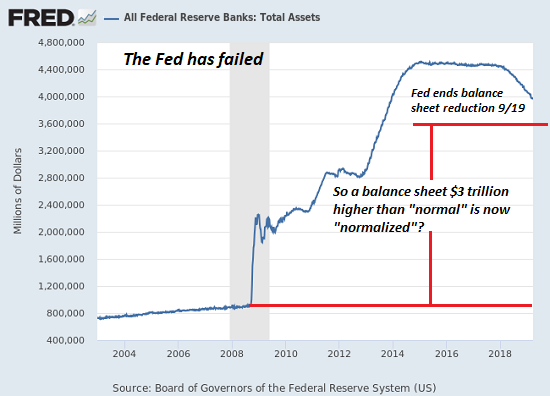

All Federal Reserve Banks: Total Assets 2004-2018 |

Tags: Featured,newsletter