Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be: “a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the economy; in which the...

Read More »Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries. This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of $650 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.” This really does sounds very...

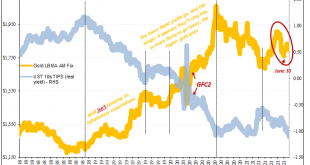

Read More »Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again. To recap the main push of last year’s acute dollar shortage: Over the past several dreadful weeks of...

Read More »Weekly Market Pulse: Buy The Dip, If You Can

[unable to retrieve full-text content]If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

[unable to retrieve full-text content]89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

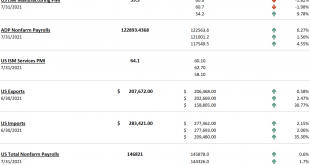

Read More »Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

[unable to retrieve full-text content]Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »Ask Bob: Withholding Taxes From Social Security

[embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-07-19 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. RRP No Collateral Coincidences As Bills Quirk, Too 2021-07-12 So much going on this week in the bond market, it actually...

Read More »Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines: SENATOR DAINES. I just was looking at the T bill chart and noticing since the 1st of February, the one month rates have dropped in half from 0.06 to today 0.03, two months went from 0.07, to 0.02. We’re starting to get into that...

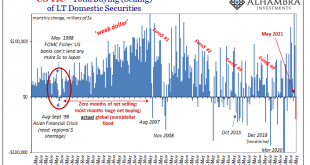

Read More »Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart. The disease is just that potent; delirium the chief symptom, especially among the virus’ central banker...

Read More »Weekly Market Pulse (VIDEO)

[embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-07-19 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. Weekly Market Pulse: As Clear As Mud 2021-07-19 Is there anyone left out there who doesn’t know the rate of economic growth is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org