According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data. Some things are best left just as they are published. . The Census Bureau today released its estimates for retail sales....

Read More »August Retail Sales Surprise To The Upside, Because They Were Down?

According to the movie The Princess Bride, the worst classic blunder anyone can make is to get involved in a land war in Asia. No kidding. The second is something about Sicilians and death. There is also, I’ve come to learn, an unspoken third which cautions against chasing down and then trying to break down seasonal adjustments in economic data. Some things are best left just as they are published. . The Census Bureau today released its estimates for retail sales....

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun responds to questions about a slowing economy, long-term economic impacts of COVID, stock prices and the business cycle. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-09-13 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars....

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-09-13 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars....

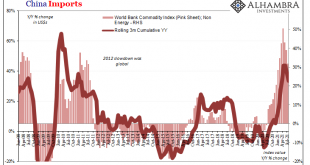

Read More »What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out. You see inflation around you; anyone can only tell deflation by hopefully noticing and...

Read More »Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary. Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

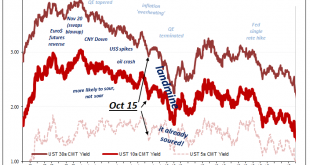

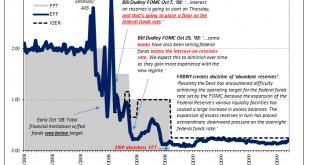

Read More »CPI’s At Fives Yet Treasury Auctions

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

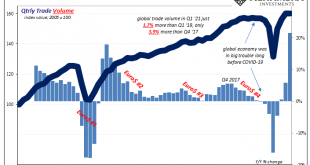

Read More »A Real Example Of Price Imbalance

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim. That’s a problem, and much bigger one that may otherwise appear especially given current...

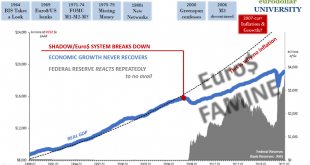

Read More »The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen long years and only...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org