Stop me if you’ve heard this before: About US5 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries. This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of 0 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.” This really does sounds very familiar: The equivalent of nearly US0 billion of the general allocation will go to emerging markets and developing countries, of which low-income countries will receive over US billion. The latter taken from the IMF’s August 13, 2009, statement giddily announcing its governing body(ies) has(d)

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, global reserve currency, IMF, Markets, newsletter, quota, SDR

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stop me if you’ve heard this before:

About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of $650 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.”

This really does sounds very familiar:

The equivalent of nearly US$100 billion of the general allocation will go to emerging markets and developing countries, of which low-income countries will receive over US$18 billion.

| The latter taken from the IMF’s August 13, 2009, statement giddily announcing its governing body(ies) has(d) agreed to a general allocation of $250 billion in SDR’s, biggest in history [to that point], according to existing quotas. The purpose: “to provide liquidity to the global economic system by supplementing Fund’s member countries’ foreign exchange reserves.”

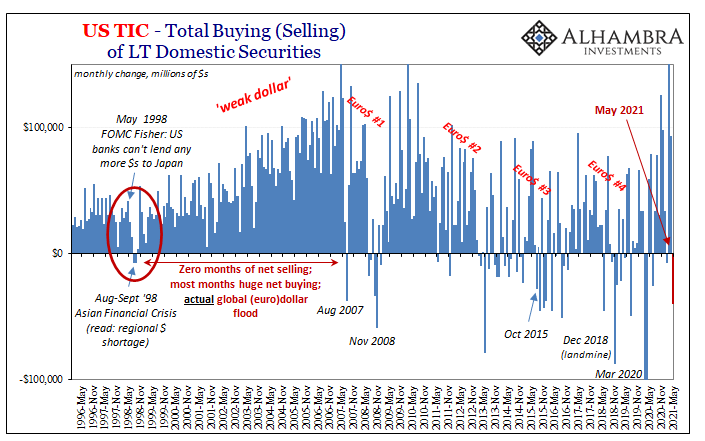

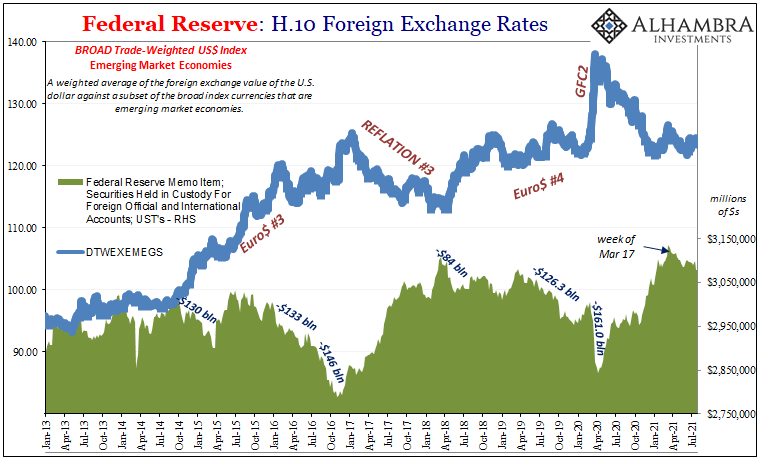

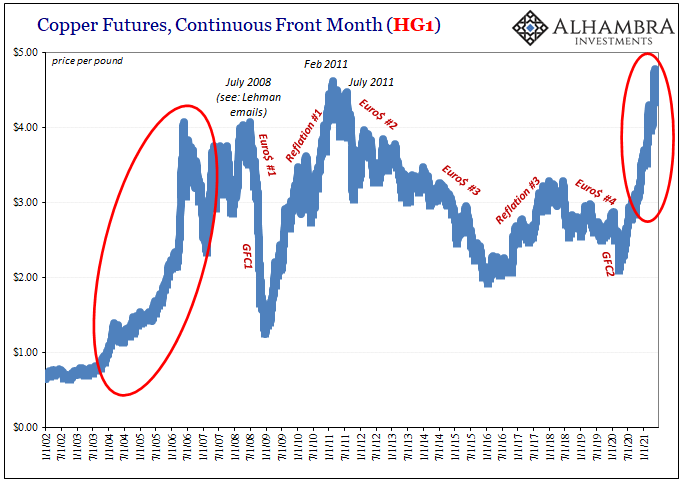

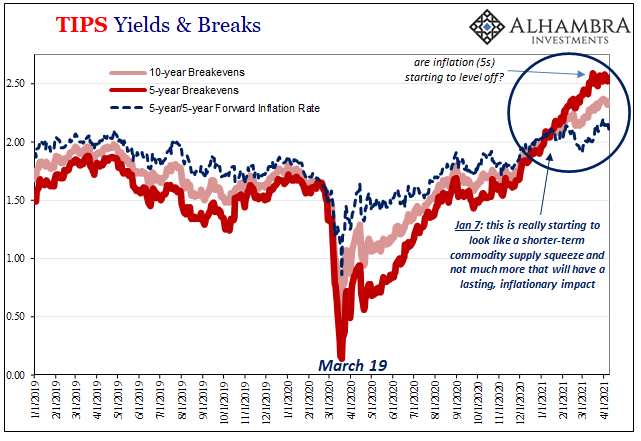

Sure, eleven years in between means a lot can happen; and a lot did, that’s the problem. It was nothing the 2009 SDR’s solved, though it was a near-continuous stream of international monetary illiquidity. These unjoyful IMF accounting conventions were supposed to aid particularly emerging and low-income nations who suffer most when international money grows scarce (leaving their economies starved for legit economic growth and all the debt problems this condition amplifies). A quarter-trillion in ’09 was a huge number, like all the others thrown around back then from ARRA to numerous QE’s. And now, just like ARRA and the QE’s, the SDR allocations have to be repeated, too. |

|

| Because they worked so well?

Ahem.

If it was a matter of raw survival in 2016, what can it be in 2021? The IMF would have you believe this is a wonderful development, a serious expansion of monetary capacities for nations all around the world. Rich and poor. |

Mere sophistry, the raise of purposefully huge numbers to tickle the emotions of the unaware (practically the entire planet, including all those in position of authority mentioned here; sophistry born from desperation bred of ignorance and repeated failure).

Which private bank in Africa will be supported by the latest SDR193 billion sent to the world’s poorest countries? That bank – unable to secure dollars – will do what?

After an unusually terse period of financial and economic destruction, joined by others in its same situation, the bank can appeal to its government or central monetary authority who, having no dollars, either, are the only ones to whom SDR’s are made available. Authorities will mark down on their books that their devastating national current dollar shortfall was covered in transition to another in the same situation by a “currency” neither banks nor their customers anywhere in any part of the real economy or financial system has any use.

Liquidity doesn’t mean what they think it means, apparently.

When a rush of private banks in poor countries are further deprived of eurodollars, they’ll create such a mess that the IMF will enter if only afterward to make a big splash of SDR’s being deployed on some official level far, far away from the monetary playing fields of useful currency. What’s the difference between IMF SDR’s, once likewise depleted, and the botched dollar rescues at Argentina? A different name for the same unfixable problem.

No wonder money-deprived El Salvador is serious about Bitcoin (even after consulting earlier with…the IMF).

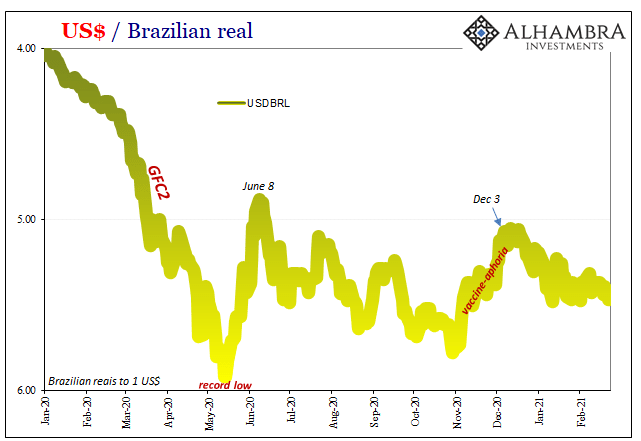

How else did Euro$ #2 then #3 followed by #4 and then a second GFC all occur, and viciously harm the poorest countries the most, with that first ’09 quarter trillion available to all? It was sitting there in the pot last March, too.

SDR’s aren’t useful liquidity any more than US$ bank reserves. Both equally proved in fact by these very same eleven years in between the last quota dodge and the current one. Pure sophistry. But that, again, is the point.

Tags: currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,global reserve currency,IMF,Markets,newsletter,quota,SDR