Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again. To recap the main push of last year’s acute dollar shortage: Over the past several dreadful weeks of liquidations the pattern has largely repeated. During the early morning hours, before regular trading opens, yesterday’s repo transactions are unwound. Under normal and even less-than-ideal conditions these are just rolled over. Not any more. Collateral calls mean in some cases using gold as a last resort

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Collateral, currencies, economy, Featured, Federal Reserve/Monetary Policy, Gold, Markets, newsletter, nominal yields, real yields, Repo, reverse repo, rrp, T-Bills, TIPS, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

To recap the main push of last year’s acute dollar shortage:

During the early morning hours, before regular trading opens, yesterday’s repo transactions are unwound. Under normal and even less-than-ideal conditions these are just rolled over. Not any more. Collateral calls mean in some cases using gold as a last resort (which gets dumped immediately) and in others the buying of pristine collateral at any price. Gold is slammed while T-bill prices skyrocket, their yields plummet. For those unlucky enough to have neither option in front of them, fire sales of assets including stocks and other risk credits. |

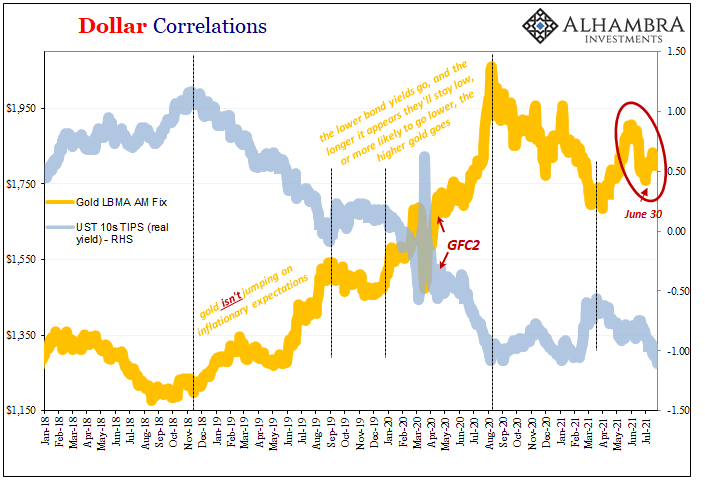

Dollar Correlations, 2018-2021 |

| No gold “slams” in 2021, though; not even last Tuesday morning during what had been otherwise a near perfect example of this scramble for collateral (scarcity).

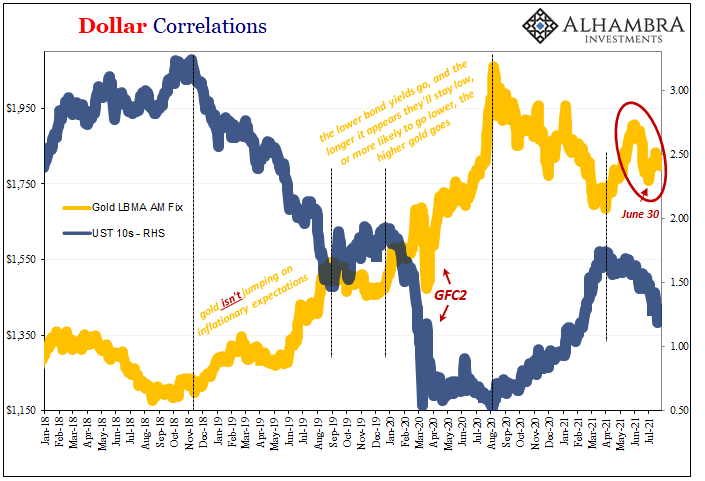

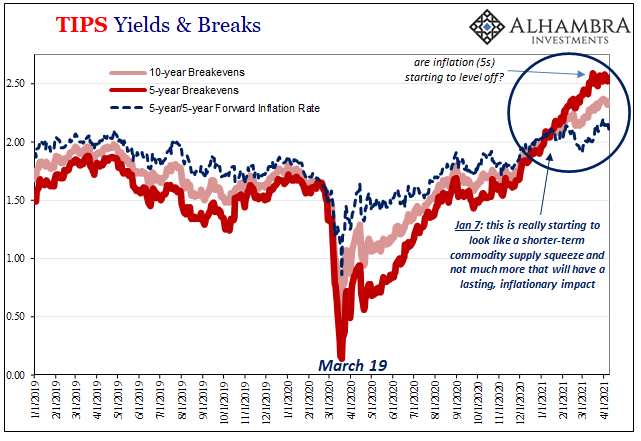

This doesn’t necessarily mean the price behavior in gold has been inconsistent or refuting the notion. On the contrary, there’s been an ongoing modest/mild contraction in it thus possible corroboration worth serious and ongoing attention and analysis. For what I do, I tend to look at gold via its relationship to nominal LT UST yields (since I’m more interested in other factors related to what’s going on in collateral). Many others, especially my colleague Joe Calhoun for more investment-focused considerations (and I encourage you to ask him all about the how’s and why’s), map gold against real yields. They both come up with mostly the same thing, despite some trivial quirks along the way. |

Dollar Correlations, 2018-2021 |

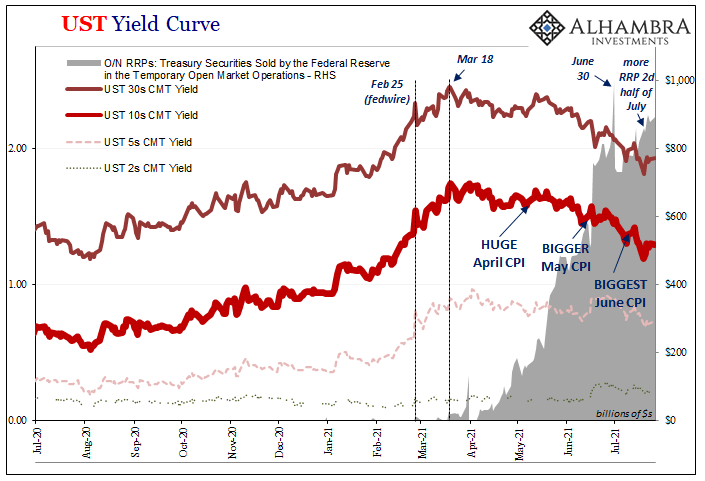

| For our purposes here, evaluating the potential for collateral scarcity, as well as attempting to get a sense of its intensity, from late May until June 30 gold moved contrary to LT nominal yields (as well as, to a smaller degree, contrary to real yields).

While there hadn’t been any obvious daily or morning “slams” that matched the price behavior of T-bills, already the five-week downturn in gold was contrary to falling nominals (and real yields sideways to lower in late June). Since gold’s opportunity cost is defined by interest rates, the drop in them and the possibility this signals lower rates farther out into the future, plus the dour outlook in real yields, it really should’ve been a good month of June for the metal. But it wasn’t. Even more compelling still, the recent bottom in gold came in on exactly June 30; the same date I’ve already noted in T-bills (and RRP, of course). From the pricing action in the secondary market, it sure seemed like there was an easing off of collateral pressure (scarcity) beginning right on July 1 (likewise confirmed by less usage of RRP) and lasting through maybe the first half of the month. |

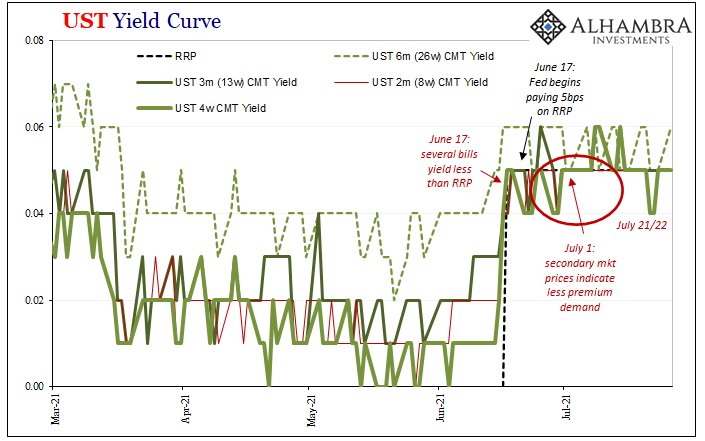

UST Yield Curve, 2021 |

| Was the subsequent rebound in gold, beginning on the same day, July 1, another point of collateral corroboration going in the other direction? It just may have been.As might this latest decline in gold; topping out on July 15, we’ve noticed and noted a downward tendency (especially in relation to the RRP “floor”) in bill yields recently, too (obviously including the early AM fireworks last Tuesday) as well as now a rising RRP toward the second half of July.

Nothing conclusive, but a lot that’s compelling because it’s consistent. Therefore, worth keeping an eye on gold for all the usual reasons, relating to real yields and whatnot, but also this keen tendency to second collateral at important times. |

UST Yield Curve, 2020-2021 |

Tags: Bonds,collateral,currencies,economy,Featured,Federal Reserve/Monetary Policy,Gold,Markets,newsletter,nominal yields,real yields,repo,reverse repo,rrp,T-Bills,TIPS,U.S. Treasuries