Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines: SENATOR DAINES. I just was looking at the T bill chart and noticing since the 1st of February, the one month rates have dropped in half from 0.06 to today 0.03, two months went from 0.07, to 0.02. We’re starting to get into that realm here of possibly negative rates, which we saw of course briefly a year ago, March. Just want to get your thoughts on that. Is there any issues here of shortage collateral? What’s driving this as you’re watching some of these short-term rates approaching zero? If your jaw has hit the floor, yes, a US

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bond yields, bonds, Collateral, collateral scarcity, congressional testimony, currencies, economy, Featured, Federal Reserve/Monetary Policy, jay powell, Markets, newsletter, reverse repo, rrp, T-Bills, treasury bills, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines:

SENATOR DAINES. I just was looking at the T bill chart and noticing since the 1st of February, the one month rates have dropped in half from 0.06 to today 0.03, two months went from 0.07, to 0.02. We’re starting to get into that realm here of possibly negative rates, which we saw of course briefly a year ago, March.

Just want to get your thoughts on that. Is there any issues here of shortage collateral? What’s driving this as you’re watching some of these short-term rates approaching zero?

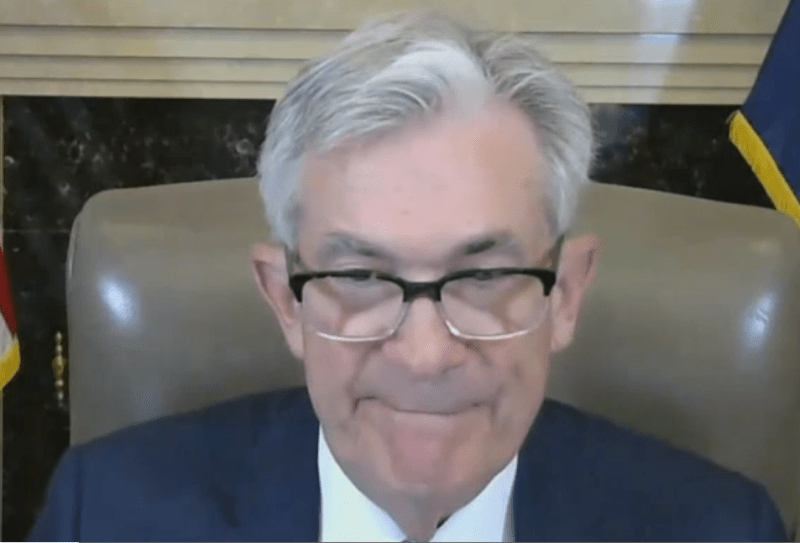

If your jaw has hit the floor, yes, a US Senator actually questioned the Federal Reserve’s top policymaker about T-bill prices and collateral scarcity (full disclosure: I was asked for my input in order to put this question in front of Chairman Powell). His answer was largely avoiding any answer, as usual (if you see the video clip, just watch his body language after being asked).

|

. |

| Blame TGA and “demand pressure.”

Fast forward to last week, as I pointed out, in front of the House of Representatives this time Powell was asked to start with the reverse repo (RRP) coming at it instead from now T-bill supply; same thing, different angle.

Nothing about the TGA, nor anything on demand. So, what changed in between late February and mid-July? You could argue he’s simply practicing CYA; after all, people are talking about the RRP quite a lot, not much that’s good. Powell wouldn’t love such heat and what it implies, the “too much money” theory which is based on “money printing” gone overboard. Even so, answering the question what changed in between February and July, it was clearly the reverse repo (RRP) no matter what you think about its popularity. This probably came as a shock to the Fed, but what Powell said to the House Committee has been obviously true – you don’t need to use confidential data to see this, just follow bill prices. |

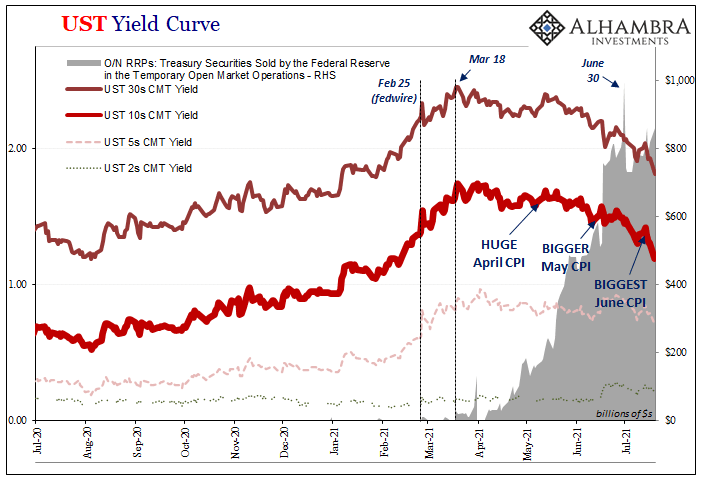

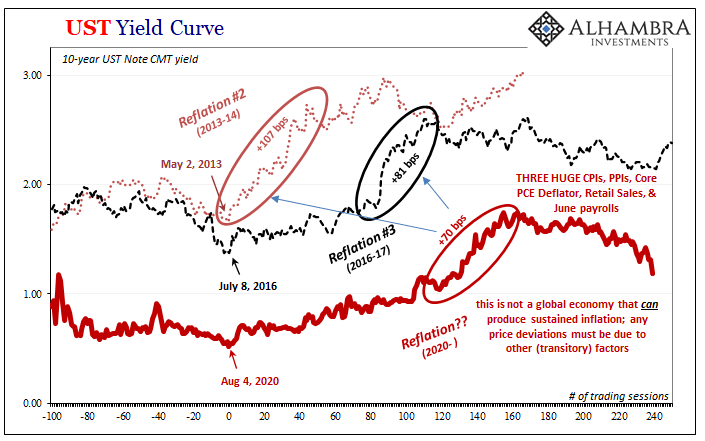

UST Yield Curve, 2020-2021 |

| It’s now the huge numbers in the RRP which have made what is typically a shadow money issue no one knows they should care about into a confusion of various overly simplistic textbook interpretations that leave the relevant parts out of them. Central bank officials, as you can see, do little or nothing to clear this up.

In a lot of ways, the couldn’t even if they wanted to. The full extent of collateral is way outside their purview. That’s really what this bill stuff is all about, even if, like Powell, you don’t really consider it much at all. To the Fed’s Chairman, a lot of technical stuff to be sorted out by the central bank’s various “tools.” Nah. |

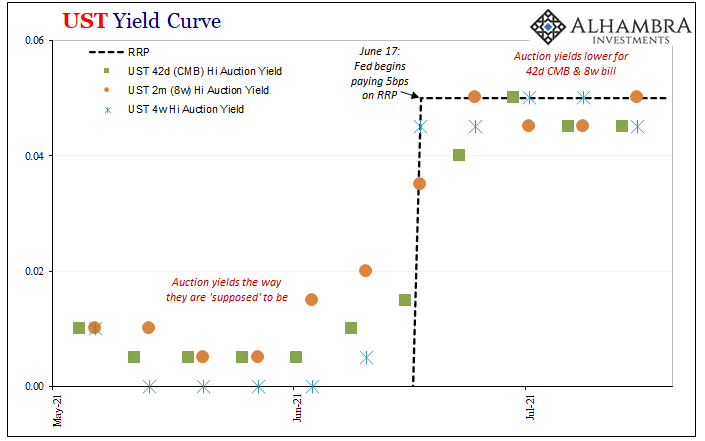

UST Yield Curve, 2021 |

| What’s really important in Powell’s shifting testimony is what that shift says about the state of the bill market before getting into its implications: there must be quite a lot going on unrelated to the TGA and the “too much money” nonsense if even Jay Powell is saying so in front of Congress and in the process changing his story. |

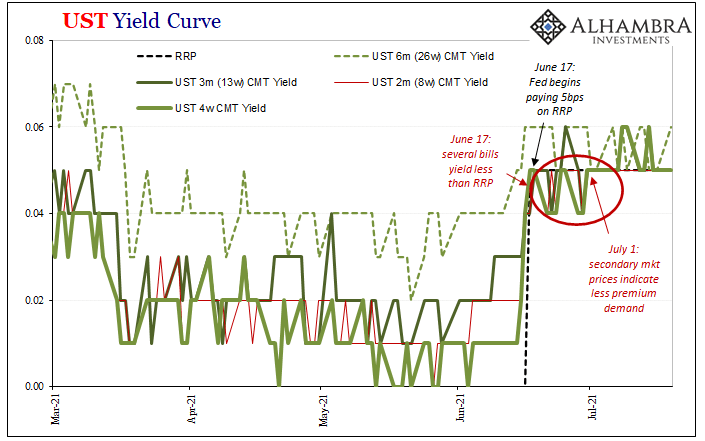

UST Yield Curve, 2021 |

| For the first half of July, it looked like maybe less pressure on T-bills. There has been a rough correlation between bill rates, the RRP, and the behavior of LT UST yields. Briefly, scarcity of bills as the best of the best collateral doesn’t bode well for global dollar money; the greater the scarcity the higher the chances for something going wrong, triggering (landmine) the deflationary waves all-too-familiar (to those not following the mainstream).

Where RRP comes into it in 2021 is two ways: cash-rich largely money market funds who are now having a lot of trouble finding counterparties able to put up good collateral (not just T-bills) have gone knocking at the Federal Reserve’s door (RRP window, actually) instead. |

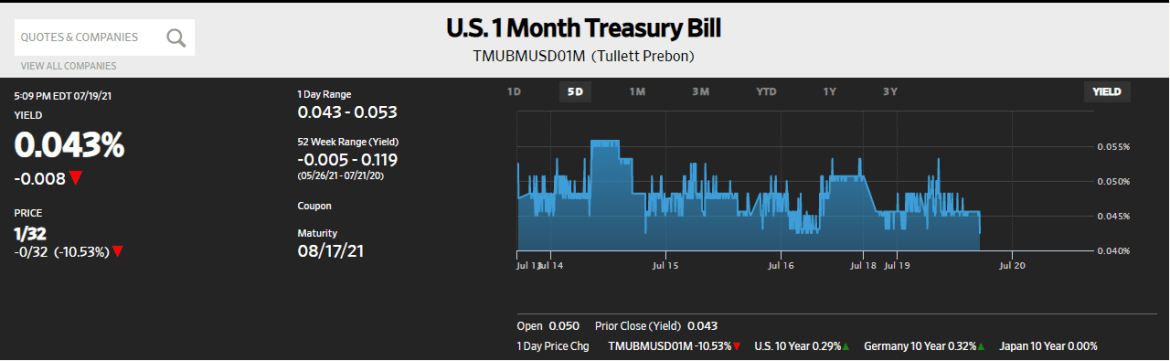

U.S. 1 Month Treasury Bill |

| In addition to those, because there is collateral coming back (at least for a day) in the RRP anyone straight up short of it can hit up the Fed’s alternative overnight (and then worry about settling up the next day).

The downdraft in LT UST yields hasn’t been caused by the RRP fuss, rather these are correlated because they are reactions to the same thing – which is what we observe in bill yields. Collateral scarcity. Potential for deflation. Seeking out collateralized alternatives. |

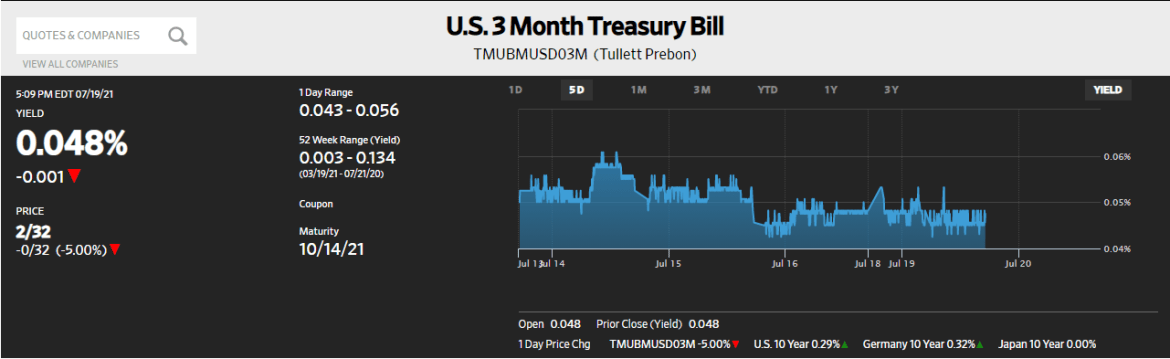

U.S. 3 Month Treasury Bill |

| Why bring this all up for the nth time? With the Treasury market taking things to an even more extreme today at the long end, it’s worth noting a slight uptick in RRP (now $860 billion today) as well as a slight downtick in bill yields (at least according to certain data providers; the Treasury Department calculates that bill yields are right at 5bps when these others show them bending downward).

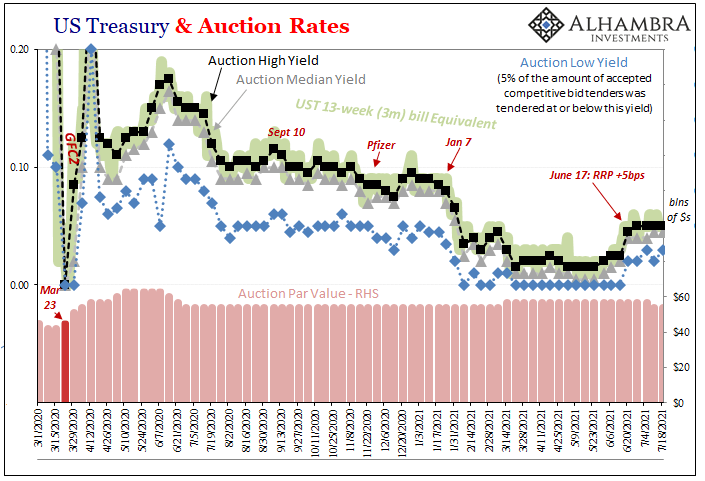

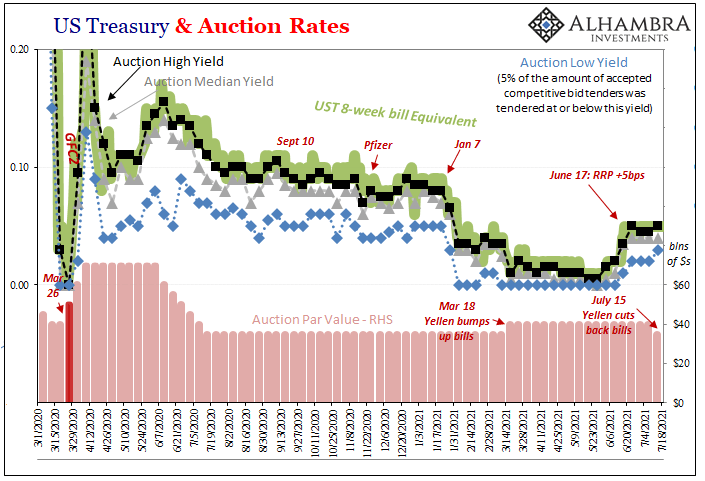

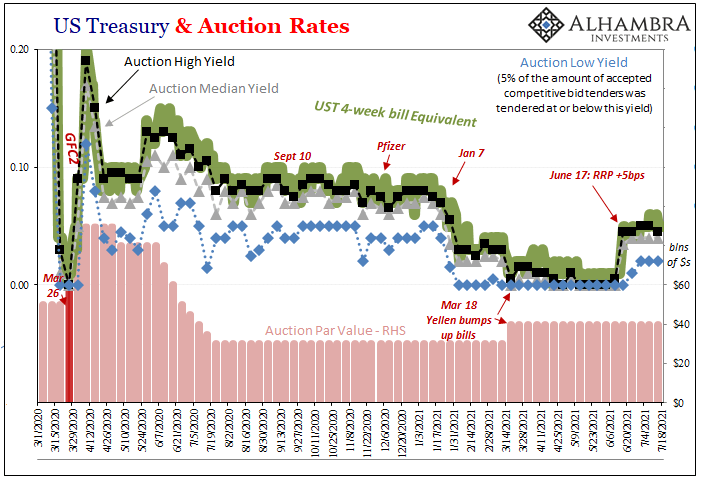

For one thing, Janet Yellen’s Treasury Department as begun refunding bills, too. The government (debt ceiling) has already been scaling way back on cash management bills CMB, terminating the 105-day and 154-day issues all the way back in early February (imagine that? February!) and now Yellen’s office is cutting into regular 8-week issuance as well as what remains of the 42-day CMB (each now down to $35 billion a week). Even the 13-week bill has been scaled back from $57 billion to the $54 billion previously (the March increase to $57b had been Treasury’s way to offset some of the disappearance in CMB’s long gone). |

US Treasury & Auction Rates, 2020-2021 |

US Treasury & Auction Rates, 2020-2021 |

|

US Treasury & Auction Rates, 2020-2021 |

|

| As Jay Powell has already admitted, “not a lot of T-bills.” Last week, there was even less and it’s going to be that way going forward.

But while the Chairman sees the lack of bills he clearly doesn’t get why that is a much more dangerous condition. This is where it is, as it has been, very helpful to put these three things together (and this is the only way to do it): bills, RRP, and LT yields (globally, not just UST’s). Each is telling a single part of an increasingly deflationary story, one of – right now – much deflationary potential, though still right now only potential. |

UST Yield Curve, 2016-2020 |

| Fewer bills, more RRP, lower bond yields – and the same whole range of negative consequences increasingly likely that come with all this. |

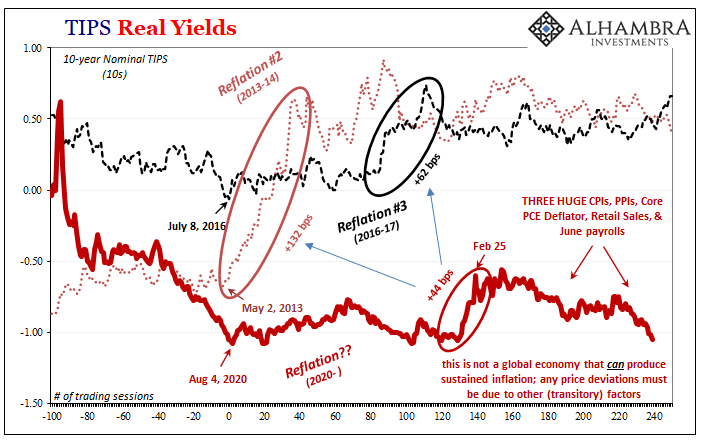

TIPS Real Yields |

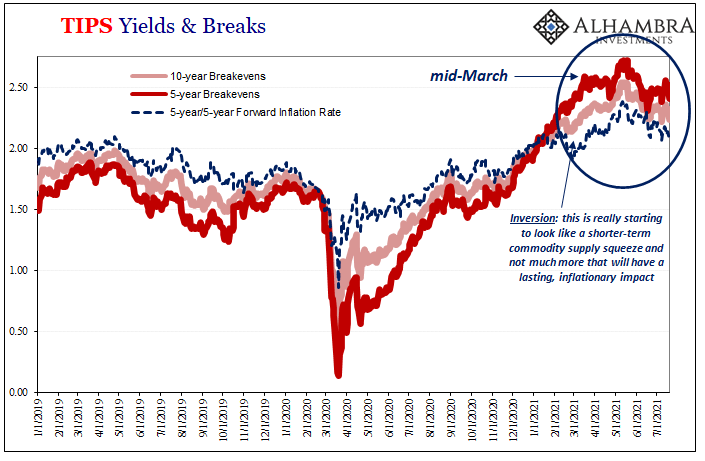

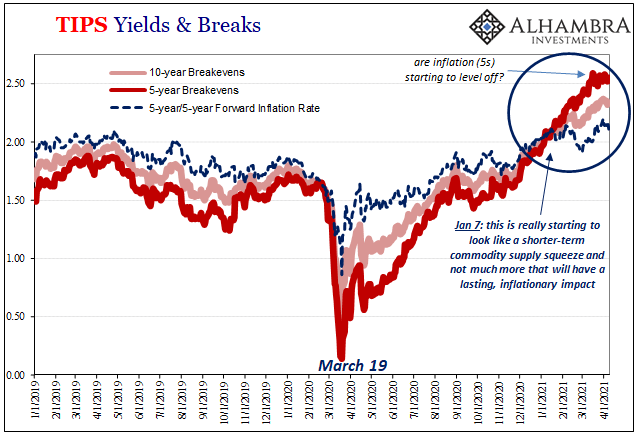

TIPS Yields & Breaks, 2019-2021 |

Tags: bond yields,Bonds,collateral,collateral scarcity,congressional testimony,currencies,economy,Featured,Federal Reserve/Monetary Policy,jay powell,Markets,newsletter,reverse repo,rrp,T-Bills,treasury bills,U.S. Treasuries,Yield Curve