Authored by Mike Shedlock via MishTalk, China was once very dependent on US chips for its phones. The latest Chinese phones have no US parts. The Wall Street Journal reports Huawei Manages to Make Smartphones Without American Chips. American tech companies are getting the go-ahead to resume business with Chinese smartphone giant Huawei Technologies Co., but it may be too late: It is now building smartphones without U.S. chips. Huawei’s latest phone, which it...

Read More »UBS Has No Choice In Passing Negative Rate Pain To Customers

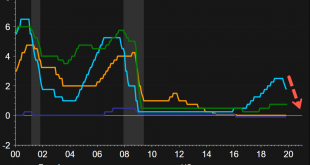

There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%. It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly...

Read More »UBS unveils Year Ahead outlook for 2020 and a ‘decade of transformation’

Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook. UBS GWM’s core recommendations for the year are: quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business...

Read More »World’s Ultra-Rich Preparing For Market Crash, UBS Warns

A synchronized global slowdown, with no end in sight, has spooked some of the wealthiest investors around the world, according to a new survey from UBS Wealth Management, seen by Bloomberg. UBS polled wealthy investors, who are preparing for a significant stock market correction by the end of next year. S&P 500 Index, 2013-2021 - Click to enlarge In the survey of more than 3,400 high net wealth respondents, 25% said they’ve sold risk assets, such as equities,...

Read More »Billionaire Boom “Has Now Undergone A Natural Correction”

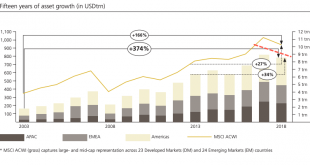

Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen. These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report. Global central banks pumped trillions of dollars into global financial markets and helped produced nearly 589 billionaires during the period,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org