Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook. UBS GWM’s core recommendations for the year are: quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business spending; a middle-of-the-road approach to bonds, given very low yields on the safest debt and rising credit risks among high-yield issuers; a preference for: precious metals over cyclical commodities; a combination of safe and high-yielding currencies; for low sensitivity to market movements within

Topics:

UBS Switzerland AG considers the following as important: 3.) Swiss Banks, 3) Swiss Markets and News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook.

UBS GWM’s core recommendations for the year are:

- quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business spending;

- a middle-of-the-road approach to bonds, given very low yields on the safest debt and rising credit risks among high-yield issuers;

- a preference for: precious metals over cyclical commodities; a combination of safe and high-yielding currencies; for low sensitivity to market movements within alternative investments.

Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, said: “Elections, trade tensions and a shifting monetary and fiscal policy mix are likely to define a ‘year of choices’ in 2020. However, investors should also look beyond the next 12 months to a ‘decade of transformation’ where new winners and losers could change how investors allocate capital.”

Over the 2020s, investors will also face a world transformed. Some 790 million people will move to cities. Workforces will shrink by 25 million in the developed world and grow by 470 million in the emerging world. The number of internet users will rise from 4.3 billion to 7.5 billion.

Sustainability and technology challenges related to these and other factors present opportunities, according to the report. Overall, the top longer-term investment themes highlighted in the Year Ahead report are digital transformation, genetic therapies, and water scarcity.

Furthermore, as 2020 approaches, investors are rallying around global standards that will make sustainable investments in particular more approachable for clients. These include the International Finance Corporation’s Operating Principles for Impact Management, as well as the International Institute for Finance’s efforts to simplify sustainable investing terminology. The latter are supported by both the world’s largest global wealth manager, UBS, and the world’s largest asset manager, BlackRock.

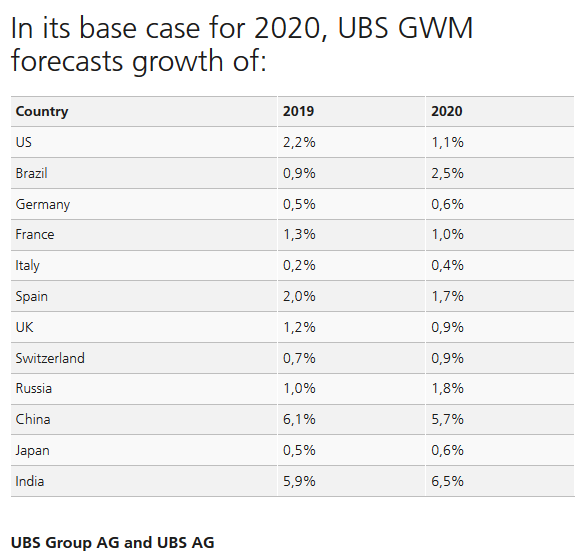

Economic outlookIn UBS GWM’s base case, the global economy will grow 3% in 2020, down slightly from 3.1% in 2019, according to the report. Developed market growth will decelerate from 1.6% to 1.1%, while emerging market growth will accelerate from 4.2% to 4.6%. However, two-way uncertainty is high, driven by choices in geopolitics and policymaking, as well as at the ballot box. The world will also probably keep a lid on inflation, with global inflation decreasing from 3% to 2.9%. The yield on 10-year US Treasuries will decline to 1.8% by the end of 2020, while Brent crude oil prices will decline to USD 60 a barrel. |

In its base case for 2020, UBS GWM forecasts growth of: - Click to enlarge |

Tags: Featured,newsletter