Singapore, 17 November – UBS is celebrating 50 successful years in Singapore with the official opening of its largest Asia Pacific office at 9 Penang Road. In the launch ceremony officiated by Axel A. Weber, Chairman of the Board of Directors UBS Group AG and Ralph Hamers, UBS Group CEO, the bank marked the occasion with clients, employees, and community activities in Singapore. Singapore’s Minister for Finance, Lawrence Wong, was the guest-of-honor for the event,...

Read More »UBS celebrates its first Female Founder Award winner as part of the Future of Finance Challenge

For the first time since starting the Future of Finance Challenge in 2015, UBS has presented a Female Founder Award as part of its Future of Finance Challenge. Around one-third of the overall entries qualified for this award. Kimberley Abbott of Vested Impact won the Female Founder Award. This year’s «UBS Future of Finance Challenge» was a huge success with 475 high-quality submissions, from which the four winners of the overall competition were chosen. Fairly AI won...

Read More »UBS launches collective philanthropy initiative to help clients address critical global issues

New York, NY,October7, 2021 – Harnessing the power of collective philanthropy, UBS today announced the launch of UBS Collectives (“Collectives”), an innovative social-impact initiative that connects UBS’s philanthropic clients on issues that matter most to them. Led by UBS’s Philanthropy Services team, UBS Collectives will help clients combine their expertise and mobilize their capital to fund initiatives that address child protection, climate change, health, and...

Read More »West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill payroll and was caught trying to steer relief funds meant for small businesses to Greensill to help avert its collapse. Most recently, Credit Suisse cited Greensill as its...

Read More »UBS International Pension Gap Index: Swiss pensions – an international comparison

Pension schemes are as diverse as the cultures of the countries whose working population they insure. Nevertheless, they all aim to guarantee a certain level of income in retirement. The UBS International Pension Gap Index, first released in 2017, analyses the sustainability and adequacy of the pension promises across 24 jurisdictions. This is done on the basis of the private savings rate required by an average person of 50 today to maintain their standard of living...

Read More »UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn’t just for rank-and-file minimum wage jobs. UBS has now said that, amidst historic competition and a “retention crisis” in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted. This is double what some of the bank’s competitors are offering. It’s part of a push for lenders “to reward and retain younger employees...

Read More »Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn’t yet known as the bank weighs whether it should cover some client losses associated with the “low risk” trade-finance funds that collapsed earlier this year. Following reports that...

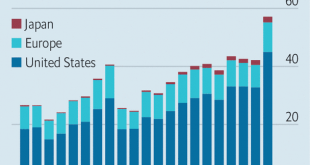

Read More »Why foreign banks’ forays on Wall Street have gone wrong—again

May 8th 2021THE IMPLOSION of Archegos Capital, a New York-based investment firm, in April splashed egg on many faces. Banks that had lent it vast sums to bet on volatile stocks have revealed over $10bn in related losses in recent weeks. America’s leading investment banks, barring Morgan Stanley, were largely absent from the big casualties, though. Instead the grim league table featured foreign champions. Most notable, because of its huge loss of $5.4bn, was Credit...

Read More »The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.“Do you think...

Read More »Credit Suisse’s Archegos Exposure Was Reportedly Over $20 Billion

Just minutes after the SEC is reportedly “exploring how to increase transparency for the types of derivative bets that sank Archegos,” The Wall Street Journal reports that Credit Suisse Group AG had somehow allowed a massive exposure to investments related to Archegos Capital Management or more than $20 billion. While the bank has said that its losses on the positions amounted to $4.7 billion, WSJ, citing people familiar with the matter, reports that Archegos’ bets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org