Does anyone know what is happening? Economic data is likely to become increasingly unreliable as a result of the coronavirus lockdown. We know the global economy will be bad. We will not know, with much accuracy, just how bad. Annualizing data is absurd in the current climate. What happens in the second quarter is not going to be repeated for the rest of the year. Time to stop annualizing numbers. Most economic data is survey based. Industrial production, some...

Read More »As COVID-19 Drives People Into Isolation, Wall Street’s New ‘Virtual Workplace’ May Become The Norm

As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street – much like a plethora of other industries – has embraced the virtual workplace, according to Bloomberg. In Hong Kong, bankers have learned to win stock offerings by video chat, and Morgan Stanley is hosting a virtual meeting for a thousand-plus attendees. At Swiss giant UBS Group AG, wealth management executives have realized trips to see clients weren’t as...

Read More »When It Comes to Raw Power, Few Have More of It Than Central Bankers

A common retort to the claim that in voluntary exchange both parties expect to become better off (or they wouldn’t do it) is that exchanges are seldom, if ever, a matter of horizontal, equal exchange of values. Instead, any such interaction between people is ultimately a matter of their exercising power over one another. The implication, and often explicitly stated conclusion, is that there is no voluntariness, that exploitation is always present, that one party...

Read More »Credit Suisse MD Dies In Freak Accident After Slipping Through Chairlift And Being Suffocated By His Own Jacket

Almost exactly 10 years ago, we detailed the tragic death of Gerard Reilly in a skiing accident – the point man on Repo 105, the point person for E&Y’s “investigation” into the Matthew Lee whistleblower campaign, Lehman’s Level 2 and Level 3 asset valuation, the brain behind the idea to spin off Lehman’s commercial real estate business, Lehman’s Archstone investment, and likely so much more: [Reilly] was skiing alone on the John’s Bypass Trail, a connector...

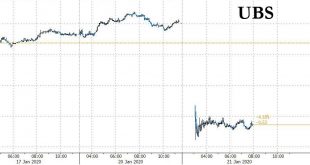

Read More »UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals. As Saxobank notes, “UBS has been hit by wealth management outflows, negative...

Read More »Changes to the UBS Board of Directors

Zurich, 10 January 2020 – The Board of Directors of UBS Group AG announced today that it will nominate Nathalie Rachou and Mark Hughes for election to the Board at the Annual General Meeting on 29 April, 2020. David Sidwell and Isabelle Romy will not stand for re-election. David Sidwell will have completed a twelve year term of office and Isabelle Romy has decided to step down after eight years on the UBS Board. Nathalie Rachou (born 1957) has been a member of the...

Read More »The S&P’s Biggest Bear Capitulates

First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank’s Aleksanda Kocic), and now the market’s QE4-driven meltup has forced Wall Street’s biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS’ head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end S&P price...

Read More »Credit Suisse Ex-Employee Says “Striking Tall Blonde” Spy Followed Her In Manhattan And Long Island

When Colleen Graham heard a story of investigators looking into Credit Suisse for spying on its recently departed head of wealth management, something sounded familiar. She had recalled, years prior, when she was working on a JV between the bank and Palantir Technologies, a “striking tall blonde” had followed her in Manhattan after she refused to sign off on how revenue from the JV would be booked. She filed a complaint in 2017 alleging the bank had taken retaliatory...

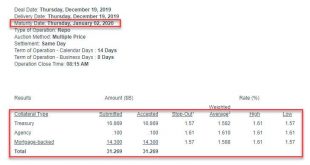

Read More »Repo Crisis Fades Away: For The First Time, A “Turn” Repo Is Not Oversubscribed

It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck. Today’s Term Repo saw $26.25BN in security submissions ($15.75BN in TSYs, $10.5BN in MBS), below the $35BN in total availability. This was the first “turn” repo that was not fully subscribed (on Monday, there was $54.25BN in demand for $50BN in repos maturing on Jan 17). As such, for the second day in a row, the Fed’s term repo operation was...

Read More »Rosenblatt Goes Full Bear On Apple With $150 Target As China iPhone Sales Slump

Rosenblatt Securities analyst Jun Zhang maintained a sell rating on Apple with a price target of $150 per share, citing a decline in iPhone sales in China is leading to a wave of production cuts by the company. “Based on our recent channel checks, we believe Apple’s total iPhone sales in China were down ~-30% y/y in November,” said Zhang in a note to clients on Tuesday. Zhang stated that consumers are opting for cheaper models than the iPhone 11 Pro, which retails...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org