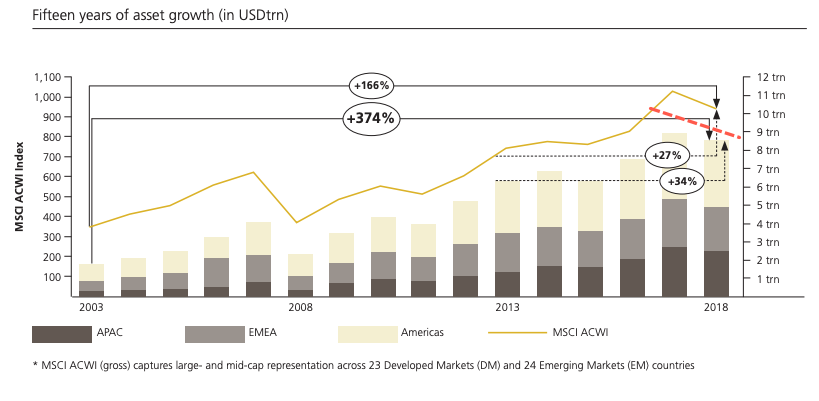

Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen. These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report. Global central banks pumped trillions of dollars into global financial markets and helped produced nearly 589 billionaires during the period, increasing the billionaire population by 39% to 2,101. Fifteen Years of asset growth, 2003-2018 - Click to enlarge It was only when the Federal Reserve started to tighten aggressively, and a global synchronized upswing transformed into a downswing, the billionaire boom went into a period of

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen.

These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report. Global central banks pumped trillions of dollars into global financial markets and helped produced nearly 589 billionaires during the period, increasing the billionaire population by 39% to 2,101. |

Fifteen Years of asset growth, 2003-2018 |

| It was only when the Federal Reserve started to tighten aggressively, and a global synchronized upswing transformed into a downswing, the billionaire boom went into a period of contraction.

In 2018, billionaire wealth plunged by 4.3%, or around $388 billion, mostly due to a synchronized global downturn generating financial market volatility in every stock exchange around the world. |

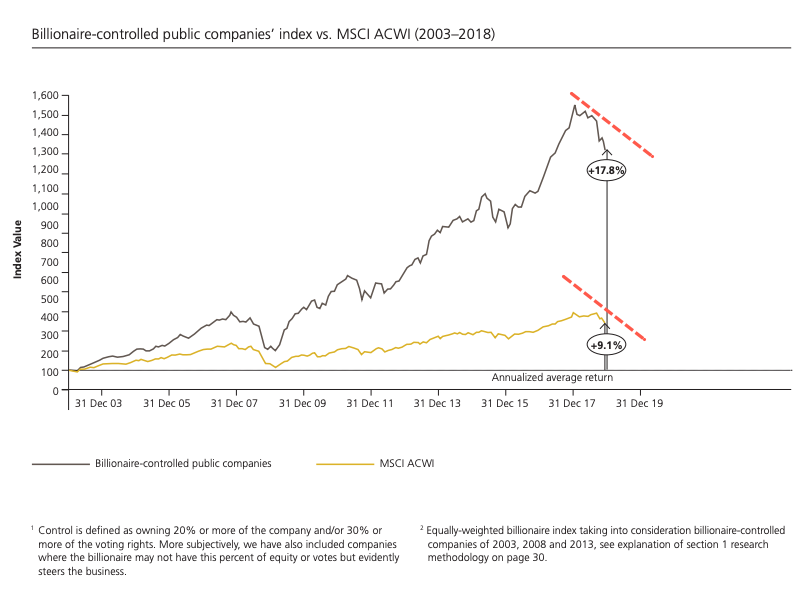

Bilionaire-controlled companies, index vs. MSCI ACWI 2003-2018 |

| The billionaire boom “has now undergone a natural correction,” Josef Stadler, head of ultra-high net worth at UBS Global Wealth Management, said in the report. “This was partly due to the translation effect of a strong dollar, as well as volatile financial markets and less buoyant economic conditions,” he added.

Billionaire wealth fell the hardest across Asia-Pacific (APAC) countries, with much of the decline in China. |

Number of billionaires across the regions 2017-2018 |

Slowing growth and a structural decline in the global economy was responsible for shrinking billionaire wealth in the APAC region to $2.5 trillion, down $217.6 billion in 2018. Net billionaires in the region plunged by 7.4%, or 60, to 754.

Over the past five years to the end of 2018, the world’s economy shifted to the Eastern Hemisphere. China created two billionaires per week over the period. Still, a pause was seen in 2018 through the current day as the government “sought to rein in financial leverage in the shadow banking system, tightening financial liquidity to certain industries of the private sector,” the report said.

Chinese billionaires’ net worth plunged 12.3% in 2018, some of which wasn’t just due to a slowing economy but also a quick depreciation in the Chinese yuan against the US dollar as the trade war escalated through 2H18.

China has risen over the period to become the world’s second-largest billionaire group. Their net wealth tripled during the period to $1 trillion. By 4Q18, China had an eighth of all billionaires’ wealth worldwide.

With a correction in the number of worldwide billionaires and their wealth currently underway, it’s likely a deeper correction could be seen in 2020 as a global trade recession appears imminent.

Tags: Featured,newsletter