While all of the banks playing “pass the hot potato” with Archegos Capital’s now-dismantled equity book are undoubtedly still assessing the damage they incurred (or at least will report to shareholders), it looks like no one had it worse than Credit Suisse. The banking giant has now slashed its bonus pool by “hundreds of millions of dollars” according to FT, after the firm lost $4.7 billion in the Archegos implosion. Credit Suisse is Switzerland’s second biggest...

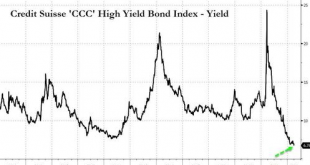

Read More »“They’re Just Chasing” – The Fed Has Put Distressed Investors Out Of Business… Again

“People aren’t investing, they’re just chasing.” That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore. He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low yield.” “People aren’t investing, they’re just chasing.” That is the ominous, ponzi-like...

Read More »Results of the Annual General Meeting 2021 of UBS Group AG

Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Claudia Böckstiegel and Patrick Firmenich as new members of the Board. Shareholders approved a dividend distribution of USD 0.37 (gross) in cash per share. They also approved the new share buyback program 2021–2024. Shareholders approved the proposals relating to the remuneration of the members of the Board of Directors and the Group Executive Board and...

Read More »Can Credit Suisse Avoid Becoming The ‘Deutsche Bank’ Of Switzerland?

“And the future is certain, give us time to work it out…” Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of...

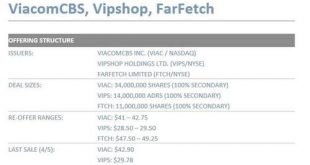

Read More »Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of “stealth” prime broker deleveraging, as tens of millions of shares were yet to be accounted for. Then, moments after 5pm, Credit Suisse – the firm that was hammered the hardest by the Archegos implosion and which had yet to provide a detailed breakdown of its Bill Hwang-linked P&L – confirmed what we said, when it unveiled a massive secondary offering dump, including...

Read More »Another Wirecard? Invoices Backing Greensill-Issued Bonds Never Existed, Administrator Finds

As the collapse of Greensill Capital threatens to ensnare former PM David Cameron in a humiliating public probe, the Financial Times on Thursday reported some disturbing new details that appear to suggest Greensill wasn’t merely reckless, but potentially guilty of a Wirecard-style fraud. According to the FT, Greensil’s administrator – who is responsible for winding down whatever assets remain and managing creditors’ claims – “has failed to verify invoices...

Read More »Credit Suisse Claws Back Bonuses, ‘Restructures’ Asset-Management Unit As Greensill Scapegoating Continues

Credit Suisse is still reeling from the collapse of Greensill Capital, a firm which it championed by helping to sell its financial products (created by ensconcing trade invoices in a complex securities wrapper). 8 months after the first reports emerged about the bank’s potential involvement in a risky “circular financing scheme” involving SoftBank and Greensill (which the bank pledged to investigate at the time), CS and its clients have been left holding the bag...

Read More »Art Basel and UBS Global Art Market Report: Online sales reached record highs in 2020, doubling in value

Zurich, 16 March 2021 – Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first...

Read More »Credit Suisse Launches Probe Into Collapsed Greensill Trade-Finance Funds

Roughly a weekand a-half has passed since Credit Suisse gated funds containing $10BN in assets packaged by Greensill, the troubled financial innovator that suckered in former British PM David Cameron, SoftBank and legions of clients and investors with its stated mission to “democratize” supply-chain finance. Now that the trade finance emperor has fallen (having filed for administration earlier this week), Credit Suisse is starting the arduous process of convincing...

Read More »UBS publishes Annual Report 2020

Zurich/Basel, 5 March 2021 – The Annual Report 2020 provides comprehensive and detailed information on the firm, its strategy, business, governance and compensation, financial performance and risk, treasury and capital management, as well as on the regulatory and operating environment for the 2020 financial year. It presents the fully audited results for the year ending 31 December 2020. UBS’s net profit attributable to shareholders for 2020 was USD 6,557 million...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org