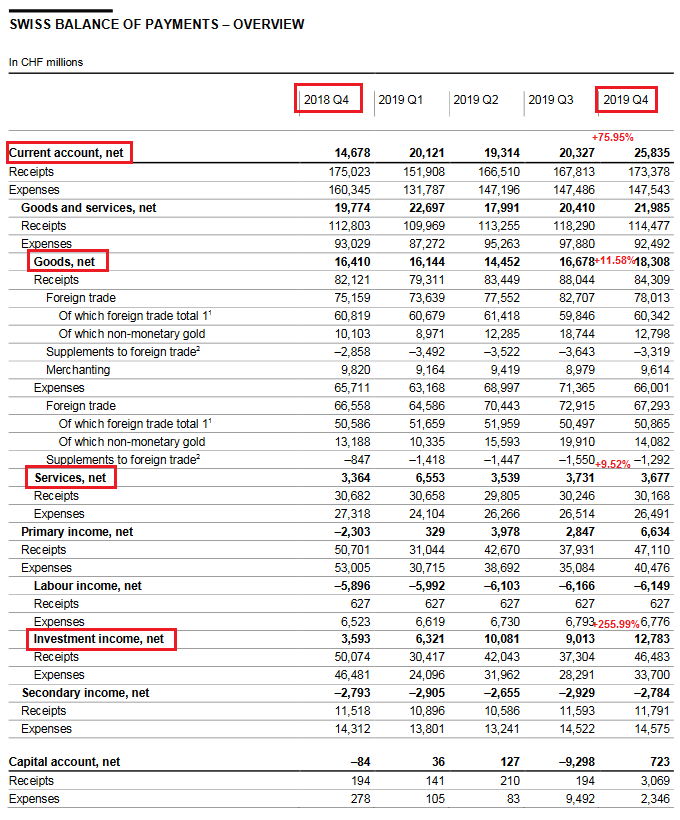

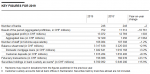

Current Account Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF. Current Account Switzerland Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge In the first quarter of 2020, the current account surplus amounted to CHF 17 billion, CHF 3 billion less than in the same quarter of 2019. This decline was principally due to trade in services, particularly licence fees, telecommunications, computer and information services, and

Topics:

George Dorgan considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, Switzerland International Investment Position

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Current AccountKey figures:Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF

|

Current Account Switzerland Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

| In the first quarter of 2020, the current account surplus amounted to CHF 17 billion, CHF 3 billion less than in the same quarter of 2019. This decline was principally due to trade in services, particularly licence fees, telecommunications, computer and information services, and business services.

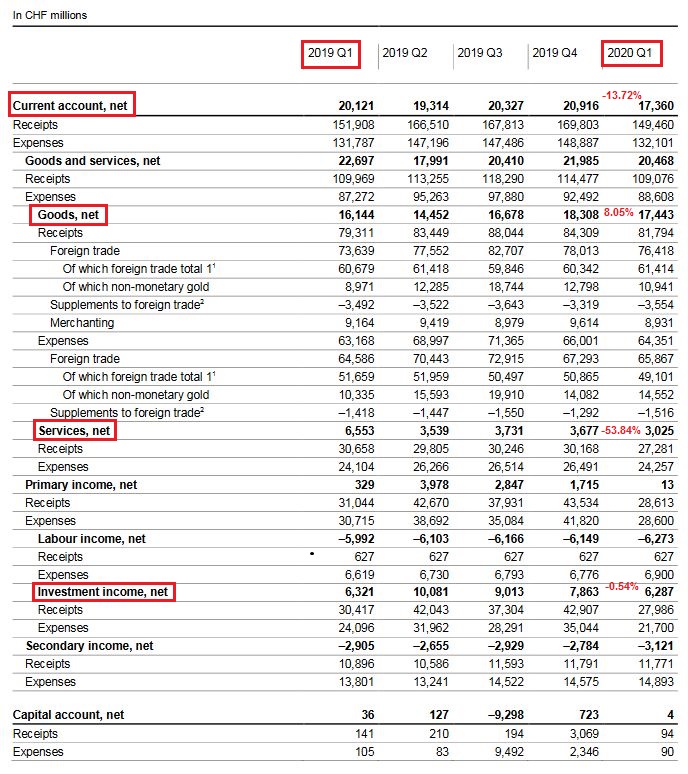

Transactions recorded in the financial account showed a net acquisition of CHF 34 billion on the assets side and a net incurrence of CHF 35 billion on the liabilities side in the first quarter of 2020. The SNB’s foreign currency purchases dominated on the assets side; this was reflected in an acquisition of reserve assets. The liabilities side was largely dominated by other investment: resident commercial banks recorded a substantial increase in liabilities to non-resident customers. Including derivatives, the financial account balance came to CHF –4 billion. |

Switzerland Financial Account, Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

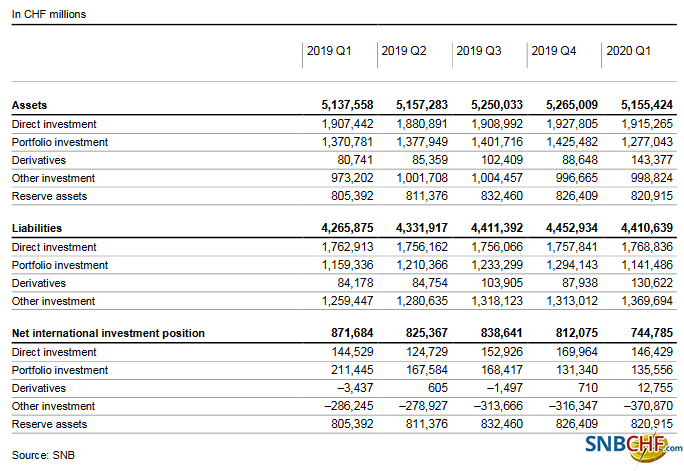

| The net international investment position fell by CHF 67 billion to CHF 745 billion in the firstquarter of 2020. Stocks of assets were down by CHF 110 billion to CHF 5,155 billion, and stocks of liabilities decreased by CHF 42 billion to CHF 4,411 billion. The decline in assets was mainly due to the huge price falls on foreign stock exchanges; the weaker euro against the Swiss franc was also a contributory factor. The decrease in liabilities was chiefly attributable to the marked drop in prices on the Swiss stock exchange.

Comprehensive tables covering the balance of payments and the international investment position can be found on the SNB’s data portal, data.snb.ch, Table selection, International economic affairs. |

Switzerland International Investment Position, Q1 2020(see more posts on Switzerland International Investment Position, ) Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position