The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) have today signed an Operational Agreement on the BIS Innovation Hub Centre in Switzerland. The Hub will identify and develop in-depth insights into critical trends in technology affecting central banking, develop public goods in the technology space geared towards improving the functioning of the global financial system, and serve as a focal point for a network of central bank experts on...

Read More »BIS Innovation Hub Centre in Switzerland

From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: “The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions. Tokens are digital assets...

Read More »SNB to cut rates in early 2020 as global economy sours – UBS

In the latest note to the clients, the UBS Economist Alessandro Bee indicated that he sees the Swiss National Bank (SNB) cutting interest rates next year. Key Quotes: “Both the European Central Bank and the Federal Reserve to “react to recession risks” with more rate cuts. That should force the SNB to cut rates in the spring, which is why there shouldn’t be a stronger appreciation of the franc in the next twelve months.” Meanwhile, the KOF Swiss Economic...

Read More »USD/CHF technical analysis: Downside limited by nearby rising trendline, 0.9937/35 confluence

USD/CHF seesaws around 23.6% Fibonacci retracement after witnessing multiple failures to cross 1.0030. A nine-day-old rising trend-line, followed by a confluence of 200-HMA/50% Fibonacci retracement limits near-term declines. Despite witnessing pullbacks from 1.0030, USD/CHF is yet to slip beneath key supports as it clings to 0.9985 during early Friday. The pair seesaws near 23.6% Fibonacci retracement of its upswing from last Tuesday and can revisit 38.2% Fibonacci...

Read More »AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

Bulls target risk back to the top of the channel and recent highs of 0.6750. Bears seek a break of trendline support and a resumption of the downside within the bearish channel. AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs. The Swiss Nation Bank has evidently been intervening in recent weeks, protecting its currency against strength vs the euro, although, on a technical basis, vs the...

Read More »USD/CHF capped again by 1.0025, retreats below parity

Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950. The Greenback weakened after US data and then recovered ground modestly. Despite rising against the US dollar, the Swiss Franc was the worst during the...

Read More »USD/CHF technical analysis: Bulls await upside break of 61.8 percent Fibo.

USD/CHF stays positive above 200-day SMA, 50% Fibonacci retracement. A sustained run-up beyond 61.8% Fibonacci retracement can aim for late-May highs. Despite successfully trading above key support confluence, the USD/CHF pair fails to provide a daily closing above 61.8% Fibonacci retracement of April-August downpour. The quote takes the bids to 0.9975 while heading into the European open on Thursday. Given the bullish signals from 12-bar moving average convergence...

Read More »USD/CHF technical analysis: Another attempt to defy 2-month-old rising wedge resistance

USD/CHF again aims to break two-month long rising trend-line, part of a bearish technical formation. Bullish MACD can trigger an uptick to 61.8% Fibonacci retracement. Sustained trading above 0.9948/50 confluence again propels USD/CHF to confront near-term key resistance-line while taking the bids to 0.9988 amid Tuesday’s Asian session. A rising trend-line since August-start, coupled with another one connecting lows marked since August 13, portrays a short-term...

Read More »USD/CHF technical analysis: Positive above multi-week old rising trend-line, 200-bar SMA

USD/CHF clings to 23.6% Fibonacci retracement amid bearish MACD. The rising trend-line since mid-August, 200-bar SMA limits downside. The seven-day long falling trend-line restricts immediate advances. Despite being mostly around 23.6% Fibonacci retracement of August-September upside, USD/CHF stays above key support-confluence as it trades near 0.9910 while heading into the European open on Monday. While the bearish signal from 12-bar moving average convergence and...

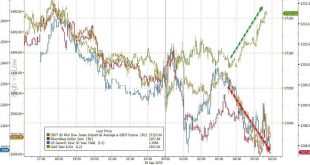

Read More »A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

Central Banks Remain Calm, Investors Not So Much The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions. Despite on-going, and universal,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org