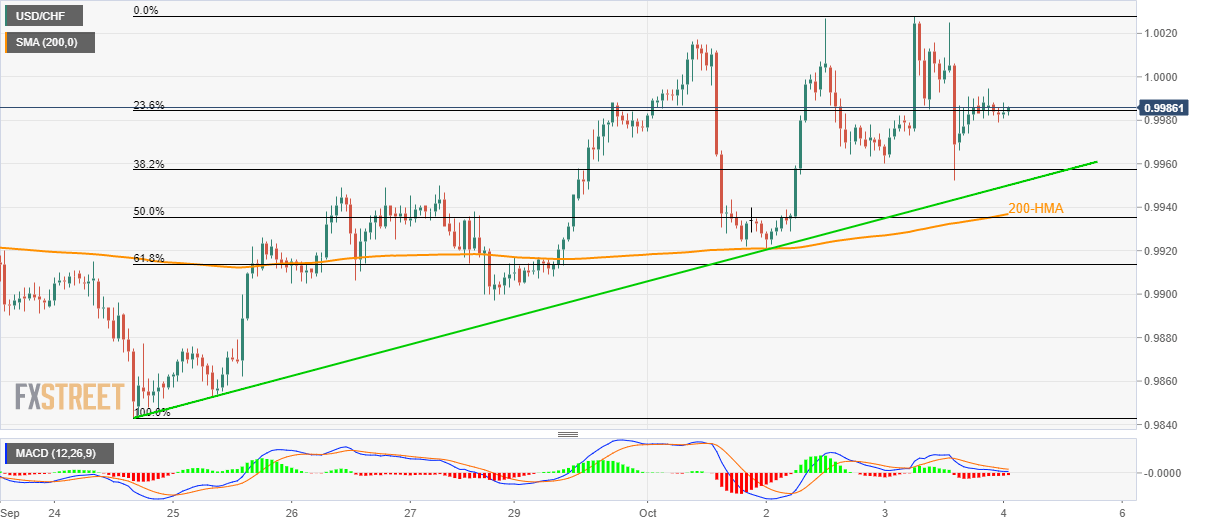

USD/CHF seesaws around 23.6% Fibonacci retracement after witnessing multiple failures to cross 1.0030. A nine-day-old rising trend-line, followed by a confluence of 200-HMA/50% Fibonacci retracement limits near-term declines. Despite witnessing pullbacks from 1.0030, USD/CHF is yet to slip beneath key supports as it clings to 0.9985 during early Friday. The pair seesaws near 23.6% Fibonacci retracement of its upswing from last Tuesday and can revisit 38.2% Fibonacci retracement level surrounding 0.9960 during further declines. However, an upward sloping trend-line since September 24, at 0.9950, followed by a 200-hour simple moving average (HMA) and 50% Fibonacci retracement, near 0.9937/35, could question pair’s further south-run. Should there be increased

Topics:

Anil Panchal considers the following as important: 1) SNB and CHF, 1.) FXStreet on SNB&CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

- USD/CHF seesaws around 23.6% Fibonacci retracement after witnessing multiple failures to cross 1.0030.

- A nine-day-old rising trend-line, followed by a confluence of 200-HMA/50% Fibonacci retracement limits near-term declines.

| Despite witnessing pullbacks from 1.0030, USD/CHF is yet to slip beneath key supports as it clings to 0.9985 during early Friday.

The pair seesaws near 23.6% Fibonacci retracement of its upswing from last Tuesday and can revisit 38.2% Fibonacci retracement level surrounding 0.9960 during further declines. However, an upward sloping trend-line since September 24, at 0.9950, followed by a 200-hour simple moving average (HMA) and 50% Fibonacci retracement, near 0.9937/35, could question pair’s further south-run. Should there be increased downside pressure below 0.9935, September 27 low close to 0.9900 will be sellers’ choice. Meanwhile, pair’s successful rise above 1.0030 could propel it to the late-May top adjacent to 1.0100. |

USD/CHF hourly chart, September - October 2019(see more posts on USD/CHF, ) |

Trend: bullish

Tags: Featured,newsletter,USD/CHF