Recently, the Swiss National Bank (SNB) unveiled the new 100 franc banknote. Only one note missing – © Janusz Pieńkowski | Dreamstime.com The note’s design is inspired by Switzerland’s tradition of humanitarianism, represented on the note by water. The note remains blue but is much smaller than the existing one, making it easier to fit into wallets. The note is the last one in Switzerland’s ninth series of notes to be updated. Updating the series began in April 2016...

Read More »Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, in einem früheren Interview mit cash. Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten “eher den Charakter von spekulativen Anlageinstrumenten als von ‘gutem’ Geld”, sagte der SNB-Präsident in einer Rede an der Universität...

Read More »Swiss National Bank Presents New 100-Franc Note

100-Franc Note - Click to enlarge The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals. The inspiration behind the new banknote series is ‘The many...

Read More »SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank’s Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits – plenty of jawboning going on here. Key comments: Negative rates are working, still, have plenty of room for fx intervention. The attractiveness of CHF...

Read More »More SNB Maechler: Right now we still have plenty of room for forex intervention

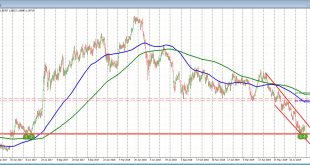

More from SNB Maechler Right now is still plenty of room for forex intervention as to negative rates are working, SNB’s Maechler says “absolutely” Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall. EUR/CHF, Daily - Jan 2017 - August 2019(see more posts on EUR/CHF, ) - Click to enlarge Drilling to the 4 hour chart below, the price of the EURCHF...

Read More »Die Nationalbank riskiert Ärger mit Donald Trump

Donald Trump (Picture: Shutterstock) Die Deviseninterventionen der Schweizerischen Nationalbank sorgen für Spannungen. Die Schweiz läuft Gefahr, von den USA als Währungsmanipulatorin gebrandmarkt zu werden. (K)ein Grund zur Sorge? In den vergangenen Wochen hat die Schweizerische Nationalbank (SNB) wiederholt am Devisenmarkt interveniert, um den Franken davor zu bewahren, noch stärker gegen die wichtigsten Handelswährungen wie Euro und Dollar zu steigen. So weit sind...

Read More »Philipp Hildebrands Coup: Gratisgeld für EU-Bürger

Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor. Verfasst hat er dieses zusammen mit anderen Autoren wie Stanley Fischer, ehemaliger stellvertretender Vorsitzender der US Federal Reserve (FED). Hildebrands Vorschlag: Geld- und Fiskalpolitik sollen miteinander verschmelzen. Den Bürgerinnen und Bürgern soll Geld direkt...

Read More »SNB sicher&solvent? Ja, meint Bern, und verweist auf Fussnote von Fussnote

Der Bundesrat behauptet, es bestehe bei der SNB kein Solvenz-Risiko. Er begründet das in seiner Botschaft an das Parlament mit einer Fussnote zu einer anderen Fussnote, die es in einer Festschrift so gar nicht gibt. Das ist liederliche Arbeit in Bundesbern; und das zu einem Thema, das staatspolitisch von grösster Tragweite ist. Kürzlich verkündete unsere Schweizerische Nationalbank (SNB) einen Halbjahresgewinn von fast 40 Milliarden Franken. Das Eigenkapital betrage...

Read More »Nationalbank unter Interventionsdruck

Der Schweizer Franken wurde zuletzt deutlich stärker gegenüber dem Euro. (Bild: Pixeljoy/Shutterstock.com) Die Zinssenkunkung der US-Notenbank Fed und die von der EZB angekündigten Massnahmen zur Lockerung der Geldpolitik sowie die jüngsten Ereignisse im Handelskonflikt zwischen den USA und China haben den Druck auf den Franken erhöht. Die Schweizer Währung wurde zuletzt deutlich stärker. In der letzten Woche sank der Euro erstmals seit zwei Jahren unter die Marke...

Read More »Nationalbank dürfte erneut interveniert haben

Darauf deuten die Sichtguthaben bei SNB hin, die als Indiz für solche Interventionen gelten und in der vergangenen Woche deutlich gestiegen sind. Die Einlagen von Bund und Banken lagen am 9. August bei 585,5 Milliarden Franken, wie die SNB am Montag mitteilte. Das ist ein Anstieg von rund 2,8 Milliarden gegenüber der Vorwoche. Schon in den beiden Vorwochen waren die Sichtguthaben um 1,5 und 1,7 Milliarden angestiegen,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org