USD/CHF struggles around 38.2% Fibonacci retracement after declining to a three-week low. Bearish MACD favors further downpour to 0.9800/9795 support-zone. With its sustained trading below 50-day SMA, coupled with the bearish MACD, USD/CHF stays on the sellers’ radar even if it clings to 0.9880 during early Friday. The September 24 low nearing 0.9840 acts as immediate support for the pair while the previous month low and 23.6% Fibonacci retracement of April-August...

Read More »USD/CHF technical analysis: Breaks below 0.9940 confluence support, turns vulnerable

The pair remains under some selling pressure for the second straight session. The ongoing slide dragged it below a two-month-old ascending trend-channel. Bears might now aim towards challenging the 0.9900 round-figure mark. The USD/CHF pair extended this week’s rejection slide from the vicinity of the key parity mark and remained under some selling pressure for the second consecutive session. The ongoing slide to one-week lows has now dragged the pair below a...

Read More »USD/CHF technical analysis: Intraday uptick falters just ahead of parity mark

Despite the intraday pullback, the pair has managed to hold above 200-DMA. The near-term technical set-up support prospects for some dip-buying interest. The USD/CHF pair failed to capitalize on its intraday positive move and faced rejection near the key parity mark, albeit has still managed to hold above the very important 200-day SMA. Given the pair’s repeated bounce from a support marked by the lower end of a two-month-old ascending trend-channel, the near-term...

Read More »Gefährliche Scheingewinne bei PKs

Die Schweizer Pensionskassen halten rund 30% ihrer Anlagen in klassischen Obligationen. Die meisten dieser Anleihen weisen eine negative Rendite aus. Dies, weil die Kurse so stark gestiegen sind, dass sich auf deren hohem Niveau trotz positivem Coupon (Nominalzins) eine Rendite auf Verfall von unter null ergibt. Das heisst, dass die erwarteten Kursverluste die Zinserträge übersteigen. So weist beispielsweise die 4% Anleihe der Eidgenossenschaft, welche ihre...

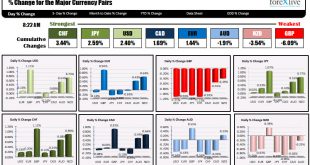

Read More »The CHF is the strongest, while the GBP is the weakest as NA traders enter for the day

Well…maybe some NA traders The US has a partial holiday with the bond market closed but the US stock markets open. Canada is off for Thanksgiving. So North American traders entering for the day, may be a little stretch today. However, the forex market is open. The CHF is the strongest as some of the euphoria from the events of last week (Brexit hope and China/US) fade and there is a flight into the safety of the CHF (and JPY). The GBP is the weakest as EU’s Barnier...

Read More »USD/CHF technical analysis: Buyers’ exhaustion around 0.9985/90

USD/CHF repeatedly fails to cross 0.9985/90 area. A two-month-old rising trend-line, 100-day EMA grabs sellers’ attention. Repeated failures to rise past-0.9985/90 resistance-area drags USD/CHF to 0.9965 by the press time of early Tuesday. The pair now witnesses pullback towards the two-month-old rising trend-line, at 0.9930, a break of which could further drag the quote to a 100-day Exponential Moving Average (EMA) level of 0.9910. Though, pair’s declines beneath...

Read More »USD/CHF technical analysis: Pivots around 200-day SMA, near mid-0.9900s

Continued with its struggle to extend the momentum beyond 200-DMA. Bears eye a decisive break below the ascending trend-channel support. Bulls are likely to await a sustained strength above the key parity mark. The USD/CHF pair failed to capitalize on last week’s attempted rebound from a support marked by the lower end of a two-month-old ascending trend-channel and met with some fresh supply on Monday. The pair’s repeated failed attempts to extend the momentum...

Read More »USD/CHF technical analysis: Positive above 200-bar SMA, 0.9890/87 confluence

USD/CHF pulls back from 0.9990, 23.6% Fibonacci retracement on the sellers’ radar. 200-bar SMA, followed by rising multi-week-old rising trendline and 38.2% Fibonacci retracement, limit further declines. Despite witnessing a downside pressure off-late, the USD/CHF pair remains well above the key supports while taking rounds to 0.9960 amid pre-European open session on Monday. While 23.6% Fibonacci retracement of August–October upside, at 0.9940, seems to please...

Read More »USD/CHF: Bulls have eyes on a break into the 1.000s in pursuit of channel resistance

USD/CHF has met a confluence of support as the US Dollar extends higher. Latest positioning data shows that CHF net shorts had been climbing for a third week. FOMC minutes at the top of the hour is next major risk. USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow. Currently, USD/CHF is trading at 0.9952 having travelled between 0.9915...

Read More »Nationalbank und SIX kooperieren bei digitalem Zentralbankgeld

Im Kontext des neu gegründeten BIZ-Innovation-Hub-Zentrum in der Schweiz kooperieren die SNB und SIX bei einer Machbarkeitsstudie für digitales Zentralbankgeld. (Bild: Pixabay) Die Schweizerische Nationalbank (SNB) und die Bank für Internationalen Zahlungsausgleich (BIZ) haben am Dienstag eine operative Vereinbarung zum BIZ-Innovation-Hub-Zentrum in der Schweiz unterzeichnet. Ziel des Innovation-Hub ist es laut SNB, vertiefte Erkenntnisse über die relevanten...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637068826263809659-310x165.png)

-637067377269597535-310x165.png)

-637066508442585331-310x165.png)