TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”. In economics it most often refers to tradeoffs or opportunity costs; resources are scarce and if you choose to use them in one way they aren’t available for an alternate use. The other way the phrase is often used is to describe a situation where it appears you are getting something for free but the cost is actually embedded in some other item. There’s always a catch and you should always look a gift horse in the mouth. I’ve seen a lot of seemingly free lunches in the investment world during my 40 year investing career. There’s

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, bonds, commodities, credit spreads, Cryptocurrencies, currencies, dot com bubble, Featured, growth stocks, inflation expectations, Interest rates, Markets, newsletter, Real estate, stocks, US dollar, value stocks, Warren Buffett

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”. In economics it most often refers to tradeoffs or opportunity costs; resources are scarce and if you choose to use them in one way they aren’t available for an alternate use. The other way the phrase is often used is to describe a situation where it appears you are getting something for free but the cost is actually embedded in some other item. There’s always a catch and you should always look a gift horse in the mouth.

I’ve seen a lot of seemingly free lunches in the investment world during my 40 year investing career.

There’s always someone out there offering high returns with allegedly low risk and year after year, decade after decade, they continue to find plenty of investors to prop up their frauds. Everyone wants to make a quick buck and our ability to resist the pull of such things is limited by experience. Get burned once on one of these things and you are unlikely to go back for seconds; this is how skeptics are born. But there is always a new generation of investors – suckers to use the P.T. Barnum appellation – who think they’ve found the financial equivalent of the ever elusive perpetual motion machine.

But the offering of free lunches expands dramatically during times of faulty monetary policy. Bubbles are just another name for free lunchism and they don’t happen in a vacuum; they are especially rife when interest rates are artificially low. We’ve had a steady diet of free lunches going back to the 90s and now after 40 years of responding to every slowdown, every hiccup in the global economy with easy money, we have finally reached the absurdity that is the crypto universe. Back in the late 90s I saw people quitting their jobs to day trade for a living in the swirl of the dot com mania and I thought they were nuts. Money was so free that we “invested” in everything worth investing in until all that was left was Pets.com. Then it all fell apart and the day traders became former day traders, although not many of them put that on their resume. Then in the mid-00s I watched again as cheap money produced real estate geniuses – just as it had stock market geniuses less than 10 year earlier – at an alarming rate. I remember being at a party in about 2005 in a tiny oceanfront condo in Hollywood, FL (with a view of the Everglades) where the owner, who had bought the place for $500k about 6 months before, said he would never take less than $1MM for the place. I looked at the person I came to the party with and said, that’s the top. But the owner was right. He didn’t sell it for less than $1MM.

After the GFC of 2008 a lot of us, myself included, thought we would finally get back to markets that put rational values on real things. I thought people would be reluctant to believe any of the old come-ons about quick riches and we’d have a more sober world. And that was true for a little while but over the course of the 2010s, stock prices started to rise again in ways that weren’t really supported by the fundamentals. But you could still make a case for long term investment in publicly traded equities through most of the decade. The real disconnect was in the private market where we had to invent a new term for overvalued, unprofitable companies – the unicorn. Companies like Uber, WeWork and a plethora of others were long on dreams and short on profits but the VCs were so awash in cash, the competition to get invested in these companies so fierce, that the companies just kept raising more money to replace what they just lost. The business plans of most of these companies seemed to be, get big enough to go public and cash out as quickly as possible. And it worked for much longer than I thought it would or should. But that free lunch wasn’t widely available enough, there weren’t enough suckers who met the definition of “qualified investor”.

Bitcoin was created in 2009 but was just an obscure, hard to understand libertarian alternative currency project. I’d seen similar projects implode in the 90s and didn’t think much of it. But over the course of the decade after it was invented, the price of Bitcoin rose so far, so fast it made the dot com era look quaint by comparison. And the mania around Bitcoin spawned what has become known as the Crypto universe or DeFi (decentralized finance) or Web3, take your pick. These projects have been hyped as the future of finance with explanations rich in techy sounding phrases that don’t mean anything and rates of return that would make Charles Ponzi blush. The technology – blockchain – is just the new wrapping on an old scam that plays on people’s fear and greed. I’ve got news for you. Distributed ledgers are not new, they are not the future of finance and unicorns don’t exist. 99.9% of the crypto space is nothing more than the same old scams updated for the digital age. And it is and was obvious all along. No, NFTs of cartoon apes don’t have any value. They are, to quote my wife, digital Beanie Babies. No, scarcity, by itself, does not ensure value. No, stablecoins are not stable. No, you can’t trust people who say they have a “secret sauce” and you should just trust them. No, bitcoin doesn’t have any value. No, “rug pulls’ are not something that just happens in all new industries. Yes, the 20% rate paid by your Anchor account was too good to be true. To be blunt, almost everything you think you know about crypto is BS. And if you lose your money speculating on this dreck there is nowhere to turn but the mirror. The one thing crypto does deliver is decentralization but it’s a bug not a feature.

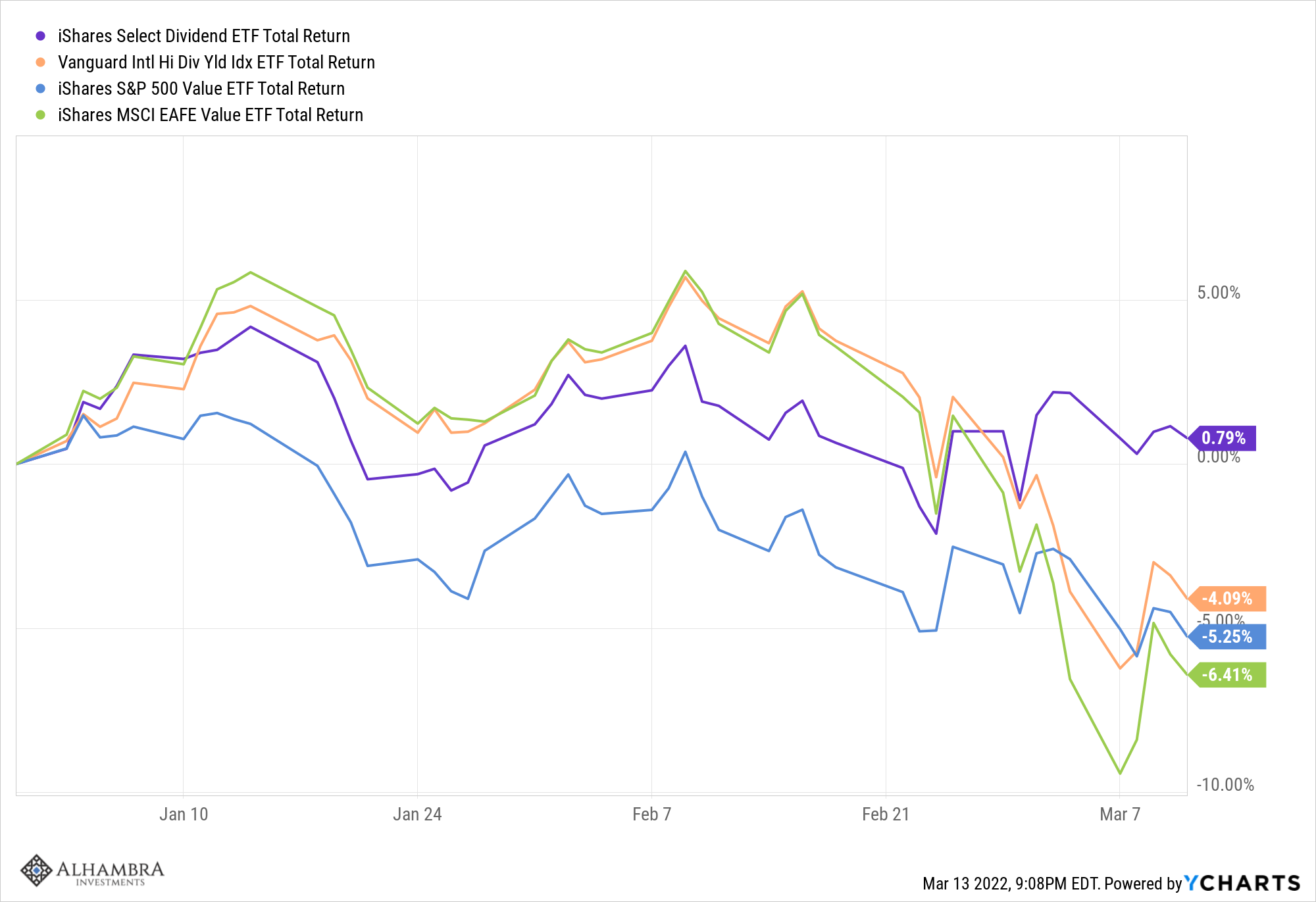

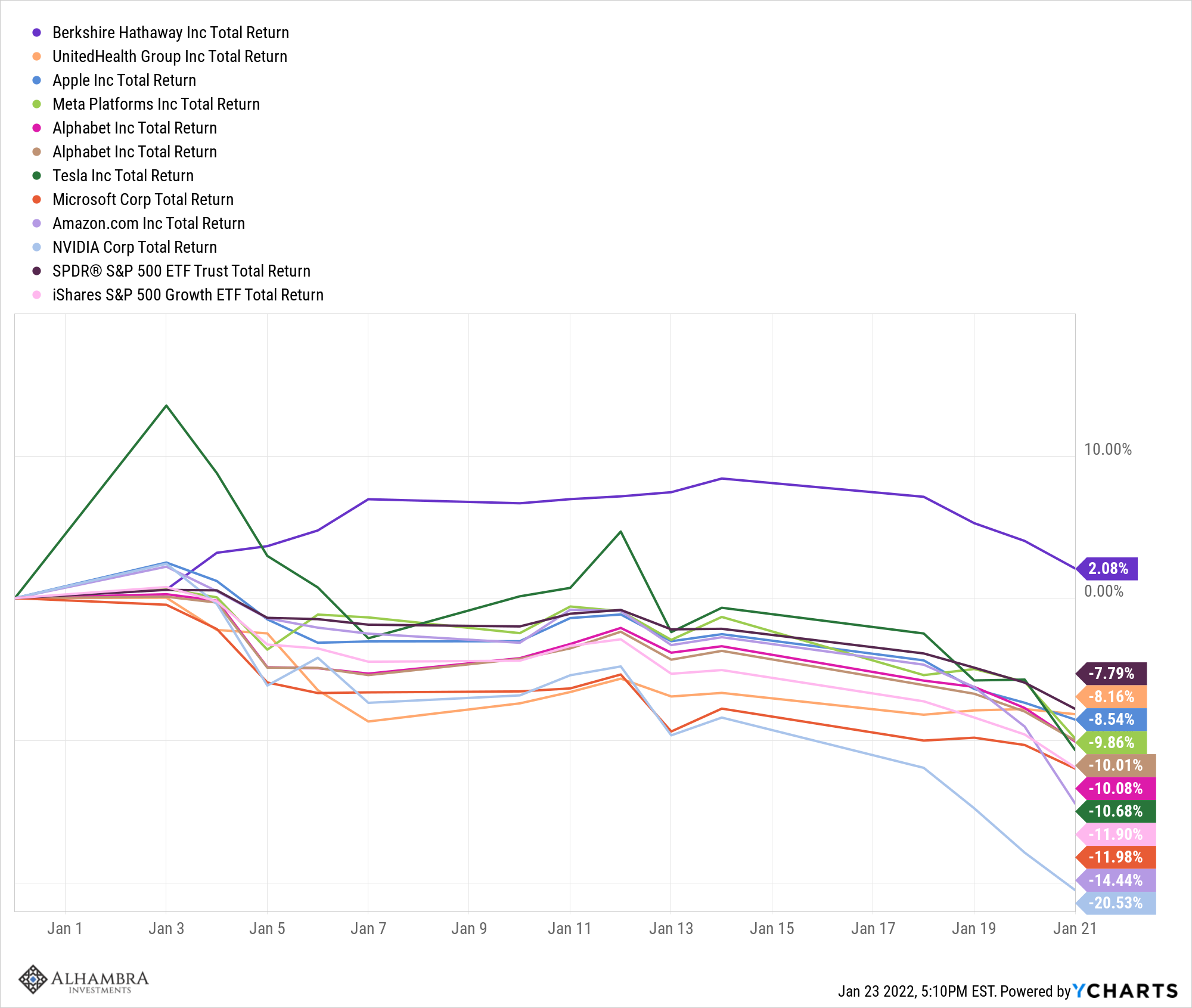

I suspect that, just like in the aftermath of the dot com bust, we will see – are seeing – a return to investing in things that are real, things you can touch and feel, things the global economy needs and companies that make actual products that people want and need. From the peak in March of 2000 the Russell 1000 value index fell 20.25% to its low in October of 2002. The Russell 1000 growth index fell 60% over the same time frame. But the drop in the value index was just a blip and from March 2000 to the peak in mid-July 2007 value stocks returned 104% while growth stocks didn’t break even until the spring of 2013. Yes, you read that right. Valuations matter even if they aren’t a great timing tool. If you are invested in real companies, with real profits and cash flow, companies that pay dividends, you are going to be just fine. If you own a bunch of companies that you hope will turn a profit someday or for which you paid a multiple of earnings that is measured in decades, you are in trouble and you’re going to be that way for a long time.

Now that interest rates are rising, the scams are being exposed and there will be more. I don’t think the losses in crypto will be big enough to harm the real economy but they are going to continue and they will hurt individuals who have foolishly allowed themselves to believe that there really are free lunches. If you don’t take the warning that was offered by the Luna/Terra mess last week, I can only say one thing – have fun being poor. TANSTAAFL.

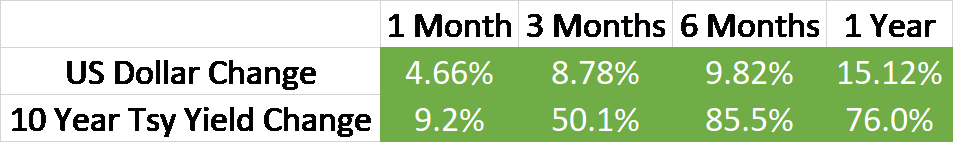

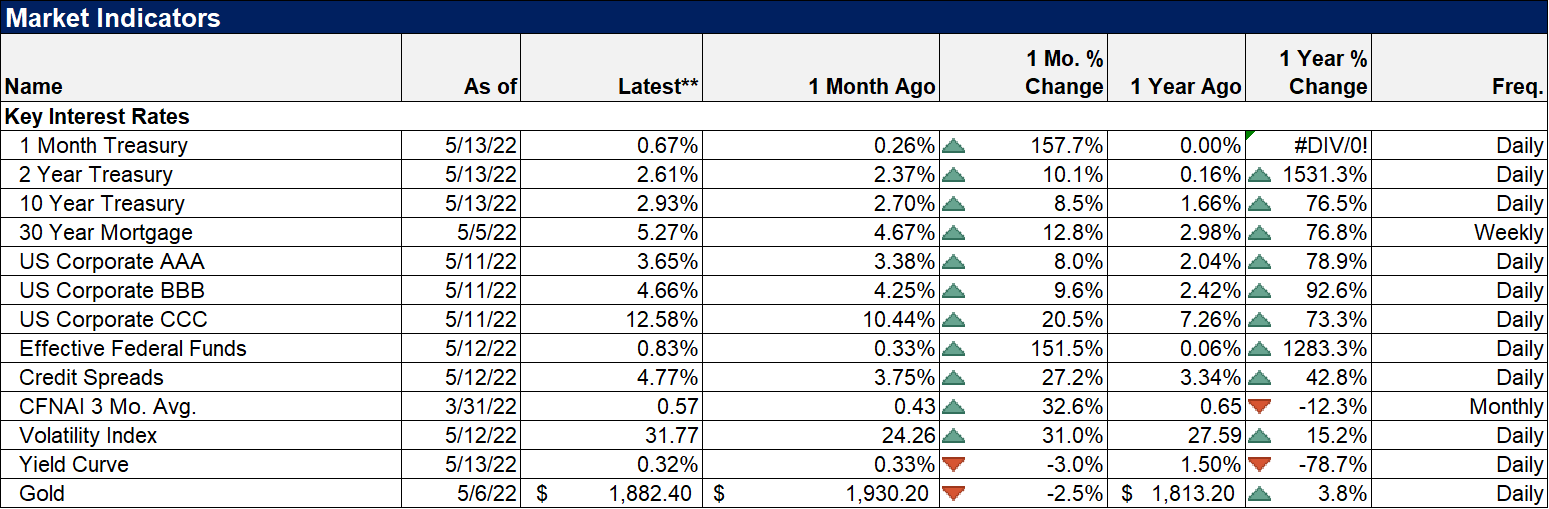

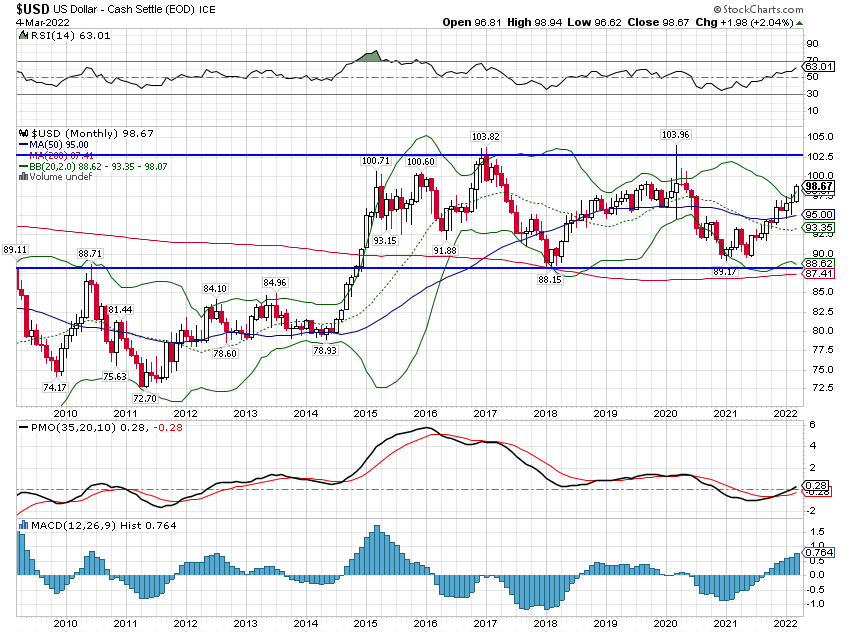

| The rising rate, rising dollar environment continues with the dollar index hitting a 20 year high last week. That rising dollar is having an impact on the rest of the global economy but so far it has been manageable. Several EM countries have had to raise interest rates and India and Hong Kong have intervened in currency markets. So far, the rise has been fairly orderly and markets remain liquid if less so than a few months ago.

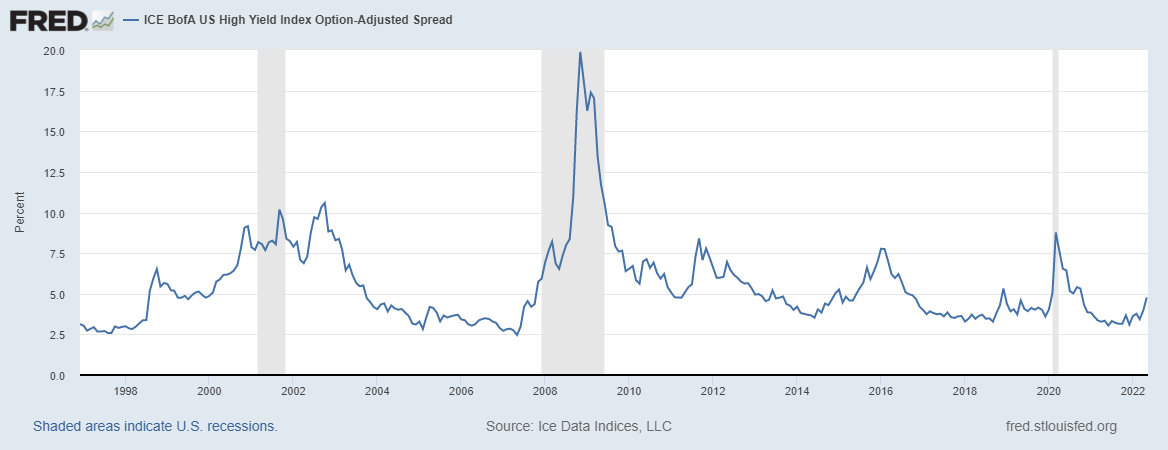

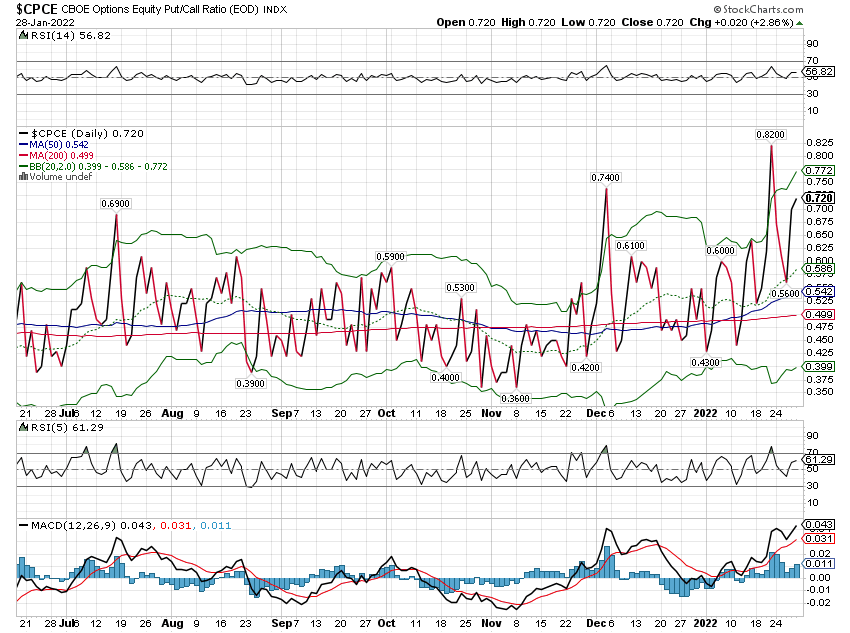

There are some signs of increased stress though and we should pay attention. Credit spreads have widened more but are less than 200 basis points above the lows (a threshhold we monitor and where we would become more concerned). Rising credit spreads are a warning but their history is full of false signals; spreads can and do widen outside of recession. And frankly, wider spreads is exactly what we need, a more rational rationing of credit. There are a lot of companies out there that have come public over the last two years, particularly through the SPAC channel, that are not profitable and will need to raise cash at some point. With their stock prices in the toilet – where they should have been all along – they probably won’t be able to issue equity and if spreads keep widening they won’t be able to afford debt. I suspect we will see a lot of these companies get bought on the cheap in the next few years. Or they’ll just fade away like the penny stocks they always were. |

|

| Additionally, the rise in rates may be about over. The 2 year Treasury yield has stalled since mid-April even as the 10 year yield continued to climb. The 10 year yield hit 3.2% last Monday and fell as low as 2.82% during the week before closing at 2.93%. Meanwhile, inflation breakevens (expectations as derived from the TIPS market) are falling pretty rapidly. The 10 year breakeven peaked at 3.02% on 4/21 and fell as low as 2.59% last week before closing at 2.69%. For perspective that is the high end of the range that has persisted since 2004. The bond market is moving on from the inflation scare. | |

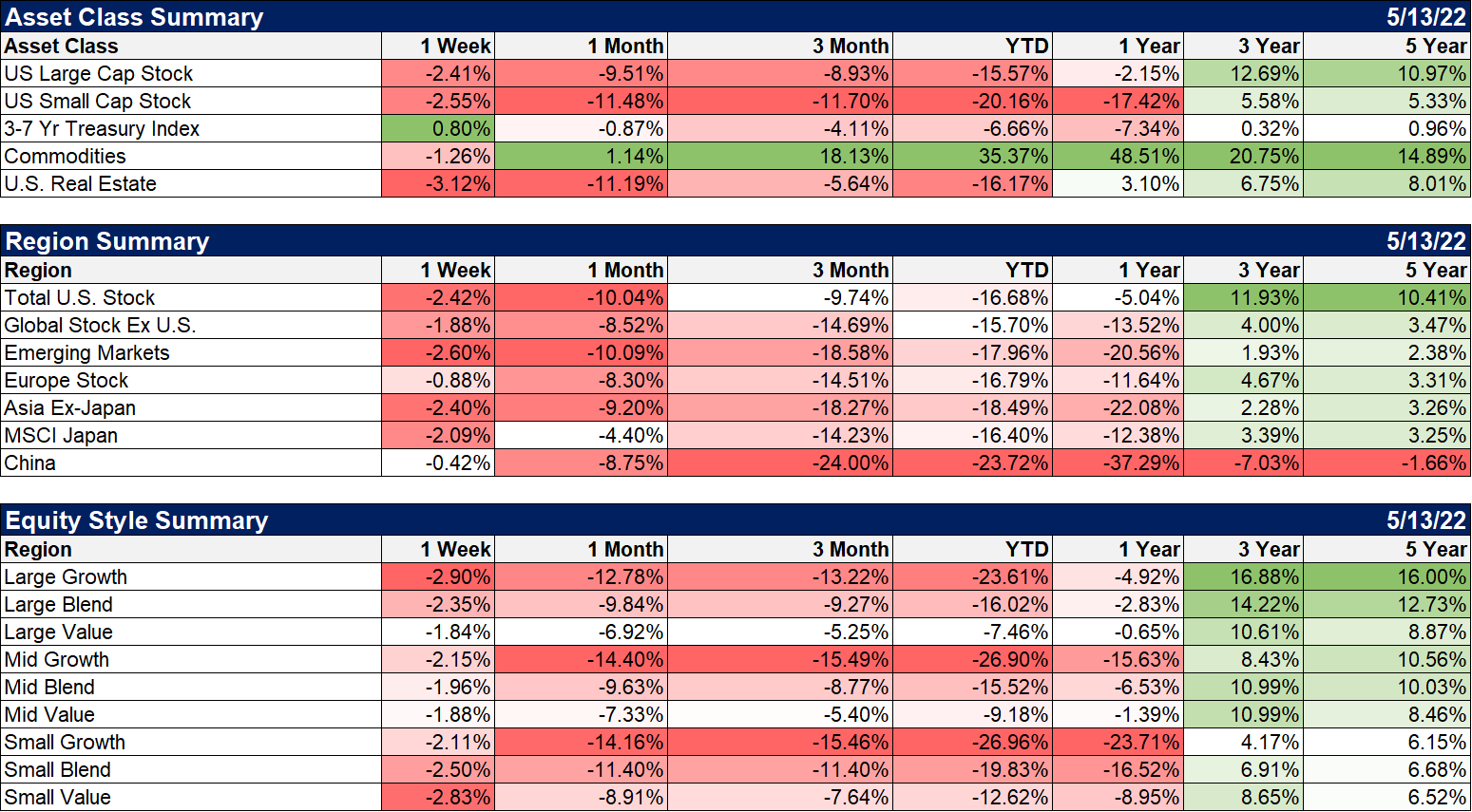

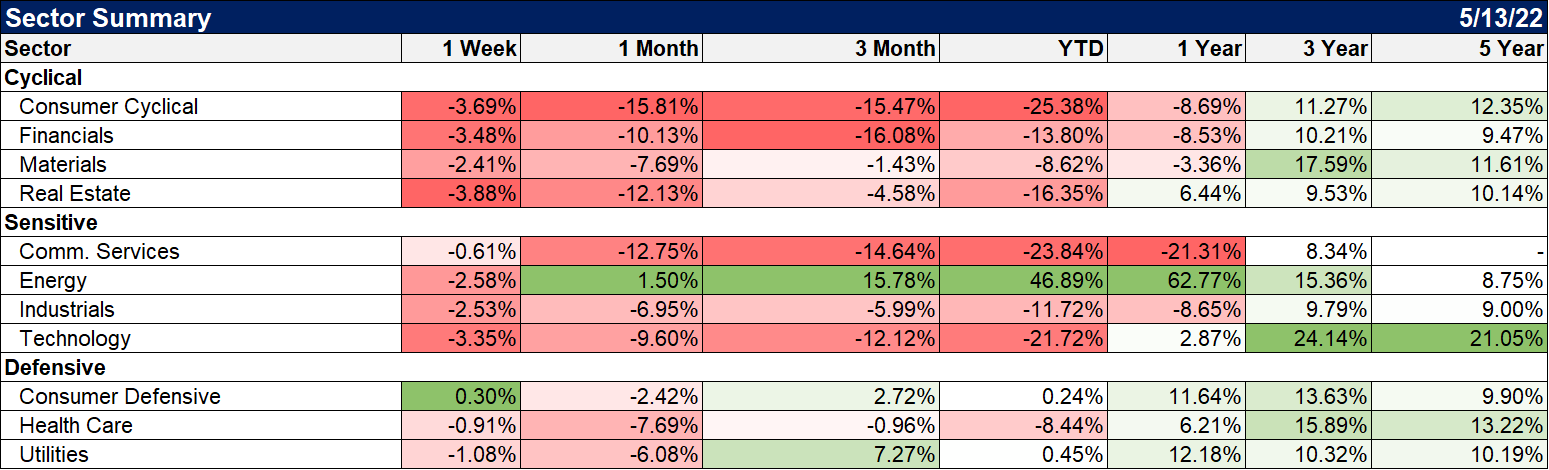

MarketsStocks closed down last week despite a big rally on Friday. Real estate was the big loser on the week but if rates really are peaking here, that will likely change. Commodities were also down last week but they are the sole asset class still up for the year and year over year. Commodities are up 197% since the low on March 31, 2020, a truly stunning move. For clients who have been invested in the space for a while we have been taking profits sporadically since the spike in crude prices at the onset of the Ukraine invasion. I expect a correction as the economy slows this year and so our current positioning is half our strategic allocation. I don’t think that will be the end of the commodity bull market though. |

|

| History says these kinds of shifts tend to last more than a few years. The last commodity bull market ran from 1999 to mid-2008 with two sizable corrections along the way. Large and mid-cap value stocks outperformed last week as they have all year (and back to the summer of 2020) but small value underperformed a little. The outperformance in small cap value has run further than large cap and so might be due for a rest.

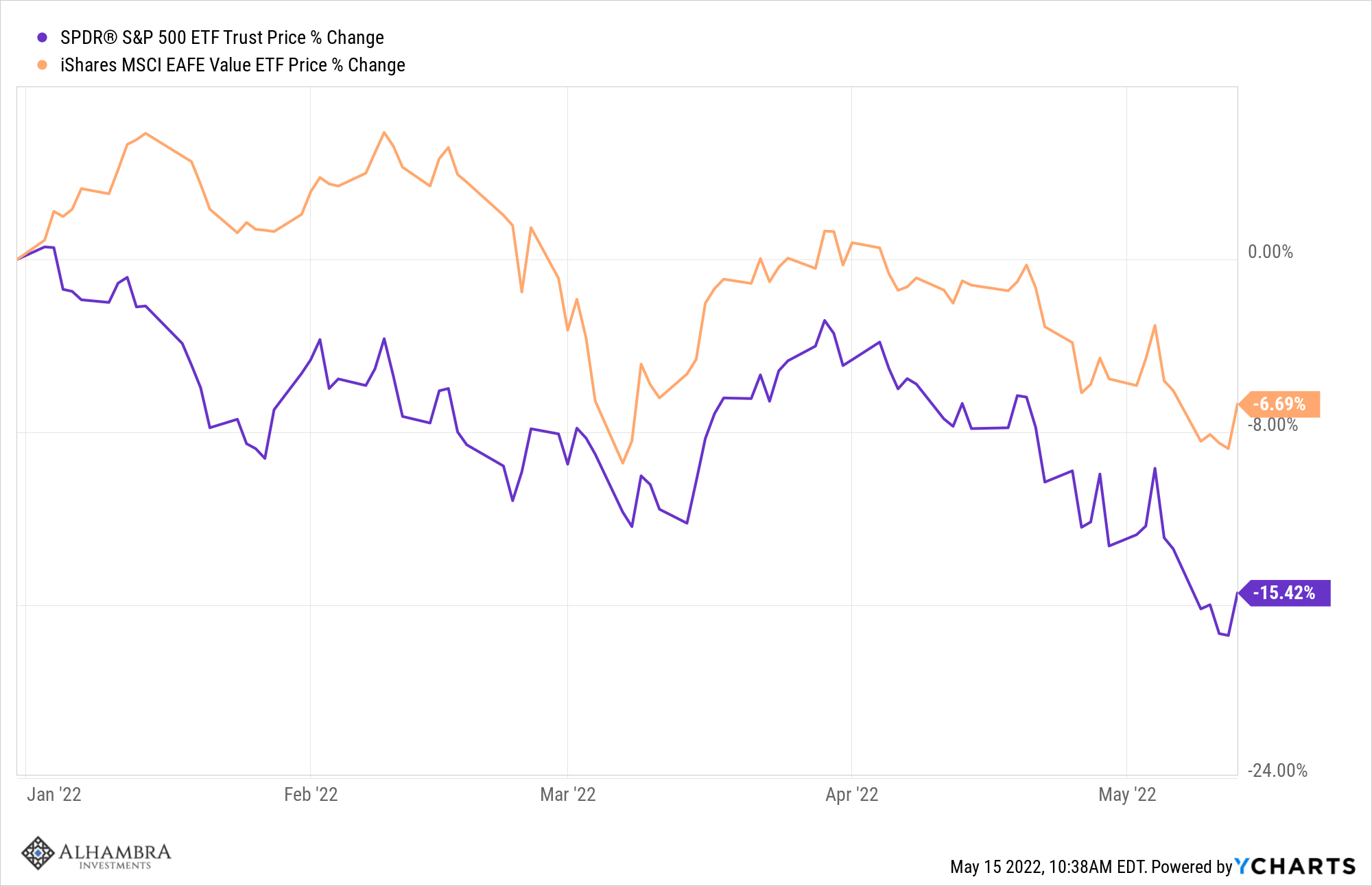

International markets were also down last week but China was only down a fraction. I’m reading this morning that Shanghai may start re-opening this week. If true that would probably be seen as a relief by all markets. By the way, value outperformance is a global phenomenon; EAFE value has outperformed the S&P 500 by 9% this year despite the strong dollar. |

|

| Defensive sectors outperformed again last week and they are the best performers year over year by a wide margin. | |

Only when the tide goes out do you discover who’s been swimming naked.

Warren Buffett

There are still a lot of skinny dippers out there but the tide of liquidity that has kept them hidden is receding. More of them will be revealed in coming months and my guess is that the Luna fiasco won’t be the biggest. Quality is, by far, the most important factor for your investments right now. Make sure you own high quality, profitable companies with ethical managements. That last one can be difficult to determine so remember that cash flow and dividends can’t be faked. It’s time to put your swim trunks on.

Tags: Alhambra Portfolios,Bonds,commodities,credit spreads,Cryptocurrencies,currencies,dot com bubble,Featured,growth stocks,inflation expectations,Interest rates,Markets,newsletter,Real Estate,stocks,US dollar,value stocks,Warren Buffett