Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.” You’ve been saving and planning and getting things in place. But have you planned for the taxes you have to pay on retirement income? Many retirees don’t take that into consideration and are surprised when they end up with less money to fund their retirement lifestyle. Uncle Sam doesn’t give you a break just because you’re retired. There are federal taxes on Social Security as well as distributions from 401(k) plans and IRAs. And unless you live in Alaska, Florida, Nevada,

Topics:

Bob Williams considers the following as important: 5.) Alhambra Investments, Featured, Financial Planning, newsletter, retirement income

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.” You’ve been saving and planning and getting things in place. But have you planned for the taxes you have to pay on retirement income? Many retirees don’t take that into consideration and are surprised when they end up with less money to fund their retirement lifestyle.

Uncle Sam doesn’t give you a break just because you’re retired. There are federal taxes on Social Security as well as distributions from 401(k) plans and IRAs. And unless you live in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, there will be varying degrees of state income taxes on retirement income, too.

Here are some of the most common forms of retirement income and how they’re taxed.

Social Security

About half of Social Security recipients pay taxes on their benefits. Whether you pay and how much is based on your combined income, which is the total of your adjusted gross income plus nontaxable interest plus half of your Social Security benefits.

If you are single and have a combined income between $25,000 and $34,000, or if you’re married with a combined income between $32,000 and $44,000, you may have to pay taxes on 50% of your Social Security benefit.

If you are single and have a combined income above $34,000, or married with a combined income above $44,000, you may have to pay taxes on 85% of your benefit.

Selling Investments

Just like before retiring, if you sell stocks, bonds, mutual funds, real estate, precious metal, etc., and make a profit, you have to pay a capital gains tax and the amount depends on how long you owned it.

Long-term capital gains come from investments you held for more than one year. Long-term gains are taxed at 0%, 15%, or 20%.

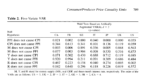

For 2021:

- The 0% rate applies to single filers with taxable income up to $40,400 and joint filers up to $80,800.

- The 15% rate is for single filers with taxable income between $40,401-$445,850 and joint filers between $80,801-$501,600.

- The 20% rate applies to single filers with income above $445,850 and joint filers above $501,600.

Short-term gains are applied to investments held less than one year and are taxed as ordinary income.

And, there’s an additional 3.8% net investment income surtax added to the 15% and 20% capital gains tax. It’s officially called the Unearned Income Medicare Contribution Tax. It took effect January 1, 2013 as part of Obamacare. You have to pay the tax if you are single with modified adjusted gross income (MAGI) over $200,000 or married filing jointly with MAGI above $250,000. Net investment income includes dividends, taxable interest, capital gains, passive rents, annuities, etc.

Municipal Bonds

Interest from municipal bonds is exempt from federal tax. And if that municipal bond is issued by an entity or agency in your state of residence, it is generally free from state income tax. There may be exceptions on the state level so check the laws where you live. And keep in mind that if you sell municipal bonds for more than your purchased them, you may have to pay federal capital gains tax on the sale, even though the interest is tax free.

Dividends

Another source of retirement income is dividends, most often paid by stocks or mutual funds in a person’s portfolio. Dividends come in two forms, qualified and non-qualified.

To be qualified, dividends have to pass a three-step test:

- Paid by a U.S. corporation or qualifying foreign entity. The dividend can come from stock, mutual funds, or ETFs.

- It has to meet the IRS definition of a dividend. Things that don’t qualify include:

- Premiums an insurance company sends back

- Annual distributions made by credit unions to members

- Dividends from co-ops or tax-exempt organizations

- You have to own the underlying security long enough

- You have to hold the security more than 60 days anytime during a 121-day period beginning 60 days before the ex-dividend date, which is the date you must own the stock to receive the dividend. For example, if your Home Depot stock declares a dividend on July 20, you have to own the shares for 61 days anytime between May 21 and September 19. When you count the days, include the day you sold the shares but not the day you bought them.

Qualified dividends are taxed at long-term capital gains rates. Non-qualified dividends are taxed as ordinary income.

Dividend rules are confusing and there are lots of exceptions and unusual scenarios with special rules, so consult IRS Publication 550.

Tags: Featured,Financial Planning,newsletter,retirement income