When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had...

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

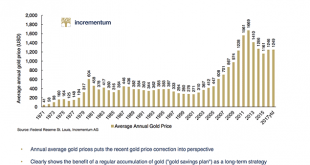

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »How Much Space Does $1,500 Rent In The World’s ‘Most Magnetic’ Cities?

New Yorkers who wince every time they slip a $1,500 rent check under their super’s door should consider moving to Shanghai, or maybe Berlin. According to a new study published on RentCafe, $1,500 will buy you three times more space in Shanghai than in Los Angeles and twice as much in Frankfurt. Meanwhile, rents per square foot are five times higher in San Francisco than they are in Berlin. Rentcafe used data from the...

Read More »How Much Space Does $1,500 Rent In The World’s ‘Most Magnetic’ Cities?

New Yorkers who wince every time they slip a $1,500 rent check under their super’s door should consider moving to Shanghai, or maybe Berlin. According to a new study published on RentCafe, $1,500 will buy you three times more space in Shanghai than in Los Angeles and twice as much in Frankfurt. Meanwhile, rents per square foot are five times higher in San Francisco than they are in Berlin. Rentcafe used data from the Global Power Index and data on price-to-square footage ratios that it...

Read More »Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

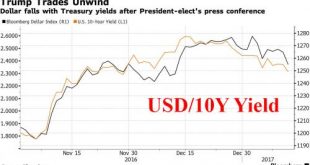

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More »The Global Run On Physical Cash Has Begun: Why It Pays To Panic First

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printing will likely be called upon to print a lot more currency as individuals and...

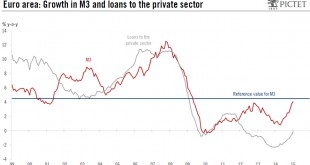

Read More »The 2015 Update: Risks on the Rising SNB Money Supply

Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (M0, often called “narrow money”), followed by the Bank of Japan and recently the ECB. In most cases the extension of narrow money did neither have an effect on banks’ money supply, the so called “broad money” (M1-M3), nor on price inflation. For the Swiss, however, the rising money supply concerned both narrow and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org