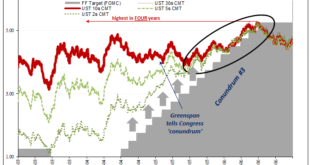

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite. Thus, between July 2005 and June 2006, the entire curve...

Read More »Houston, We Have An Oil (and inventory) Problem

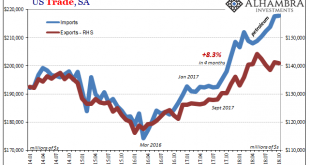

If only, like in the aftermath of the Apollo 13 explosion, we could just radio Houston to get started in figuring out just the way out of our fix. Mission Control would certainly buzz all the right people with the right stuff, summoning the best engineers and scientists from their quiet divans to the frenzied and dangerous work ahead. Sadly, in this context all we could ever turn to is Economists. And from Houston, we aren’t like to extract any more oil. The US...

Read More »The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right...

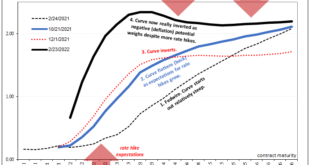

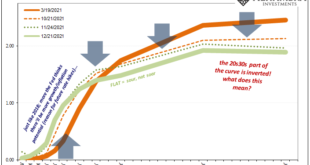

Read More »Start Long With The (long ago) End of Inflation

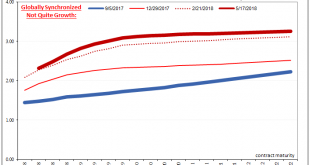

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns. What I mean is, those latter have come later (“growth scare”) only long after the world’s real money truly began to dry up. Money then economy. How do we know? For one, sequence...

Read More »This Is A Big One (no, it’s not clickbait)

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two. Twenty-eighteen, right? Yes. And also today. Quirky and kinky, it doesn’t seem like a lot,...

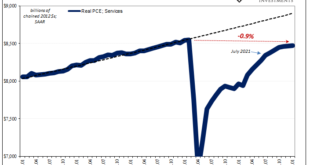

Read More »With No Second Half Rebound, Confirming The Squeeze

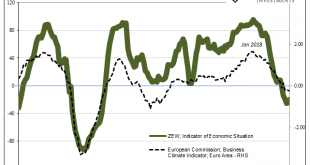

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis). You can see it in how everything is framed. When first presented with this “unexpected” globally synchronized downturn early on in 2019 (they ignored all the...

Read More »Converging Views Only Starts With Fed ‘Pause’

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise. That’s how these things go. Global synchronized growth, decoupling,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org