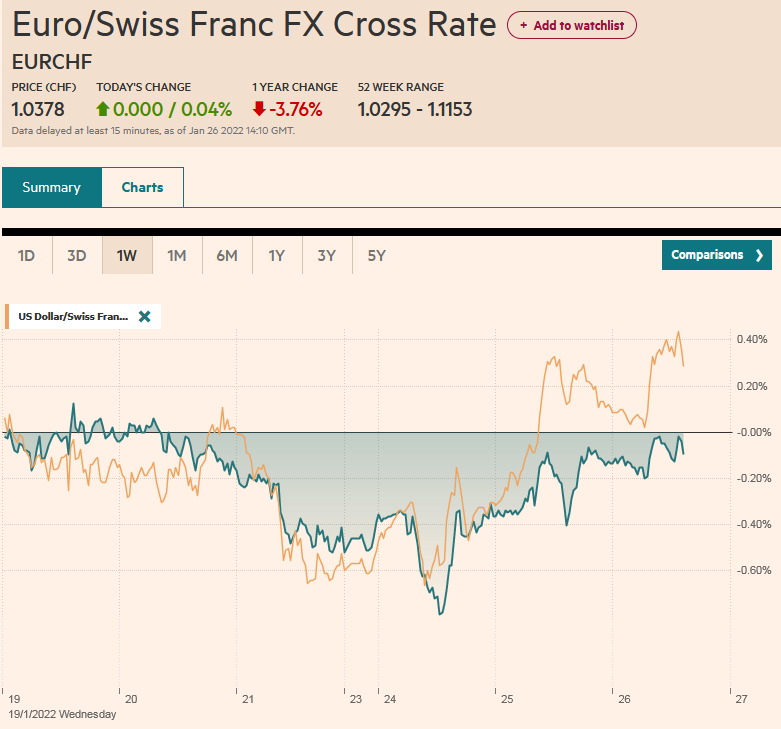

Swiss Franc The Euro has risen by 0.04% to 1.0378 EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe’s Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the S&P 500 popping more than 1% and NASDAQ by 2%. The equity recovery is having little impact in the bond market, where the US 10-year yield is up a basis point or so to near 1.79% and European yields are slightly firmer. The risk-on sentiment is evident throughout the foreign exchange market as the Swiss

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Chile, China, Currency Movement, Featured, FOMC, IMF, Italy, newsletter, Oil, Swiss National Bank, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

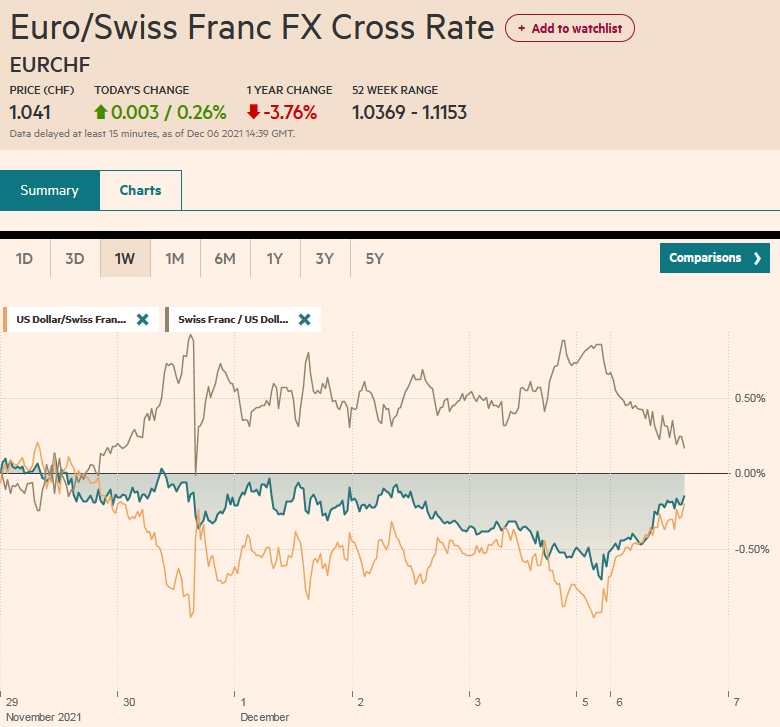

Swiss FrancThe Euro has risen by 0.04% to 1.0378 |

EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

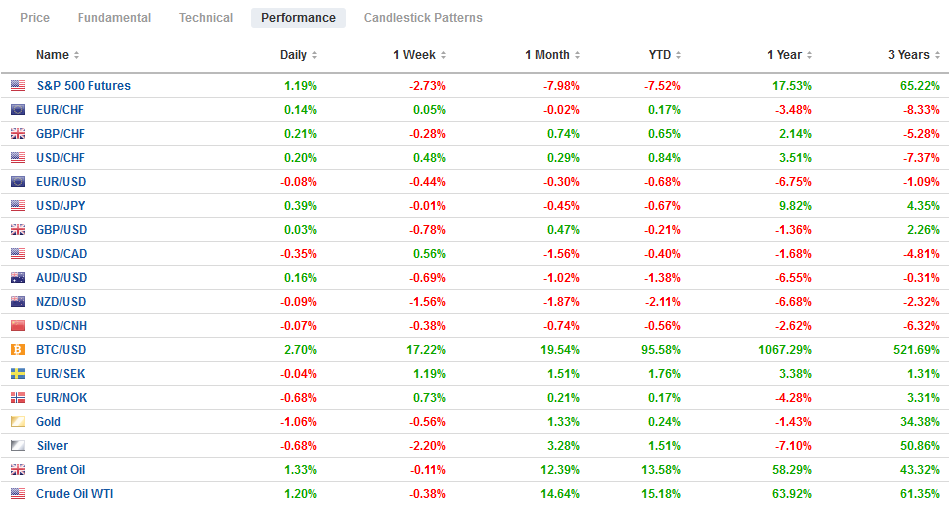

FX RatesOverview: After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe’s Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the S&P 500 popping more than 1% and NASDAQ by 2%. The equity recovery is having little impact in the bond market, where the US 10-year yield is up a basis point or so to near 1.79% and European yields are slightly firmer. The risk-on sentiment is evident throughout the foreign exchange market as the Swiss franc and yen are underperforming and the Norwegian krone, and dollar-bloc are leading the advance. Emerging market currencies are mixed. While the South African rand tops the performers, Russia and Eastern European currencies are sporting modest declines. The JP Morgan Emerging Market Currency Index is paring yesterday’s gain. Meanwhile, gold’s rally may be stalling around $1850, a two-month high. March WTI is firm and has held above $85 a barrel and is pushing through $86. US natural gas is up around 5% to extend its rally for a fourth consecutive session, while Europe’s benchmark (Dutch) is snapping a four-day rally with a 3% pullback. Iron ore extended its gains to the best level since August, and copper is firm in the middle of its recent range. The main interest today is on the equity performance after the volatility and the Fed and Bank of Canada meetings. |

FX Performance, January 26 |

Asia Pacific

The IMF downgraded this year’s forecast for global growth to 4.4% from 4.9% projected in October. The virus, higher inflation, and high debt levels were key considerations. The new constraints on mobility are expected to weigh on Q1 activity but recover in Q2. Still, a reassessment of the world’s two largest economies is at the heart of it. The combination of more aggressive Fed tightening and failure to pass the large (~$2.2 trillion) hard and soft infrastructure measures led to a sharp cut in the IMF’s US growth forecast to 4% from a little over 5%. China’s zero-Covid policy and travel restrictions, prompt the IMF to reduce its projected growth by 0.8% to 4%.

Beijing has continued to harass Taiwan by sending warplanes into its Air Identification Zone, with nearly 40 planes earlier this week, which is the most this year. Trying to make rhyme or reason for the continued action, some point to the two US carrier strike groups in exercises in the South China Sea. On another front, reports suggest Lithuania is considering asking Taiwan to change the name of its de facto embassy. It had planned to break tradition and allow Taiwan’s name to appear, rather than the more customary Taipei. China reacted as one would expect.

Coming into this week, the dollar had fallen against the yen for 11 out of 13 sessions. Today is the second day this week the dollar is posting gains and has resurfaced above JPY114.00. Initial resistance is seen in the JPY114.25-JPY114.50 band. Support is seen near JPY113.80. As it was yesterday, so too today, the Australian dollar is within Monday’s range (~$0.7090-$0.7190). Indeed, it is within yesterday’s range (~$0.7120-$0.7175) but appears set to push higher. A move above $0.7200 would lift the tone, while a break below $0.7150 would be disappointing. The Aussie is also extending its gains against the New Zealand dollar to new highs since last July above NZD1.07. The next important technical level is near NZD1.08. The Chinese yuan continues to edge higher. Today is the sixth consecutive advancing session. It has only fallen in four sessions this year. The dollar finished last year near CNY6.3560 and tested CNY6.3200 today. The PBOC does not appear to be using the fix to express its displeasure, and today its reference rate for the dollar (CNY6.3246) was spot on the market projection (Bloomberg survey median forecast).

Europe

Italy’s presidential selection process continues. Tomorrow things will turn more interesting. The first three rounds of votes are really about the behind the scenes jockeying, which is far from transparent. However, after today’s vote, the threshold is lowered to a simple majority to win, making a deal more likely. There is concern that if Draghi gets the nod, the coalition he led may not survive. Because snap elections cannot be entirely ruled out, voter polls are being watched closely. The latest shows the center-left PD with a small lead around 21.4%, but the right’s Brothers of Italy have been edging up and are now at 20.2%, followed by the League at 18.5%. Support for the 5-Star Movement has slipped to 13.8%, while Berlusconi’s Forza Italy has a little below 8%.

The euro had fallen to CHF1.03 at the start of the week, its lowest level in almost seven years. Despite no relaxation in Eastern European tensions, it has recovered to almost CHF1.04. The fingerprints of the Swiss National Bank are suspected, and Monday’s sight deposit report will be scrutinized for evidence of intervention. Separately, an SNB board member (Maechler) argued that the risk of a central bank digital currency for retail outweigh the benefits. The central bank’s efforts will be focused on a wholesale digital currency.

The euro is softer for the third consecutive session. The bounces after dipping below $1.13 have become shallower as if the bids are being absorbed. Yesterday’s low, slightly below $1.1265 is the first obvious target and below there is $1.1235. The 1.2 bln euro option at $1.1225 that expires today seems too far away to be in play, especially ahead of the FOMC outcome. That said, the trendline drawn off last year’s low in late November (~$1.1185) and catching the mid-December lows (~$1.1220 and $1.1235) held on Monday and was penetrated on an intraday basis yesterday. It comes in today around $1.1285. Sterling made a marginal new low for the move yesterday (~$1.3437), held the month’s low (~$1.3430) and recovered above $1.3500. Follow-through buying lifted it to $1.3520 before stalling. It encountered mild selling pressure in the European morning. Support is seen by $1.3480 and there is an option for GBP365 mln at $1.3450 that rolls off today. At the end of last week, the euro had been sold to almost GBP0.8300, its lowest level since March 2020. The rebound began ahead of the weekend and peaked near GBP0.8425 on Monday. It has drifted lower and is back near the week’s low (~GBP0.8350). An expiring option for 360 mln euros at GBP0.8325 may attract interest.

America

The US reports the December goods balance and some inventory figures that may be helpful to fine tune Q4 GDP figures due tomorrow. New home sales may be interesting after a 12.4% surge initially reported for November. But the real interest lies with the central bank meetings. The Bank of Canada’s meeting concludes first. The market has about a 70% chance of a hike discounted that economists (Bloomberg survey) are almost 50/50 split on. The case against a hike is that the central bank has indicated that the output gap won’t close until later in the first half. However, a case can be made that the economy is outperforming expectations, and the Q4 business outlook (surveyed by the Bank of Canada) suggest strong investment and hiring intentions. The Bank of Canada meets eight times a year and the swaps market has six hikes and a little more (1-in-3 chance) of a seventh hike. This is pretty aggressive and disappointed traders could punish the Canadian dollar. In the Thursday-Monday trading and the volatile equities, the greenback recouped half of what it lost from December 20 through January 19. A break of Monday’s high near CAD1.2710 could signal a move toward CAD1.2770-CAD1.2815. On the other hand, given that the outcome of the Fed’s meeting is a few hours later, a 25 bp hike may spur a strong advance. Separately, there had been some talk that after having finished the buying a little abruptly last year, the Bank of Canada could surprise by announcing an early roll-off of its balance sheet. Such a move would seem to surprise the market and could spur knee-jerk gains for the Canadian dollar.

Given the number of hikes that some banks have suggested by the Fed this year, today could be the most boring meeting of the year. It is the only one that nearly everyone agrees will not see a rate hike. The assessment of the economy will be tweaked, and word cues are expected to confirm a March hike, where the Fed Funds futures has about a 1-in-5 chance of a 50 bp move discounted. Given the apparent marching directions from Congress and the White House, the Fed may have little interest in indicating that it is not taking inflation seriously and therefore may not push against such views, regardless of its intentions. At his confirmation hearings, Chair Powell suggested it may take two-four meetings to sort out the balance sheet strategy. It seems reasonable that Powell repeats something like this at his press conference, but the statement is unlikely to refer to it. The Fed is still buying securities. There seems little Powell can say to push against market expectations for four hikes this year when several officials seem open to it. A reporter is bound to ask about the volatility of the stock market. Powell will be reluctant, we suppose, to accept much blame for the overvalued metrics or the timing of the volatility. He could explain how he monitors the equity market not simply because of the impact on shareholders, but what it may say about broader economic and financial conditions.

Last week’s EIA estimate of US oil inventories rose by 515k barrels (through January 14), the first increase since mid-November. API estimated that inventories fell by around 875k barrels (in the week through January 21). Economists expected EIA to show inventories increased by one million barrels. Separately, but not totally unrelated, the US announced it would loan 13.4 mln barrels out of its strategic reserves, which would be the second-largest operation. Many observers are concerned about the possible disruption of supplies should Russia invade Ukraine. Reports suggest that the German government sought to get an exemption for the energy sector if the US moved to prevent Russian banks from clearing dollar transactions. Other European countries have reportedly also looked for carve-outs, advocated transition periods for implementing sanctions, and protections for existing contracts.

The Canadian dollar is bid ahead of the central bank meeting outcome and amid better risk sentiment. The US dollar has approached Monday’s low (~CAD1.2455). The CAD1.2545 area corresponds to the (61.8%) retracement of the recent greenback bounce from around CAD1.2450 to CAD1.2700. Below there, we note the 200-day moving average is near CAD1.2500. Mexico reports November retail sales, which even on uneventful days, tends not to be a market-mover. The dollar is consolidating its recent gains against the peso and is also within Monday’s range (~MXN20.4370-MXN20.6900). The intraday technicals favor a greenback bounce in early North American activity. Initial resistance may be near MXN20.65. Note that the Chilean central bank meets today too, and late in the session, it is expected to lift its rate target to 5.25% from 4.00%. It would match a similar move last month and in October. The policy rate began at 0.50% last year. Local politics, and the weakness of emerging market currencies as an asset class saw the Chilean peso depreciate by 16.5% last year, making it the worst performer after Turkey and Argentina. So far this year, the peso’s 6.5% gain leads the world.

Tags: #USD,Bank of Canada,Chile,China,Currency Movement,Featured,FOMC,IMF,Italy,newsletter,OIL,Swiss National Bank