Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary. Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer bond purchases so much as positive excitement paced by the slightly better potential for a real recovery. . For the first time since maybe 2010, in May 2013, the bond market got onto the same page as to what Bernanke was telling Brady: CHAIRMAN BERNANKE. If we see continued improvement and we have

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Ben Bernanke, bond buying, bonds, currencies, Deflation, Dollar, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, global dollar shortage, inflation, jay powell, Markets, may 2013, newsletter, QE, taper, taper tantrum, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary.

Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer bond purchases so much as positive excitement paced by the slightly better potential for a real recovery. |

. |

For the first time since maybe 2010, in May 2013, the bond market got onto the same page as to what Bernanke was telling Brady:

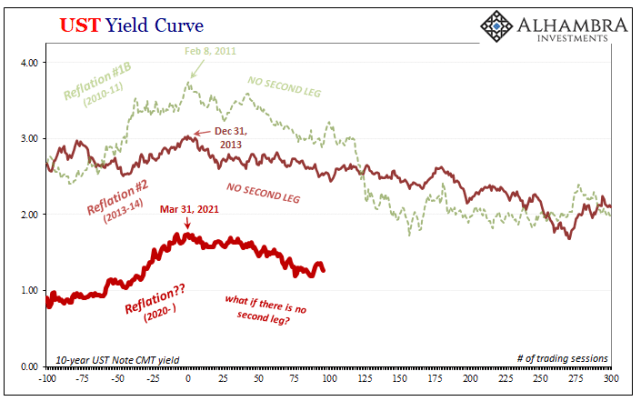

The key part behind both the Fed’s tapering as well as bond yields surging upward was actually the same thing, another thing, rather than the former driving the latter. In other words, “…confidence that that is going to be sustained.” The second “that” being economic progress – legit economic progress. |

|

|

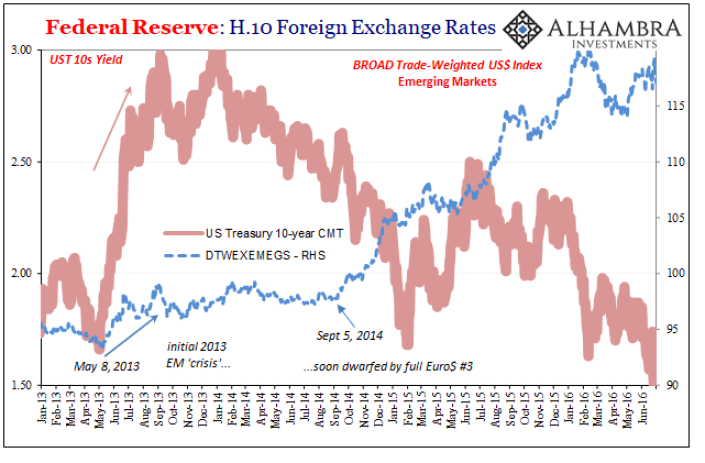

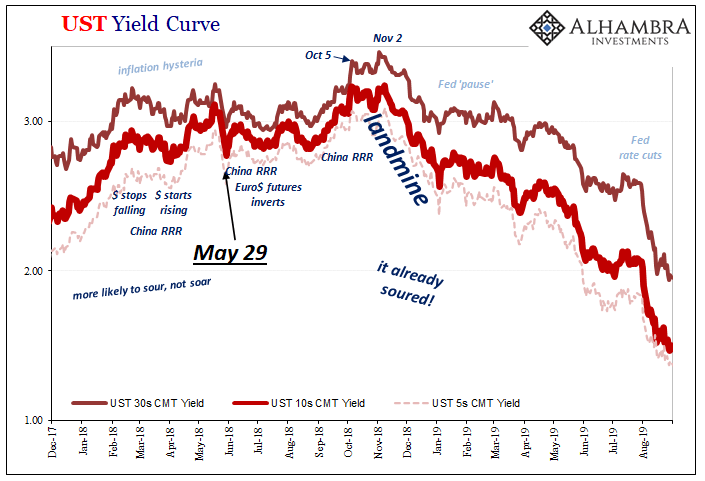

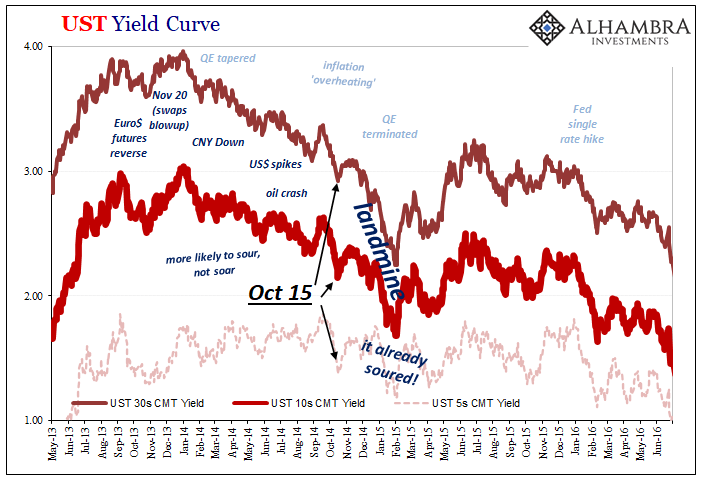

As we came to find out, however, such progress came to be defined (or had already been redefined) in very different ways. The reason the “tantrum” came to an arresting halt wasn’t anything Bernanke did to talk it down or counteract the rise of rates; on the contrary, the FOMC would go ahead and vote to step down the pace of purchases (both QE3 and QE4) later in December 2013. Confounding everything we were told, and have still been told, rates reversed even as Bernanke then Yellen scaled back their purchases. This change to “monetary” policy was entirely predicated on a very narrow definition of this relevant confidence. There’s was derived almost exclusively by the US unemployment rate and Establishment Survey. And such was Bernanke’s undoing. The bond market, on the contrary, took these US unemployment stats as together one minor indication among many including many more pertinent across the global whole. It might have represented a real pathway for sustained progress had it – at any time – been met by a solid set of corroborations not just here but across the rest of the world. |

|

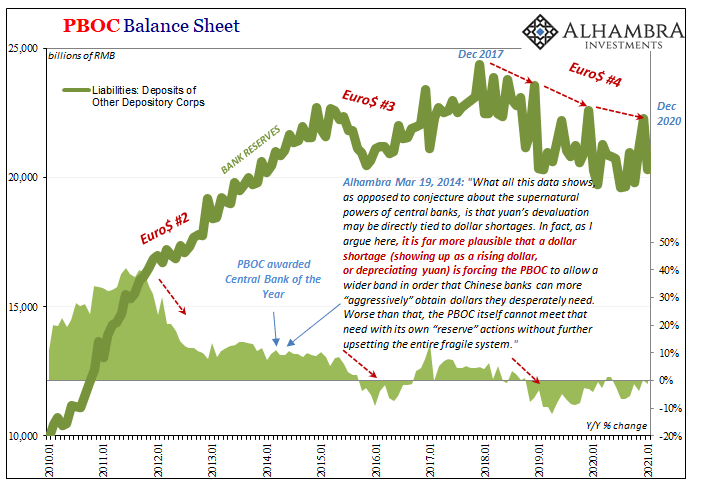

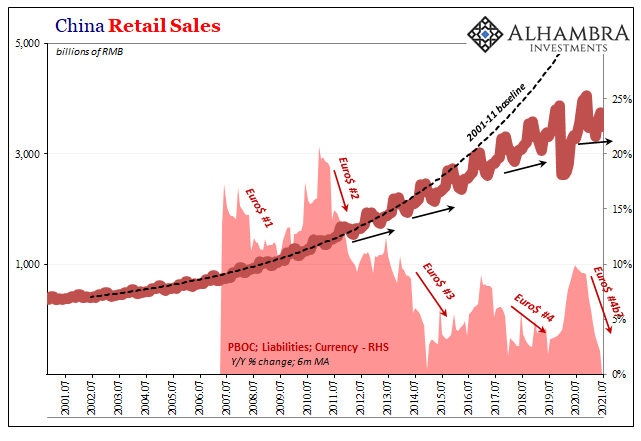

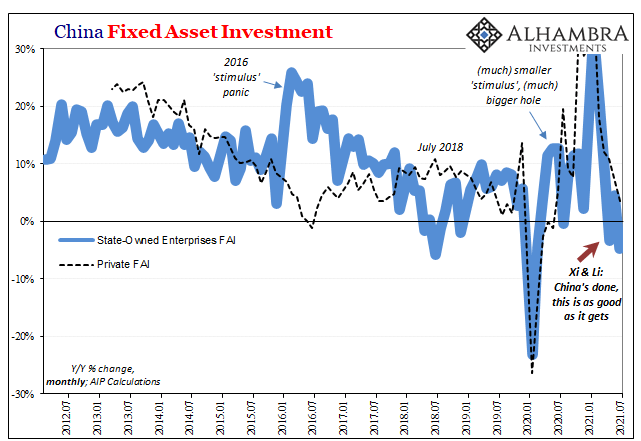

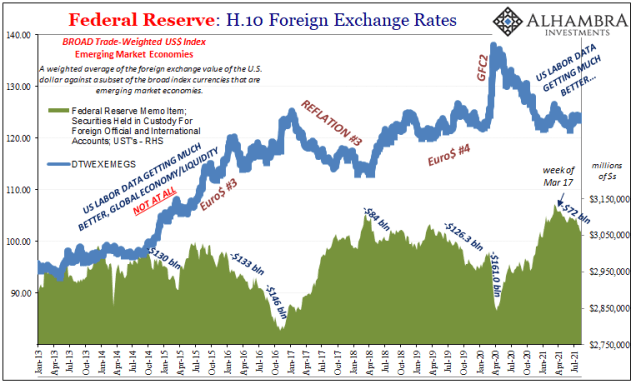

| But therein lay the problem; the rest of the world wasn’t coming around to the better future – money meaning dollar nor economy – posited by certain domestic labor numbers, it was more and more going the opposite way. The balance began to tip back in this other direction, the deflationary one, only beginning with US Treasury yields all the while Fed officials grew more confident in their own prognosis.

Economists still today believe that national economies are just that; essentially closed systems between which there may be only some trivial connections. Thus, the US unemployment rate would seem a definitive measure of the US condition if this national economy ever really exists. |

|

| It doesn’t, nor has it in a very, very long time. Worse still, this worldview more a matter of mathematical convenience (econometrics) than any attempt at a realistic science.

As I wrote in inflation review last week:

This lesson remained unheeded regardless of its overwhelming authority (see: Yellen, 2015). When Jay Powell stepped into the big chair in February 2018, he merely continued the same mistake of focusing exclusively on the US labor market numbers. No larger context, devoid of the necessary global factors to more realistically inform his (or anyone’s) rational view. Though 2014’s reversal still within decent memory, and 2018’s same thing yet closer to anyone’s rational mind, here we are all over again with all the same useful idiots poised to make essentially the same stupid mistake. It may seem overly harsh, but, yes, this really is downright stupid given how everything, and I mean everything, is right here in the open available for everyone to see it; as well as how it repeats one after another after another (after another and now another). |

|

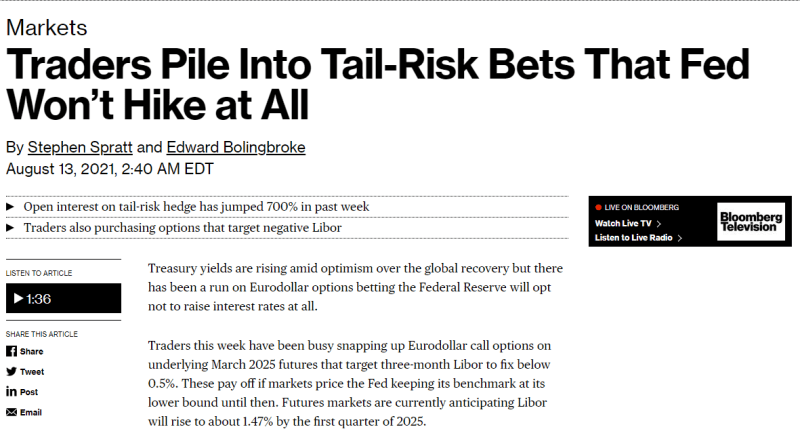

| Jay Powell’s Fed – even after committing a set of seriously unforced errors just a few years ago – is more and more committing itself to do this all over again. Assigning inappropriately huge interpretative value to recent US labor market data, the FOMC is, right now, preparing the public for eventual taper.But this is where the similarities to 2013 end; no tantrum anywhere in sight. This isn’t because the market doesn’t believe Powell’s group will do what they’re now more openly hinting. Oh no, it’s because the market doesn’t believe in what Powell believes.

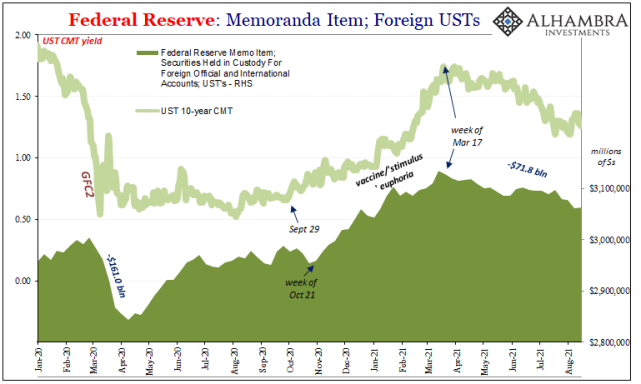

The US labor data might be steady and even convincing about the current state of the US labor market and maybe the domestic part of the economy, but remember what Bernanke said back then; “and we have confidence that it is going to be sustained.” The FOMC’s confidence is rising while at the same time the bond market’s is plummeting. So long as this remains the situation, there will be no “tantrum” even if there is taper. |

|

| Today is a perfect reminder of this underlying truth, the set of facts that deny the common interpretation of May 2013 and the misunderstood events of that summer. Taper noises grow only louder while bond yields go only lower – the bond market here and elsewhere getting more confident that the US labor data will not be sustained even if or as the FOMC’s policy resolve can be.I wonder where it could possibly get that idea? | |

Tags: Ben Bernanke,bond buying,Bonds,currencies,Deflation,dollar,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,global dollar shortage,inflation,jay powell,Markets,may 2013,newsletter,QE,taper,taper tantrum,U.S. Treasuries,Yield Curve