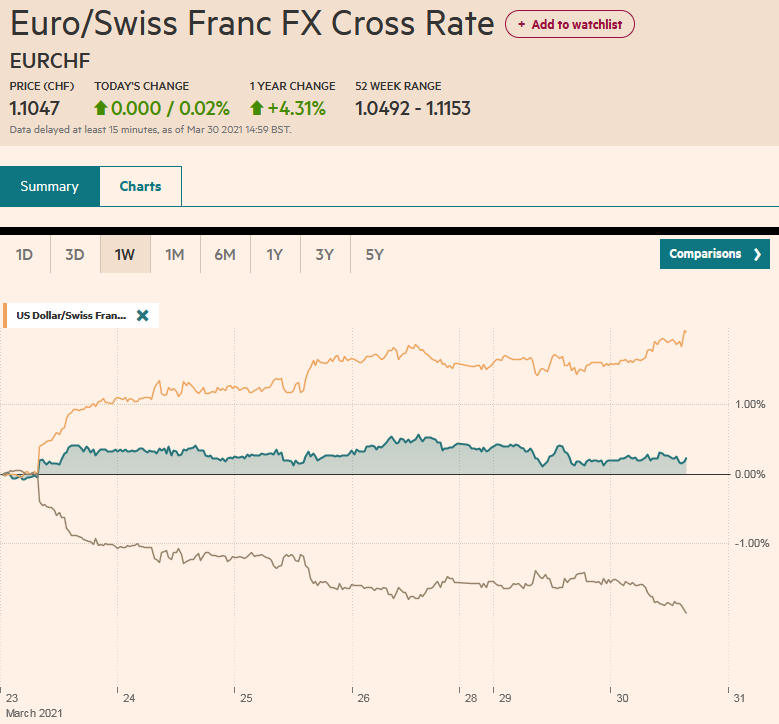

Swiss Franc The Euro has risen by 0.02% to 1.1047 EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US 10-year yield is at new highs since January 2020, pressing above 1.77% and helping pull up global yields today. European benchmarks yields are up 4-5 bp, and the Antipodean yields jump 8-9 bp. The impact on equities has been minor, and the talk is still about the unwinding of Archegos Capital. Most large markets in the Asia Pacific region rose, with the notable exception of Australia. South Korea and New Zealand led the region. Europe’s Dow Jones Stoxx 600 is at a new high in over a year, while US futures are mixed. The dollar has rallied above JPY110 for the first time since

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Australia, Brazil, China, Currency Movement, Featured, inflation, newsletter, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.02% to 1.1047 |

EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

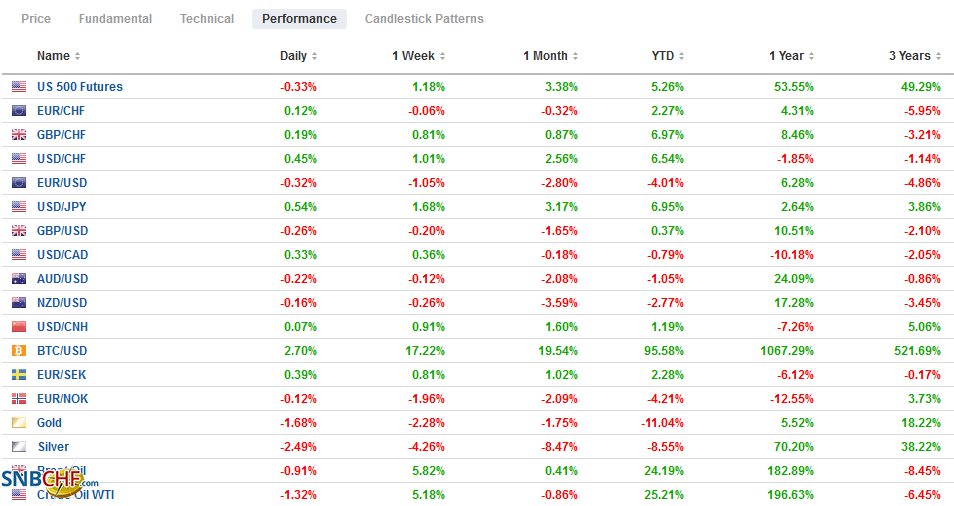

FX RatesOverview: The US 10-year yield is at new highs since January 2020, pressing above 1.77% and helping pull up global yields today. European benchmarks yields are up 4-5 bp, and the Antipodean yields jump 8-9 bp. The impact on equities has been minor, and the talk is still about the unwinding of Archegos Capital. Most large markets in the Asia Pacific region rose, with the notable exception of Australia. South Korea and New Zealand led the region. Europe’s Dow Jones Stoxx 600 is at a new high in over a year, while US futures are mixed. The dollar has rallied above JPY110 for the first time since last March, and the euro has been pressed below $1.1735. Sterling and the dollar bloc are showing some resilience. Most emerging market currencies are lower. Turkey’s Erdogan fired the deputy governor of the central bank (and replaced him with a former executive of Morgan Stanley), and the Turkish lira has approached last week’s extreme. The Chinese yuan managed to eke out a small gain in the mainland markets. The JP Morgan Emerging Market Currency Index is off for a third session. After dropping nearly 1.2% yesterday, gold is off another 0.75% and below $1700 for the first time in three weeks. Oil prices initially extended yesterday’s recovery, and May WTI rose to an eight-day high near $62.25 before retreating to almost $61.00. OPEC+ meets on April 1 and is not expected to alter its output, though Russia and Kazakhstan are thought to be pressing for increased quotas. US oil inventories are expected to have fallen last week for the first time in six weeks. |

FX Performance, March 30 |

Asia Pacific

The Australian government let the JobKeeper program expire. There seem to be compelling reasons. Australia lost about 378k full-time positions as the pandemic struck last year, and 358k have returned. The participation rate since last October has been 66.1% compared with 65.9% in December 2019. Yet, the unemployment rate, which was at 5.1% in February 2020, was at 5.8% in February 2021. Part of the improvement was flattered by the JobKeeper initiative, which had been extended twice. Reports suggest around 900k workers were still getting a wage subsidy as the program ended, and more than 10% will likely lose their jobs. The Reserve Bank is putting greater weight on the labor market in setting monetary policy, and this will likely be underscored at next week’s (April 6) RBA meeting. The new six-month round of A$100 bln bond-buying program begins mid-April.

FTSE Russell confirmed yesterday that it would add Chinese bonds to its World Government Bond Index. The inclusion will begin at the end of October and gradually increase to 5.25%-weighting over the next three years. This period seems longer than many would have anticipated. It will be the sixth-largest component when finished. Broadly, this is how Chinese markets are becoming more integrated into the global capital markets: benchmark inclusion and the rise of passive investment. When it comes to equities, Americans are sensitive to companies tied to China’s military, but bonds appear to be a different matter. Separately, FTSE Russell says it will consider adding India and Saudi Arabia to its emerging market bond index.

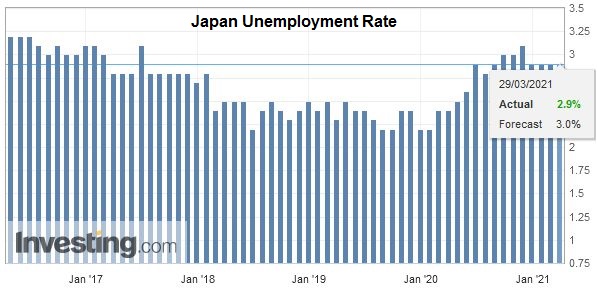

| Japan’s unemployment rate remained at 2.9% in February, defying expectations for an increase, though the job-to-application ratio slipped, as anticipated to 1.09 from 1.10. However, the more significant surprise was the 3.1% rise in February retail sales. The expected 0.8% increase was blown away by the 3.1% surge reported. Even when considering the downward revision in the January series to -1.7% from -0.5%, the February report was impressive. It was the first increase in three months and was the biggest since last June when its first state of emergency was lifted. While demand for durable goods appeared robust, the report may overstate the strength of consumption because it does not capture the drop in spending on services. Still, economists may pare forecasts of a contraction here in Q1. |

Japan Unemployment Rate, February 2021(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

After consolidating in its pre-weekend range yesterday, the dollar has been lifted through JPY110 with the help of rising US yields. It is the highest the dollar has been since last March when it recorded a high near JPY111.70. In February 2020, the dollar spiked to almost JPY112.25. Support will likely now be encountered in the JPY109.85-JPY110.00 area. The Australian dollar is steady. It made a five-day high near $0.7665 but has eased back and found support in the $0.7625 area, just below where it settled yesterday. It needs to resurface above the $0.7670, and ideally $0.7700, to lift the tone. The US dollar initially extended its gains against the Chinese yuan, reaching almost CNY6.58 before yielding to selling pressure and falling to session lows near CNY6.5640. The reference rate was set at CNY6.5641, which was in line with bank estimates. The PBOC does not appear to be causing the yuan’s weakness, but it has not appeared to be resisting it.

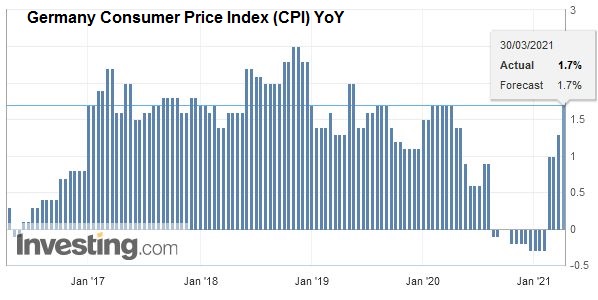

EuropeThe preliminary estimate of March eurozone inflation will be reported tomorrow. Germany and Spain reported their preliminary figures earlier today. Spain reported a larger than expected rise. The harmonized measure jumped 1.9% in the month and lifted the year-over-year rate to 1.2% from -0.1% in February. German states have reported an increase, and the national harmonized figure is due shortly. It is expected to have risen by 0.5% in March for a 2.0% year-over-year gain. There may be upside risks on the aggregate figures after a 0.9% year-over-year increase in February, unchanged from January. Recall that in the last four months of 2020, the year-over-year rate was negative 0.3%. The median forecast in Bloomberg’s survey is for a 1.4% rise. ECB President Lagarde went through the litany of “technical and transitory” factors that are behind the apparent rise in price pressures, including the end of the German VAT holiday, base effect from energy prices, shifting seasonal sales in France and Italy, and adjustment of the basket of goods and services that are being measured. |

Germany Consumer Price Index (CPI) YoY, March 2021(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| At her press conference following the ECB meeting on March 11, Lagarde announced that the ECB would significantly expand its bond-buying under the flexible Pandemic Emergency Purchase Program. She was not about to be pinned down by journalists to specify the meaning. With two weeks of data in, the significant buying appears to be around a 33% increase. From July through last month, the ECB averaged weekly purchases of about 15 bln euros a week. The average since the recent ECB meeting looks closer to 20 bln euros. |

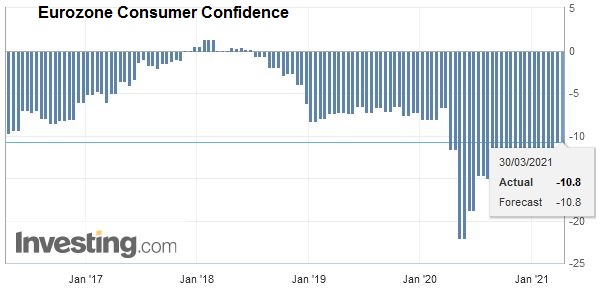

Eurozone Consumer Confidence, March 2021(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

The euro settled in North America yesterday near session lows (~$1.1765) and, after a slow start in Asia Pacific turnover, lurched lower and fell a little below $1.1735 before European markets opened. An initial attempt to recover stalled near $1.1750. There is an option for almost 700 mln euros at $1.1740 that expires today, but it has likely been neutralized. Although there may be some support around $1.1700, the risk extends toward $1.16, which it last saw as the polls in the US were closing last November. Sterling also settled on its lows yesterday. However, selling pressure was more modest than on the euro. It slipped through yesterday’s $1.3755 in late Asia turnover and fell to almost $1.3740 before European bids were found. Yet, selling pressure capped it near $1.3780. Last week’s lows were in the $1.3670-$1.3675 area.

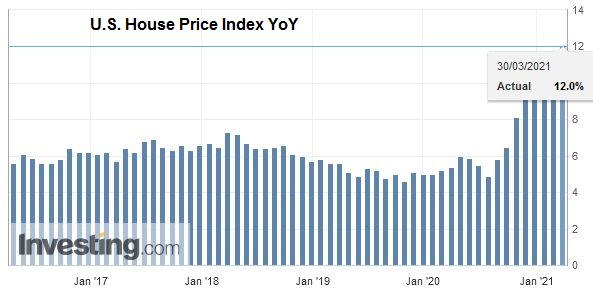

AmericaWhile several US states have relaxed public health rules much to the chagrin of the CDC and are experiencing an increase in the contagion, the vaccinations are accelerating with over three million inoculations a day. The Biden Administration says that 90% of US adults will be eligible for the vaccine by April 19, and 90% of the country will be within five miles of a vaccination site. The North American economic calendar is light today. The US reports S&P CoreLogic house prices for January. In December, its national indicators showed house prices increased by nearly 10.4% last year. The Conference Board’s consumer confidence measure is also on tap. Attention will turn to the labor market tomorrow with the ADP estimate and Thursday’s weekly initial jobless claims, ahead of Friday’s national figures, where around 650k of job growth is expected. The Fed’s Quarles and Williams speak today. President Biden’s speech in Pittsburgh tomorrow will unveil details of his infrastructure proposal, which is expected to include some tax hikes. Canada reports January GDP tomorrow. Mexico reports reserves and budget figures today. Note that Brazil reports inflation figures today (IGPM), producer prices, and the central government’s budget balance. However, the government shake-up, includes the ministers of defense, foreign affairs, and justice. The cabinet changes seem driven by the public backlash against the government dealing with the pandemic. |

U.S. House Price Index YoY, January 2021(see more posts on U.S. House Price Index, ) Source: investing.com - Click to enlarge |

The US dollar is little changed against the Canadian dollar, trading comfortably inside yesterday’s range (~CAD1.2570-CAD1.2625). The greenback found a base in the second half of last week in the CAD1.2540-CAD1.2550 area. Below there support is seen near CAD1.2500. On the top side, the CAD1.2625-CAD1.2630 area looks like a good cap. The US dollar is also inside yesterday’s range against the Mexican peso (~MXN20.56-MXB20.79). A consolidative session is likely, but the risk seems on the dollar’s upside. The greenback finished just above BRL5.78 yesterday. The year’s high was set on March 9 near BRL5.8745, while last year’s high was recorded in mid-May near BRL5.9715. The larger than expected 75 bp rate hike on March 17 (lifting the Selic rate to 2.75%) does not seem sufficient to prevent the real from falling to new lows.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Brazil,China,Currency Movement,Featured,inflation,newsletter