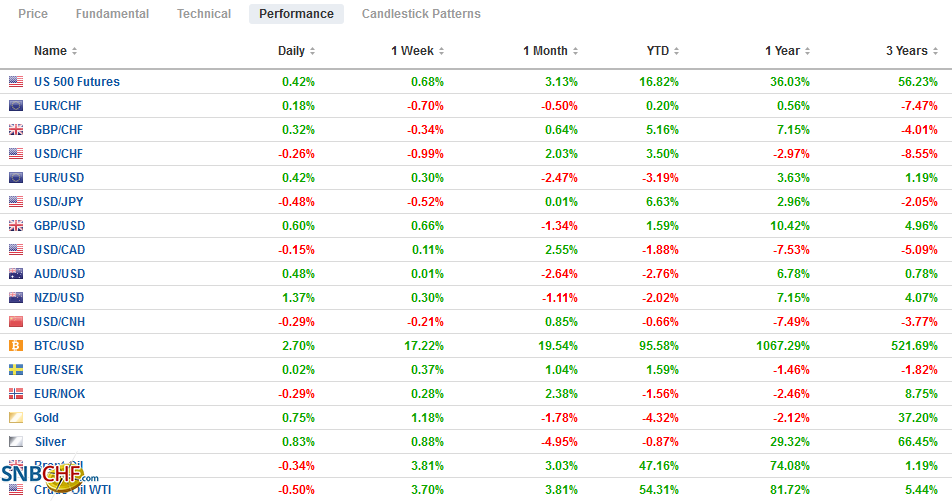

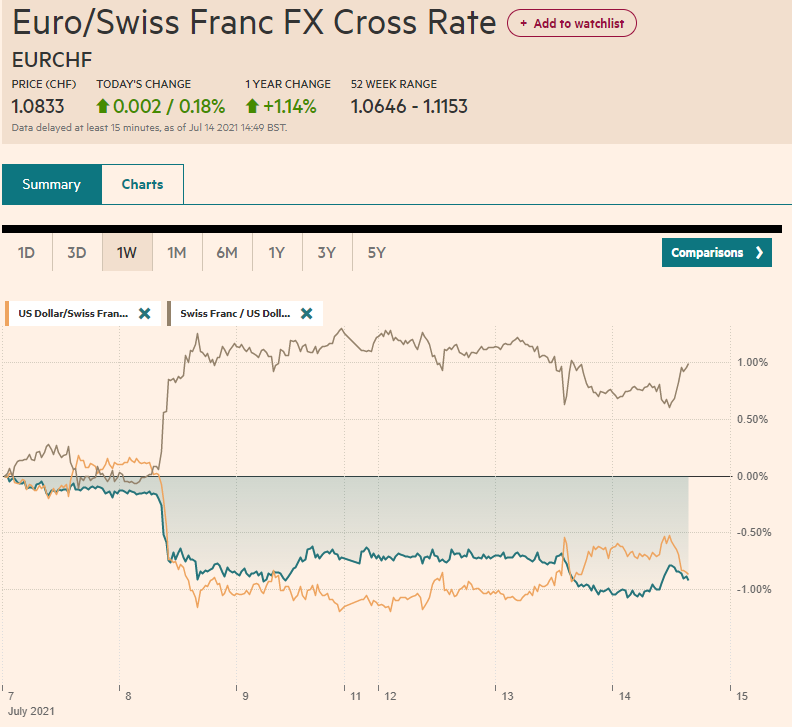

Swiss Franc The Euro has risen by 0.18% to 1.0833 EUR/CHF and USD/CHF, July 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand’s s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against the greenback today. Sterling is up around a quarter of a percentage point after it reported a larger than expected rise in CPI. Most of the other major currencies, but the Swiss franc and Swedish krona are posting small gains. Emerging market currencies are also narrowly mixed, leaving the JP Morgan

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Chile, Currency Movement, Featured, Federal Reserve, inflation, newsletter, RBA, RBNZ, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% to 1.0833 |

EUR/CHF and USD/CHF, July 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The Reserve Bank of New Zealand jumped to the front of the queue of central banks adjusting monetary policy by announcing the end of its long-term asset purchases. New Zealand’s s 10-year benchmark yield jumped seven basis points, and the Kiwi is up almost 1%, to lead the move against the greenback today. Sterling is up around a quarter of a percentage point after it reported a larger than expected rise in CPI. Most of the other major currencies, but the Swiss franc and Swedish krona are posting small gains. Emerging market currencies are also narrowly mixed, leaving the JP Morgan EM index virtually flat on the session. Of note, ahead of Turkey’s central bank decision, the lira has stabilized after rising for the past four sessions. Equity markets are struggling today. The MSCI Asia Pacific Index fell for the first time this week. Of the large markets, only Australia and India indices gained. Europe’s Dow Jones Stoxx 600 is also threatening to post its first loss of the week. US futures are little changed. The US 10-year yield slipped lower after yesterday’s unexpectedly strong CPI print but reversed with the help of a poor 30-year auction that generated a four basis point tail, the biggest this year. The benchmark yield is off a couple basis points today and is back below 1.40%. European bond yields are little changed, though, on the back of a strong CPI report, the 10-year Gilt yield is up four basis points. Gold is firm, within yesterday’s range, around $1815. Oil prices have come back softer after yesterday’s 1.5%-1.7% gain. Industrial metals are mixed. Iron ore prices rose for the third consecutive session, while copper prices are heavy and have not risen this week. The CRB Index rose yesterday for the fourth consecutive session. |

FX Performance, July 14 |

Asia Pacific

The Reserve Bank of New Zealand met and surpassed the more hawkish shift in market expectations. It announced that its long-term asset purchases were no longer necessary and will stop these operations by the end of next week. Its statement dropped the reference to the need for patience to achieve its dual mandate. The market had been leaning toward a rate hike in November and solidified those expectations today. Some aggressive participants may see a hike at the August 18 RBNZ meeting. Note that at the end of this week, New Zealand reports Q2 CPI. The year-over-year rate is expected to rise to 2.7% from 1.5% in Q1.

Australia reports June employment data tomorrow. The tight border restrictions have helped the labor market recover. It filled 97.5k full-time positions in May but cannot maintain that pace. Sydney’s lockdown has been extended another couple of weeks, but Westpac’s measure of consumer confidence improved from June (1.5% vs. -5.2%). Separately, South Korea, Indonesia, and Malaysia are reporting a record number of covid cases. Meanwhile, Japan’s May industrial output was revised lower. Rather than contract by 5.9% on the month, as initially reported, it fell 6.5%. The BOJ’s two-day meeting starts tomorrow and today’s data reinforces ideas that it will revise down its growth forecast from its previous projection of 4% growth. Elsewhere in the region, South Korea reported its fourth consecutive month of jobs gains, while Singapore’s economy contracted by 2% in Q2, a little more than expected, after a 3.1% quarter-over-quarter expansion in Q1.

The US dollar edged up to a four-day high (~JPY110.70) against the Japanese yen. It clipped the 20-day moving average but has stalled. Recall the dollar hit a multi-week low last week near JPY109.50. Nearby support is pegged around JPY110.20, and there is an option for $415 mln struck at JPY110 that expires today.

The Australian dollar peaked in late Asian turnover near $0.7470 and has been sold toward yesterday’s lows around $0.7430. The low for the year was set last week’s close to $0.7410. The $0.7380 area corresponds to the (61.8%) retracement of the Aussie’s rally since the end of last October.

The Chinese yuan slipped fractionally lower today, its first loss in four sessions. For the first time in several days, the PBOC’s dollar fix was tight to expectations (CNY6.4806 vs. median in Bloomberg’s survey for CNY6.4808). China reports Q2 GDP first thing tomorrow in Beijing. The economy is forecast to have expanded by 1% in Q2 after a 0.6% quarter-over-quarter expansion in Q1.

EurozoneMay’s industrial output fell 1% in the eurozone, and April’s 0.8% gain was shaved to 0.6%. Given the miss in Germany (-0.3% vs. median forecast of +0.5), France (-0.3% vs. +0.8%), and Italy (-1.5% vs. 0.3%), a weak report was not particularly surprising. What may not be fully appreciated is the drag from the auto sector. German auto output fell for a fifth consecutive month in May. The 3.4% drop in capital goods in Germany was led by a 7.2% fall in vehicle output, which is off more than a quarter from pre-pandemic levels. While the shortage in semiconductor chips has been well-document, supply problems extend to steel, copper, wood, and plastics, according to reports. |

Eurozone Industrial Production YoY, May 2021(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

The UK’s June CPI rose 0.5% on the month, more than twice expectations, and lifted the year-over-year rate to 2.4% when owner-occupied costs are included from 2.1% in May. Excluding food and energy, core prices are 2.3% higher than a year ago, up from 2.0% in May. The biggest monthly gains occurred in household goods (1.4%) and transportation (1.3%). Those sectors also saw the largest year-over-year increase (3.3% and 7.3%, respectively). Of the 12 sectors, only food and non-alcohol drinks are lower year-over-year and only housing (1.9%), health care (1.6%), and the miscellaneous category (1.2%) after up less than 2%. The Bank of England meets August 5, and despite the stronger than expected rise in today’s report, there is little in it to challenge the idea that officials subscribe that the price pressures stem largely from the re-opening up of the economy (though masks will be required on the tube after next week’s economy-wide re-opening) and from the base effect.

The euro is trading quietly below $1.18. In fact, without more gains in the remainder of the session, it could be the first since early April that the euro has not traded above $1.18. There is an expiring option today for about 760 mln euros at $1.1810. The euro fell to almost $1.1770 yesterday after the US CPI, and it has held so far today. The year’s low set at the end of March was closer to $1.1700.

Similarly, sterling was sold to $1.38 yesterday, and it is also holding today. It reached the session high near $1.3860 after the inflation report. Resistance is seen in the $1.3880-$1.3900 area.

America

US June CPI soared. The headline and core rates jumped 0.9% to 5.4% and 4.5%, respectively. Despite the claims by pundits, it does not resolve the debate about the durability or transitional nature of the price increases. The fact that it is not only food and energy prices that have risen sheds little light on the debate. The case for it being temporary 1) the price increases are not broad. About two-thirds of the items measured by CPI are up less than 2% year-over-year, and 2) many of the prices that have risen by more than 2%, like rents, airfares, apparel, saw hits last year. The increase in used vehicle prices again accounted for about a third of the June rise in CPI. As we have noted before, the wholesale market for used vehicles appears to have eased, and the consumer market can be expected to follow with a lag. Used vehicle demand is partly a function of fleets (wholesale) and partly a squeeze on the production of new cars and, in particular, a shortage of semiconductor chips. It also seems to reflect the lingering distrust of public transportation (e.g., subways and commuter trains).

The US sanctions on China’s largest chipmaker and the largest chip buyer have added another dimension to what appears to have been a shortage of chips and some inventory management issues. The rise in energy prices is also not simply the result of the pandemic. Supply restraint by OPEC+ and the financial hardship of US shale producers, some of whom survived by selling options on this year’s output, and face a tougher loan market, have played an important role. As we have observed before, the notable caveat is that the last three economic downturns in the US were preceded by a doubling of oil prices. They have done so again since the end of last October. The ECB’s July 2008 rate hike, largely because the price of oil rose to around $160 a barrel, is a good reminder that the threat posed by the dramatic rise in oil prices is not inflationary.

Although Fed Chair Powell will likely be quizzed about the jump in inflation as he starts his two-day semi-annual testimony before Congress (House panel today, Senate panel tomorrow), he will stick to the script that comes from the recent FOMC statement. The Fed has acknowledged that inflation is running higher than it had expected, and that was before the June report. Even if Powell was having second thoughts about the transitory nature of prices, this is not the forum or time to express them. As an aside, at his press conference following the FOMC meeting Powell used lumber prices to illustrate the temporary nature of the price increases. The July lumber futures contract tumbled 12.5% yesterday, its fifth consecutive drop, during which time it has fallen by a quarter to below $600 for the first time since last November.

Powell may be in the hot seat, but Bank of Canada Governor Macklem gets the early attention. Even though Canada lost full-time jobs each month in Q2, the economy is poised to jump out of its slump. After expanding at an annualized rate of 5.6% in Q1, it may have expanded at less than half that pace in Q2. But that is history, and the Canadian economy is set to reaccelerate here in Q3. The median forecast in Bloomberg’s survey is for 9.2% annualized growth, followed by 6% in Q4. The Bank of Canada announced it would reduce its bond-buying to C$3 bln a week at the April meeting and brought forward the closure of the output gap to H2 22. The Canadian dollar peaked in May and early June near $0.8333 (CAD1.20) and since pulled back nearly four cents (CAD1.26), giving back nearly everything recorded in response to the April meeting. While Macklem can softly backpedal if needed, but on balance, many expect him to maintain the forward guidance from April and taper further.

The speculative gross longs in the futures market have been cut by 20k contracts over the past five reporting weeks through last Tuesday to about 70k contracts. This compares to about 48k contracts before the April Bank of Canada meeting. As of the end of June, the bears’ gross short position had dwindled to a four-year low of 22.5k contracts. It rose to 28.7k contracts in the first reporting week in July. The implied three-month vol is around 7%, the upper end of its trading range since the end of Q1. The put-call skew (risk-reversal) favors the USD calls by nearly 1%, the most in a year. This seems to suggest USD calls were bought, likely as a hedge to long CAD exposure.

The US dollar is in a narrow range against the Canadian dollar ahead of the Bank of Canada announcement (~CAD1.2490-CAD1.2525), hovering in the upper end of yesterday’s range. A short-term trendline comes in near today’s high, and a break of it could see the greenback test last week’s high near CAD1.26. A small shelf has been created around CAD1.2440, and its violation could mark the end of the US dollar recovery that began in early June.

The greenback rose to a four-session high of almost MXN20.0820 yesterday and settled above MXN20.00 for only the second time in the past three weeks. The US dollar has come back offered today and is below MXN20.00. Support is seen in the MXN19.80-MXN19.85 band. The Chilean central bank is expected to hike its overnight target rate to 0.75% from 0.50%. June CPI, reported last week, accelerated to 3.8% year-over-year. A little less than half of the Chilean peso’s year-to-date decline of around 5.1% has taken place this month (-2.1%). The US dollar rose to its best level against the peso last week (~CLP759.50) and settled yesterday slightly above CLP750.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Chile,Currency Movement,Featured,federal-reserve,inflation,newsletter,RBA,RBNZ,U.K.