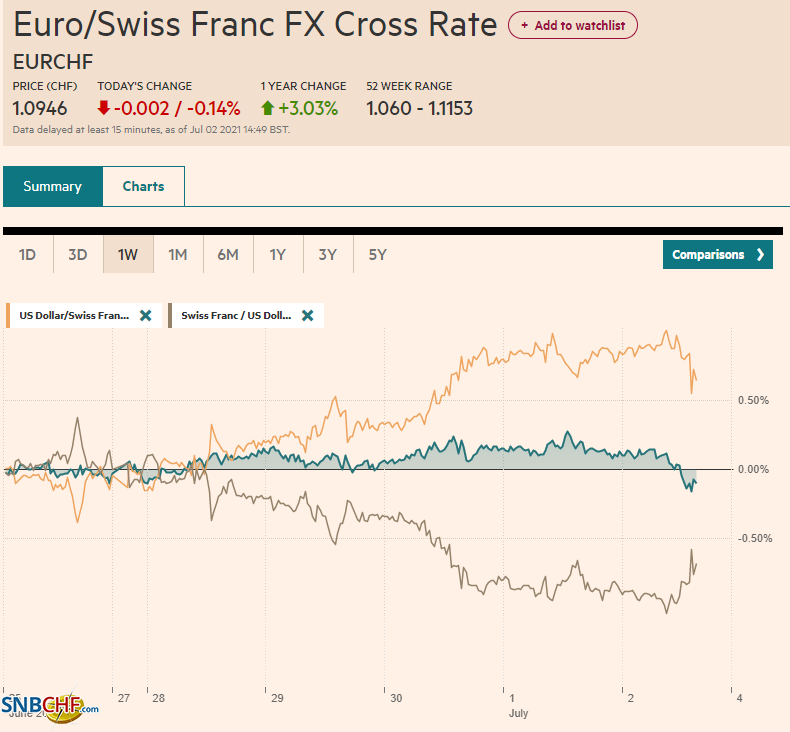

Swiss Franc The Euro has risen by 0.14% to 1.0946 EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging market currency complex, and the JP Morgan index is off for the sixth consecutive session. The Brazilian real is the strongest currency in the world last month and is leading this week’s losses with a 2.25% drop coming into today. Equity markets are mixed. In Asia Pacific activity, Japan, Australia, and

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Canada, Currency Movement, EU, EUR/CHF, Featured, Japan, jobs, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.14% to 1.0946 |

EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

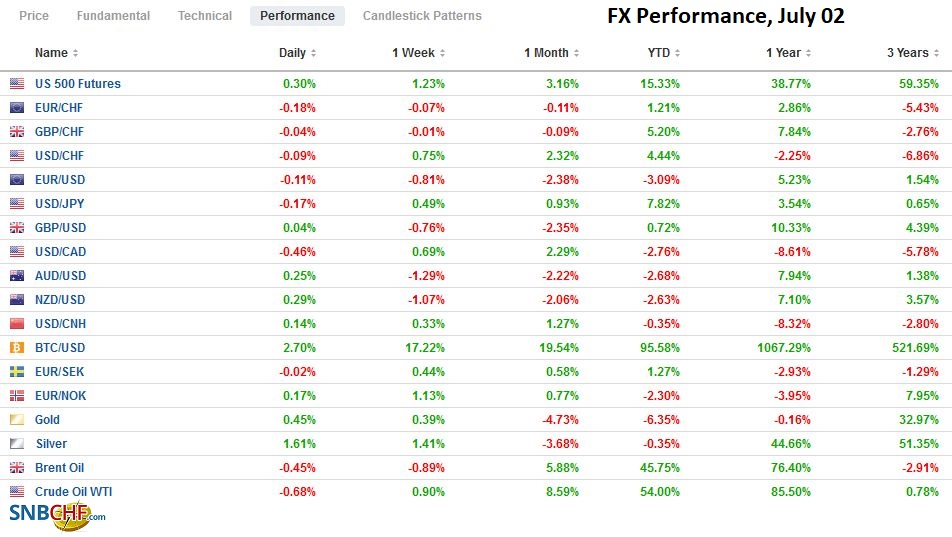

FX RatesOverview: The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging market currency complex, and the JP Morgan index is off for the sixth consecutive session. The Brazilian real is the strongest currency in the world last month and is leading this week’s losses with a 2.25% drop coming into today. Equity markets are mixed. In Asia Pacific activity, Japan, Australia, and India, of the large markets, gained, but the regional index fell on the week. European shares are up and today’s gains, if sustained, point to a small weekly gain. US futures are firm. The US 10-year yield is hovering around 1.44%. It is off for the fifth consecutive session after finishing last week a little above 1.52%. The two-year yield is about a single basis point lower for the week coming into today’s session. Recall that it had closed May near 14 bp and ended June near 25 bp. European yields are off 1-3 bp today and mostly 4-6 bp lower on the week. However, Australia, which has put cities that account for around 80% of the country’s population in new lockdowns, saw its 10-year yield fall four basis points to bring the week’s decline to nearly 11 bp (to about 1.47%). Gold is trading firmly after recovering from a test on $1750 earlier this week. It is now near $1782, just below the high of the week set Monday near $1786. WTI closed above $75 a barrel for the first time in three years yesterday as the OPEC+ deal to boost output by 400k barrels a day for the last five months of the year ran into a glitch as the UAE’s wanted a new baseline for its quota given its expanded capacity. The CRB Index begins today after advancing for the last ten consecutive sessions to new seven-year highs. |

FX Performance, July 02 |

Asia Pacific

Japan’s vaccination rollout has run into trouble. Reports suggest that some cities, like Osaka, are running out of the vaccine and have stopped taking reservations. It is not clear whether it is a distribution problem within Japan or whether there is a shortage. Only about 12% of Japan’s adult population is fully inoculated, the lowest in the G7, where others have fully vaccinated 30%-50% of the adults. Japan hopes to achieve 100% vaccination for its over-65 population by the end of the month.

Australia’s housing market is not just about people buying homes to live in, though owner-occupied loan value did rise by 1.9% in May, which was less than half the increase expected. The bigger move was among investors. Their loan value rose more than 13% in May, the largest monthly increase since April 2015. It was more than twice the median in Bloomberg’s survey. Overall, housing loans rose by 4.9%, the fastest since January. It has averaged a 4.7% gain a month this year after averaging 2.5% in 2020 and 1.3% in 2019.

South Korea’s June CPI unexpectedly fell by 0.1%. It is the first monthly decline since last November. The year-over-year rate slipped to 2.4% from 2.6%, while the core rate was steady at 1.5%. The central bank signaled last month that it intends to raise interest rates this year, and the market has a 25 bp hike discounted for Q3 and leans to the second one in Q4. The policy rate stands at 50 bp, and the small decline in the pace of inflation likely has no policy implication. The central bank meets on July 15.

The dollar edged up to make a new high for the year against the Japanese yen near JPY111.65. There is a $2 bln option expiring today at JPY111.75. The high in March 2020 was about JPY111.70, while the high in February 2020 was near JPY112.25. The greenback settled at JPY110.75 last week, and this is will likely be the fourth consecutive weekly advance.

The Australian dollar remains under pressure. It, too, is at new lows for the year (~$0.7450). There is little chart support ahead of the $0.7400 area. Barring a dramatic reversal, the Aussie will post its sixth weekly loss in the past eight weeks.

The US dollar broke higher from the narrow ranges that have confined it in recent days against the Chinese yuan. It reached a seven-day high near CNY6.4850 today. Last week’s high was a little above CNY6.49. The dollar has risen in four of this week’s five sessions with a net gain of about 0.35%. It is the fifth consecutive weekly increase. The PBOC’s set the dollar’s reference rate at CNY6.4712, a little above the median projection in the Bloomberg survey for CNY6.4704.

EurozoneSlovenia takes over the rotating EU Presidency, but there is no honeymoon. Slovenia Prime Minister Jansa was given no honeymoon. EC President von der Leyen was directly critical of him for curbing media freedom and the independence of the judiciary. Several eastern and central European countries are less liberal than their richer western neighbors and are an ongoing source of tension within the EU. It is not clear the agenda and priorities over the next six months. However, Jansa seems more sympathetic to the investment deal with China that is now on hold, following Beijing’s counter-sanctions on several officials, including a few members of the European Parliament who need to approve the agreement. |

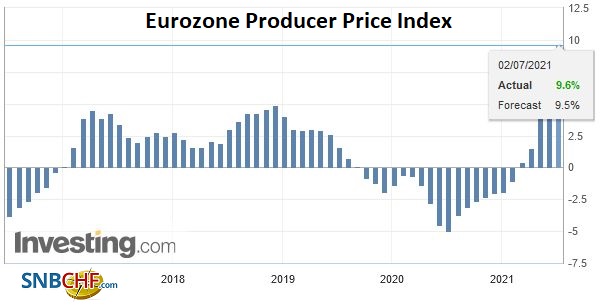

Eurozone Producer Price Index (PPI) YoY, May 2021(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

The Bundesbank’s Weidmann gave a hint on the coming change in the ECB’s inflation target that is now officials close to but below 2%. He advocated a symmetrical 2% target over the medium-term. He argued that the “medium-term” signaled that monetary policy can not immediately or precisely stem price pressures. Separately, the eurozone reported that in May, producer prices rose 1.3% after a 0.9% (originally 1.0%) rise in April. The year-over-year rise stands at 9.6%, up from 7.6% in April. In addition to the final PMI service and composite trading, the eurozone will report May retail sales next week, and the EC updates its economic forecasts.

For the first time since last October, the euro is poised to decline each session this week. It is testing the $1.1820 area in European turnover. It finished last week near $1.1935. A break of $1.18 would bring the year’s low set at the end of March near $1.17 into view. There is an option for 2.3 bln euros at $1.1850 that expires today and another one there next Tuesday for a little more than a billion euros. Still, this would be the fourth weekly decline in the past five weeks, and the technical indicators are over-extended.

Sterling rose on Monday but has fallen in the past three sessions and is slightly lower today, near $1.3755 near midday in London. This will likely be the fourth week in the past five that sterling has moved lower against the dollar and is at its lowest level since mid-April. Initial resistance is seen around $1.3780, but it may take overcoming the $1.3800-$1.3820 area to stabilize it.

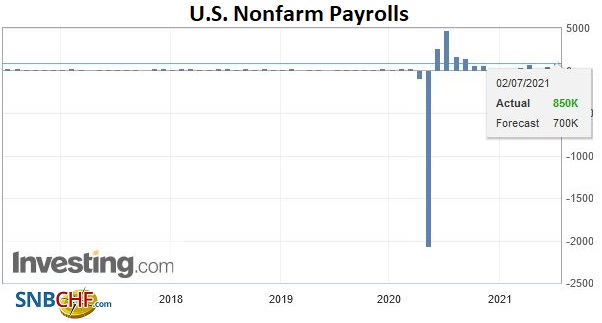

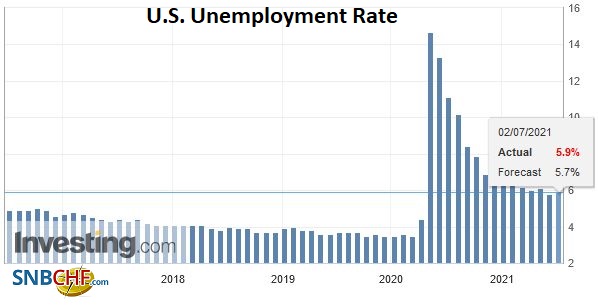

AmericaThe median forecast for the June non-farm payrolls in the Bloomberg survey has crept up to 720k from 700k at the end of last week. It is difficult to understand the significance of a “whisper” number that Bloomberg cites for 800k. If it is a forecast, why isn’t it included in the survey? If it is just a guess by a market participant, why is that important? In any event, the market has been disappointed with the last two jobs reports, and given that evolution of the Fed’s guidance over the last couple of months, it seems clear that its reaction function is not tied tightly to one month’s number. While the focus is on the employment report, the US also reports May’s trade balance (deterioration is expected) and May factory orders. The preliminary durable goods orders report (May 2.3%) steals some of the “thunder” from factory orders. Recall excluding airplanes and defense, durable goods orders fell by 0.1% in May after a 2.7% surge in April. Not to be lost, the US auto sales plummeted to a 15.36 mln unit pace last month. The median forecast in Bloomberg’s survey saw it at 16.5 mln, down from nearly 17 mln in May. This will likely weigh on retail sales and consumption figures. The main problem appears to be supply bottlenecks, not demand. |

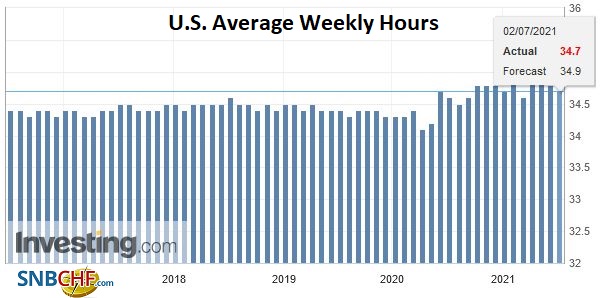

U.S. Average Weekly Hours, June 2021(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge |

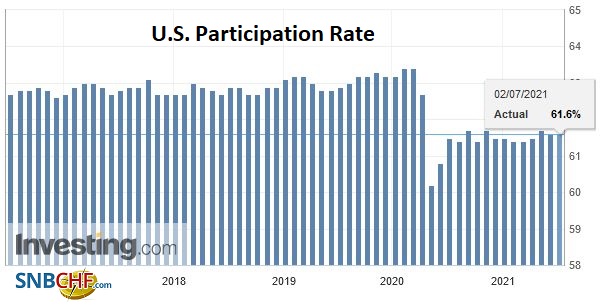

U.S. Participation Rate, June 2021(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

|

U.S. Nonfarm Payrolls, June 2021(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

|

U.S. Unemployment Rate, June 2021(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Separately, finishing its review, the IMF has opined that the Federal Reserve will need to hike rates in late 2022 or early 2023. Looking at the Eurodollar futures market, investors are already there, pricing in at least one hike by the end of next year. The IMF suggested that slowing the Fed’s bond purchases could begin next year. Several Fed officials are sympathetic to tapering this year. The non-partisan Congressional Budget Office updated its forecasts yesterday. It revised up its forecast for this year’s growth to 7.4% (and slowing to 3.1% next year and 1.1% in 2023), and it revised up its deficit projections to incorporate the stimulus legislation since March.

On holiday yesterday, Canada reports May building permits and merchandise trade balance alongside the June manufacturing PMI. The takeaway is likely that the Canadian economy is stronger than the disappointing job loss in April and May suggest. Canada reports its June jobs data next week, and the initial forecasts are coming in around 40k. We note that Canada has a favorable terms of trade shock given the rise in commodities. This year, for example, it has an average of C$407 mln monthly surplus. In the first four months of 2020, the average monthly deficit was C$3.8 bln and C$2.1 bln in 2019.

The US dollar reached a new high for the week against the Canadian dollar near CAD1.2450 earlier today but has backed off in the European morning before challenging last week’s high near CAD1.2490. Nearby support is seen around CAD1.2420, but a break of the CAD1.2360 area is needed to suggest a top is in place. The greenback settled a little below CAD1.2300 last week, and without a dramatic sell-off ahead of the weekend, it is set to close higher for the fifth week in the past six.

The US dollar poked a little above MXN20.08 yesterday and found sellers today near MXN20.05. Since the middle of May, the dollar has alternated between weekly gains and falls. Last week, the greenback fell 4% against the peso to finish near MXN19.8240. A break of MXN19.90 today would put it in a good position to continue to sawtooth pattern by suggesting a near-term dollar top is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Canada,Currency Movement,EU,EUR/CHF,Featured,Japan,jobs,newsletter,South Korea,USD/CHF