Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices. All the major indices weakened. South Korea's Kospi fell to a new marginal low for the year and took the won with it. The Dow Jones Stoxx 600 in Europe is off around 0.2%, and US indices have recouped their earlier losses after yesterday's poor close. The bond market is quiet, leaving the US 10-year yield a little above 1.60%. European yields are softer after, setting new three-month highs. The dollar is slightly lower against most of the major currencies.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, 4.) Marc to Market, Australia, Currency Movement, Featured, Germany, IMF, Japan, newsletter, U.K., USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

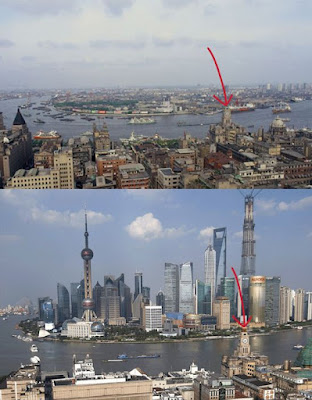

Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices. All the major indices weakened. South Korea's Kospi fell to a new marginal low for the year and took the won with it. The Dow Jones Stoxx 600 in Europe is off around 0.2%, and US indices have recouped their earlier losses after yesterday's poor close. The bond market is quiet, leaving the US 10-year yield a little above 1.60%. European yields are softer after, setting new three-month highs. The dollar is slightly lower against most of the major currencies. Emerging market currencies are mixed. The Turkish lira is at new record lows. Thailand is a standout with a 1.3% gain. The easing of the quarantine and resumption of tourism helped lift the baht to a two-week high. The JP Morgan Emerging Market Currency Index is trying to snap a six-session drop. Before today, it has risen only twice since the FOMC meeting concluded on September 22. Crude oil is firm, but both Brent and WTI are consolidating below yesterday's lows. Natgas is trading lower for the third consecutive session, while coal rose to a new record high in China. Iron ore extended its rally for the fifth session while copper is snapping a three-day advance. A base in gold near $1750 is holding. Ahead of a report from the US Department of Agriculture, core and soy have edged lower.

Asia Pacific

Since the last FOMC meeting, in which the Fed indicated its bond purchases would end around the middle of next year, the dollar has appreciated by almost 4% against the Japanese yen. It traded above JPY113 yesterday for the first time in three years. The next important band of resistance is between JPY114.50 and JPY115.00. A cautionary note comes from the pace of the dollar's rise. It closed above the upper Bollinger Band (~JPY112.95) and is trading above it today (~JPY113.33). Benchmark three-month implied volatility has also been bid above 6.2% to five-month highs and has moved above the 200-day moving average (~5.8%) for the first time in eight months.

The Australian dollar rallied the most in a month yesterday, seemingly breaking out with two successive closes above $0.7300 at the end of last week. The end of Sydney's lockdown and rising commodity prices, especially iron ore, coal, and natural gas, are seen as constructive. However, the speculative market may be leaning the wrong way. The net short speculative position in the futures market has grown without fail since the end of June. Over the 15 weeks until October 5, the net short position has risen from about 17.6k contracts to a record of almost 90k contacts. The $0.7365 area holds the upper Bollinger Band and the (61.8%) retracement of the sell-off since early September.

The dollar reached almost JPY113.50 in Asia turnover before easing ahead of European activity and testing support at JPY113.00. The high in the holiday-thinned North American session yesterday was slightly above JPY113.40. The yen is also softer on most crosses. The Australian dollar is firm but within yesterday's range (~$0.7290-$0.7375). It softened in the first half of the local session before rebounding late, and new marginal session highs were recorded in early European turnover. The greenback edged higher against the Chinese yuan for the second consecutive session. It has solidified its foothold back above CNY6.45. An option there for $1 bln expires tomorrow. The dollar's reference rate was set at CNY6.4447 compared with a median projection (Bloomberg) of CNY6.4441. The yield on China's 10-year bond eased for the first time in five sessions, while the PBOC continues to let the holiday liquidity provisions roll off.

Europe

The UK's strong employment report will keep expectations for a December rate hike at elevated levels. The effect of the end of the furlough program last month is not fully evident in today's data from the ONS, but tax authorities suggest that payrolls rose by almost 210k. In September, ONS reported that jobless claims fell by 51k. The unemployment rate and employment changes are released with an extra month lag and the ILO unemployment rate for the three months through August slipped to 4.5% from 4.6%. It was steady a 3.8% in the last four months of 2019. Employment rose by 235k in the three months through August. Average weekly earnings, including bonus payments, slowed to 7.2% from 8.3% in the three months compared with the year-ago period, while excluding bonuses, the average weekly earnings rose by 4.5% (slipping from 4.6% previously). The implied yield of the December 2021 short-sterling interest rate futures contract stabilized after rising 8.5 bp yesterday on the heels of hawkish BOE comments over the weekend. It stands near 0.345%, having practically doubled since the BOE meeting on September 23.

The German DAX slumped 3.6% last month, its first monthly decline since January. This, coupled with rising energy prices and increasing inflation, seems to sap investor confidence. The October ZEW survey deteriorated and by more than anticipated. The assessment of the current situation slumped from 31.9 in September to 21.6 in October. It is the first decline since February and is the lowest level since June when it last was below zero. The expectations component fell to 22.3 from 26.5. The median forecast in Bloomberg's survey was 23.5. It is the fifth consecutive decline and now stands at its lowest level since March 2020, when it collapsed to -49.5.

Several large European countries, including Germany, France, Italy, and the UK, support IMF Managing Director Georgieva and put the US in a difficult place. The US was seen leaning against her. Traditionally, the head of the World Bank is picked by the US, and the head of the IMF is selected by Europe. But more than that, there have been five managing directors from France. For the US to push for Georgieva's resignation would have likely antagonized France and counter the administration's attempt at a rapprochement after the sub snub. The claim that the IMF gave into Chinese pressure is the Cold War framing of the issue. Saudi Arabia, and, according to Bloomberg reporting, Brazil also successfully lobbied for changes. The change in the Chinese rating from 85 to 78 does not seem material. The larger point is that such indices are pregnant with judgment calls and bias. Only one deeply embedded in liberal and neoliberal ideology could think it is objective. Some issues, seemingly minor, like how many large cities one should include, are not simply neutral methodological points but have a real and knowable impact on the outcome.

The euro continues to trade in narrow ranges. Today's range so far is about a third of a cent. In fact, for the fourth consecutive session, the single currency remains within the range set last Wednesday (~$1.1530-$1.1605). It has not traded above $1.16 since then, nor below $1.1540. Sterling advanced to two-week highs yesterday near $1.3675 but reversed lower and settled below $1.36. Follow-through selling saw it trade at a four-day low, slightly under $1.3570. However, it regained its poise and is straddling $1.36 in the European morning. It is an important level, and options are expiring there today and in the next two sessions.

America

The JOLTS report is unlikely to tell us anything new. There are a huge amount of job openings. The number one reason for keeping people away from work last month was Covid, and it looks as the latest wave has crested. We note that the participation rate of men was unchanged in September, while the participation rate of women fell, which seems consistent with the pattern earlier in the pandemic where the household economy and homeschooling fell more on mothers than fathers.

What has changed is the reaction function of the Federal Reserve. It continues to move toward tapering next month. There continues to be speculation about a second term for Chair Powell. In terms of policy outlook, what is striking is the strong sense of continuity. Next month, the decision to taper will likely be unanimous, especially among the governors where a potential successor (Brainard?) may arise. Moreover, we suspect that Bernanke and Yellen, if they had their previous jobs, would also be leading the Fed to taper. Clarida, Bostic, and Barkin speak today. September CPI figures, minutes from last month's FOMC meeting, and Brainard and Bowman speak tomorrow.

Canada's economic diary is light this week. The drivers of the Canadian dollar are the broad risk appetite and the weakness of equities warns of some consolidation after its recent run. Mexico reports August industrial production figures. After rising 1.1% in July, industrial output is expected to have slowed in August. Finally, Brazil reports August services activity, which is not a market mover typically.

The US dollar fell to nearly CAD1.2445 yesterday, its lowest level since the end of July. It rebounded late as stocks reversed lower. Further gains were scored in Asia that lifted the greenback to almost CAD1.2500 before coming off. It is finding support near CAD1.2460 in Europe. There is a $530 mln option at CAD1.2505 that expires today. Above there, resistance is seen near CAD1.2520. The next important support area is around CAD1.2400. After closing firmly against the Mexican peso yesterday, the dollar climbed a bit further and briefly poked above MXN20.90 for the first time since March. It was offered near midday in Europe and fell below MXN20.80. This seems to be stretching the intraday momentum indicators, and initial support is now seen in the MXN20.70-MXN20.75 area. The dollar also closed at seven-month highs against the Brazilian real slightly shy of BTL5.54 yesterday. Support is pegged near BRL5.50, while the next technical target is closer to BRL5.60.

Tags: #USD,Australia,Currency Movement,Featured,Germany,IMF,Japan,newsletter,U.K.