Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi rivaling only Mao in terms of dictatorial reach. It was traditionally the Premier’s job to look after economic and industrial affairs, stripped instead and place in the hands of more assured loyalists. That is until recently; funny, the timing. As the Chinese economy has lurched into its first modern contraction, it’s as if

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, China, communist china, currencies, economy, fai, Featured, Federal Reserve/Monetary Policy, fixed asset investment, industrial production, Li Keqiang, Markets, newsletter, Retail sales, stall economy, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics?

Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi rivaling only Mao in terms of dictatorial reach. It was traditionally the Premier’s job to look after economic and industrial affairs, stripped instead and place in the hands of more assured loyalists.

That is until recently; funny, the timing. As the Chinese economy has lurched into its first modern contraction, it’s as if Li has been purposefully brought out of hiding and given a seemingly expanded role. China’s savior, or Xi’s foil? Economic guru, or fall guy?

After the events of 2016, the events of 2017 proved it was the latter at least the first time around. Indications so far this time aren’t encouraging.

Earlier this month, the Premier set off a frenzy (in both Chinese stocks and media) when he declared a necessary focus on what he called China’s “stall economy.” By that he didn’t mean the lack of acceleration leading it toward its crash-y demise, as in the aviation term “stall”, rather Li was talking about small businesses who might work out of tiny, cramped street-side stands and kiosks as opposed to those conglomerations populating the glittering modern megaliths of glass and steel.

In the eastern city of Yantai, in Shandong, at the beginning of June Li said, “The street-stall and small-store economy is an important source of employment and human culinary culture — it’s part of China’s livelihood just as much as larger, high-end businesses.”

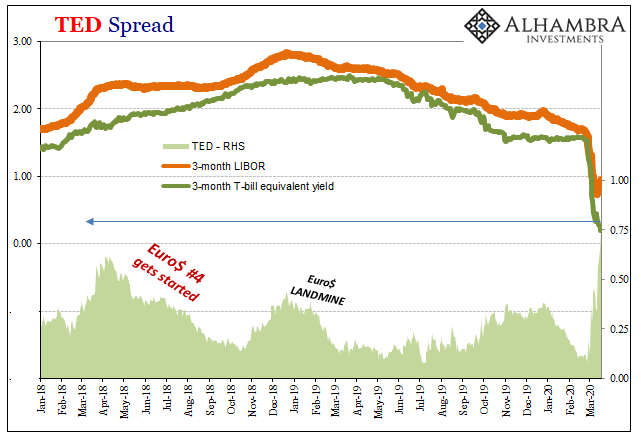

It was a somewhat public admission of hidden joblessness. What is China going to do if lost jobs plus lost growth add up to too much idle labor? For many people in the West, especially Economists hooked on the uneducated words of Jay Powell and his like, they’re still trying to catch up to China in 2017 (to put it simply: globally synchronized growth was a total scam).

Lost jobs and lost growth were 2018-19’s problem; a future that was unsettled and undecided, because of it requiring Xi’s (certainly in Xi’s view) more proven hand, unfettered by any opposition at all. The recession in 2020, however, could mean the future is now.

Communist China, too, also suffers from what amounts to the same Main Street vs. Wall Street divide as we know if but too well. Li could be positioning himself as champion of the “little people”, the forgotten and downtrodden who are almost certainly feeling the worst of this economic downturn. Xi’s government can, and does, rescue the big guys whenever it suits. What about everyone else?

And if the big guys are left to struggle minimally in mere survival mode from here on, then idleness really would be a 2020 issue.

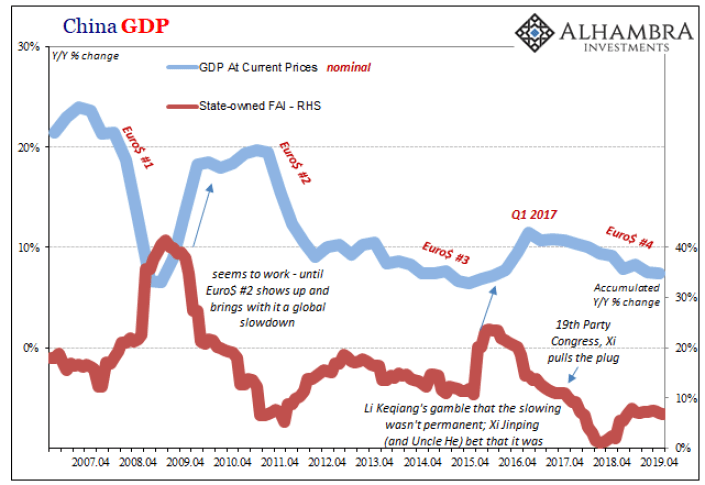

Almost as soon as the term “stall economy” went viral, however, the official backlash began. You never know in China whether Xi is behind anything, just as in 2016 when Li Keqiang donned his Keynes hat and went nuts with fiscal “stimulus” only to be chastised unusually in public by leaked, approved criticism. Given how things turned out, Li was definitely being set up (by the eurodollar system as much as his political rival).

The day after “stall economy” or “street economy” was heard ‘round China, the Beijing Daily, an official mouthpiece, indicated that someone high up was none too pleased (rough translation):

The pressure of the business stalls on urban management, environmental sanitation, and transportation travel is obvious. Dirty streets, fake and shoddy, noise disturbing people, traveling to the streets, traffic jams, unhygienic and uncivilized once the city’s persistent illnesses come back, the previous governance results may be lost to the east, which is not conducive to establishing a good image of the capital and country. Help to promote high-quality economic development.

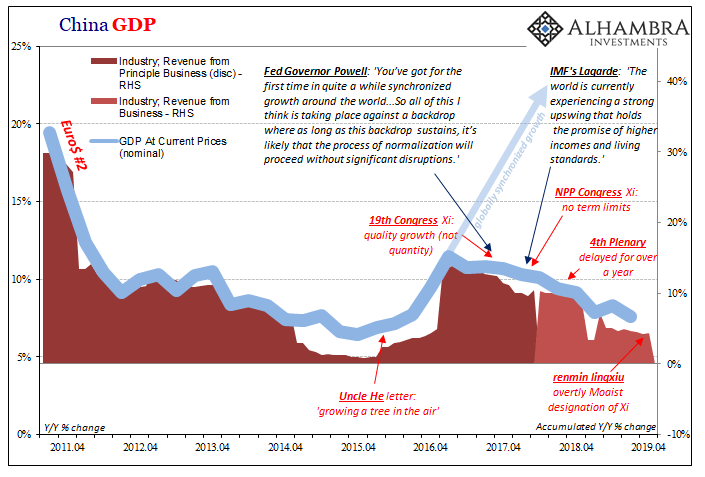

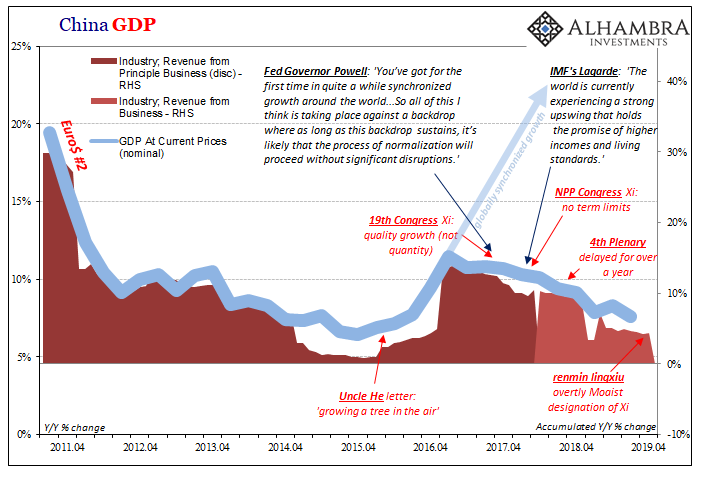

| Notice, particularly, the term “high-quality economic development”; the very buzzword Xi’s takeover mainstreamed all the way back at the 19th Communist Party Congress held in October 2017. Someone in position of authority appears to be saying Li’s “stall economy” does not qualify as high quality.

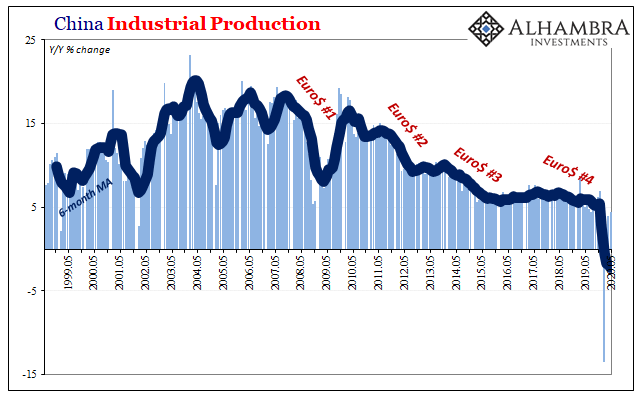

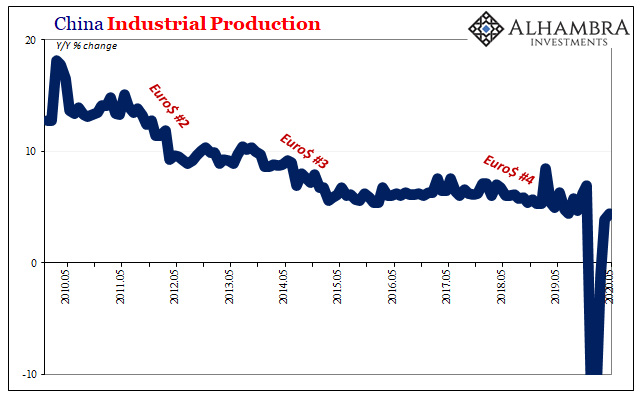

This divide is particularly sharp right now simply because China’s “V” has shown up light on its right, too. The Big 3 economic accounts, Industrial Production, Retail Sales, and Fixed Asset Investment (FAI), continue to languish through May. No robust rebound, not even the fakeness like what’s surrounding China’s import and export numbers (which are tabulated and published by different government bureau). Late last night, US time, the Chinese National Bureau of Statistics reported that IP was up just 4.4% year-over-year in May, not much different than the +3.9% posted last month. If not for the proceeding couple of months, these would be the worst in the entire series. Instead, they qualify as merely closest to the worst; quality status therefore unknown. |

China Industrial Production, 1999-2020(see more posts on China Industrial Production, ) |

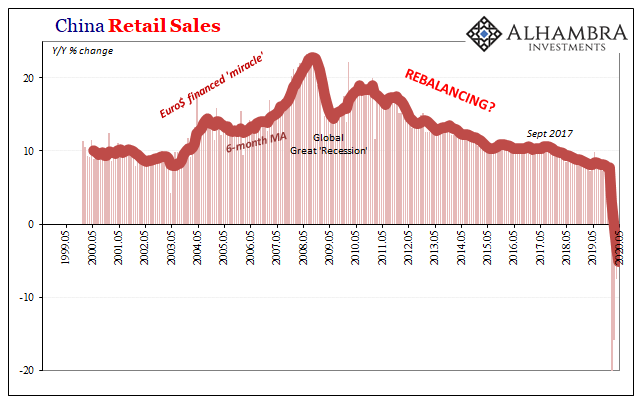

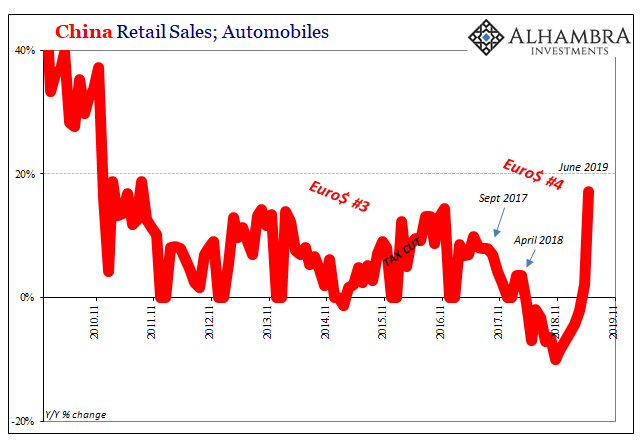

| Consumer spending in May contracted yet again. Before April 2019, retail sales growth had been less than +7.7% on just one occasion back in 2003. When the rate declined to +7.2% last April, it suggested the serious extent to China’s economic woes especially when the feat was matched three more times by October. |

China Industrial Production, 2010-2020 |

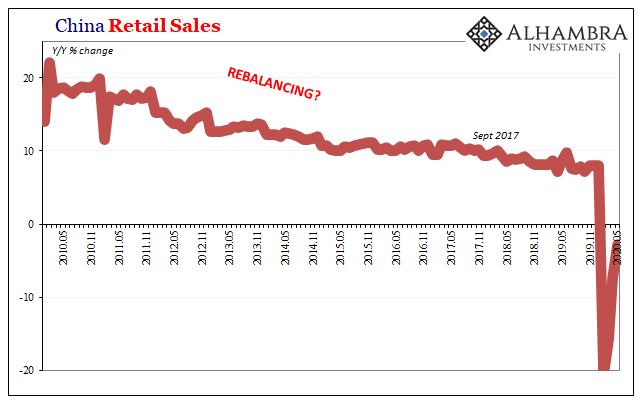

| According to the NBS, after the severe shutdown-related contraction in the January/February period, retail sales continue to shrink. In May, the rate was -2.8% compared to -7.5% in April. The second derivative has changed, but as we know a rebound isn’t always a recovery (in the post-2008 world, it rarely is).

Being ten percentage points behind the previous worst, three months after the trough, is a particularly inauspicious sign, but certainly one that is consistent with trying to take the economy to the streets. |

China Retail Sales, 1999-2020 |

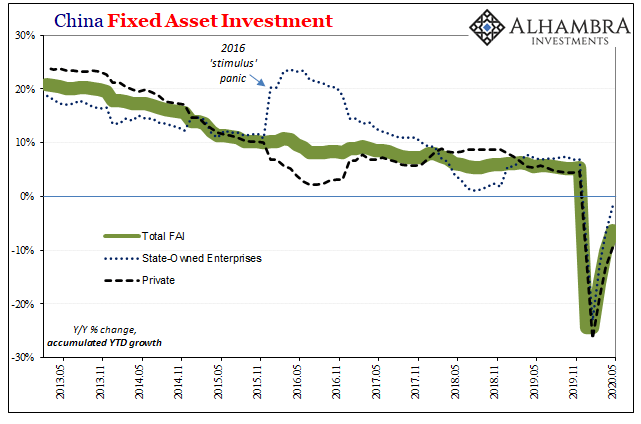

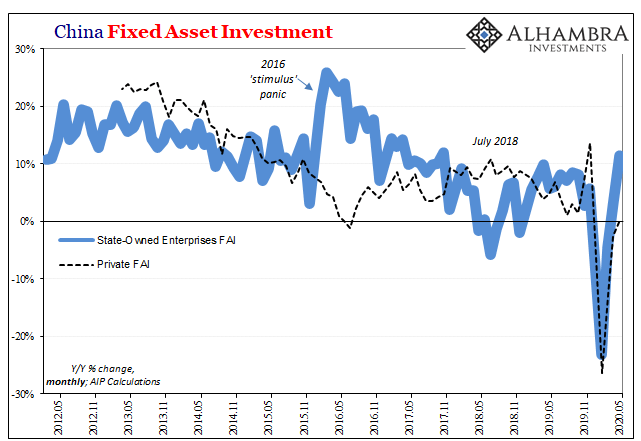

| In terms of FAI, private investment continues to lag while public spending (FAI of State-owned Enterprises) has been ramped up. Cue Li’s public re-appearances. |

China Retail Sales, 2010-2020(see more posts on China Retail Sales, ) |

| The accumulated growth rate for total FAI was -6.3% January through May (compared to the same months in 2019), while the monthly change (year-over-year) was still negative for private FAI (-0.2% compared to -2.6% in April) and double-digit positive, the highest since late 2017, further accelerating for SOE’s (+11.4% in May, +3.6% in April). |

China Fixed Asset Investment, 2013-2020(see more posts on China Fixed Asset Investment, ) |

| Given that it worked out well at least for Xi Jinping the last time around, not so much for China and globally synchronized growth, Li Keqiang may have some use after all. He can promote the idea that China’s Communists are working toward a solution to the plight of the unemployed (many recently), but that starts with recognizing how there needs to be a solution in the first place. Like last time, Li vs. Xi looms against a backdrop of a high degree of uncertainty (to put it charitably). |

China Fixed Asset Investment, 2012-2020(see more posts on China Fixed Asset Investment, ) |

| And if China’s economy fails to live up to such hype, as it did in 2017, Xi Jinping has himself the perfect foil. The “stall economy” pitch stalled, he’ll say, leaving for China the lower levels of growth envisioned all the way back in 2017 (actually 2014); you know, “high quality.”

In China, anyway, Xi’s side has proven the higher the quality the less the quantity. The higher the expected quality, therefore… Both on the street level as well as in all the skyscrapers (empty and not). |

China GDP, 2011-2019(see more posts on China Gross Domestic Product, ) |

China GDP, 2007-2019(see more posts on China Gross Domestic Product, ) |

Tags: China,communist china,currencies,economy,fai,Featured,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Li Keqiang,Markets,newsletter,Retail sales,stall economy,Xi Jinping