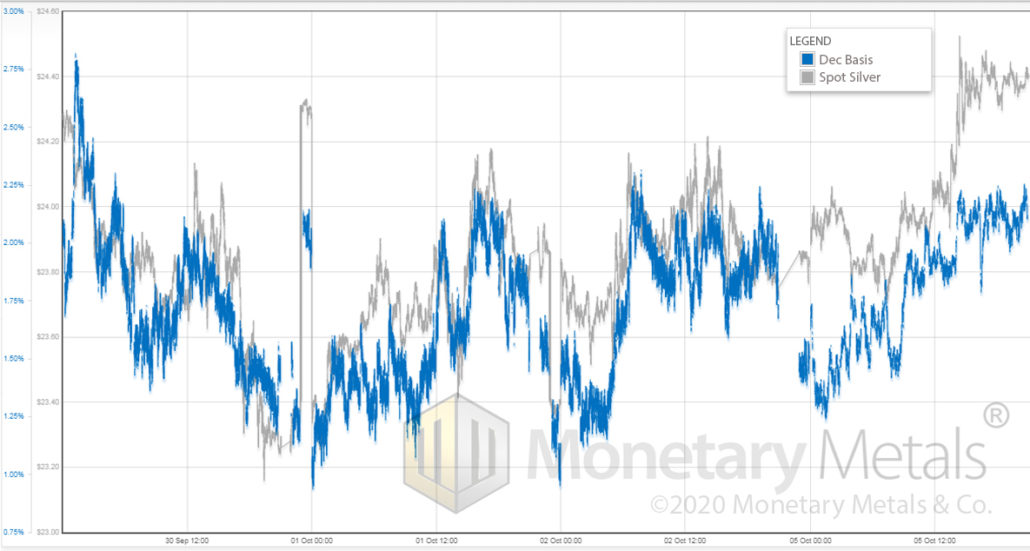

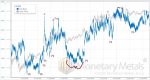

There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution. Let’s take a look: It’s remarkable how the basis tracks the price, until Oct 5. When basis tracks price, this means the action is primarily in the futures market. At times when the price is rising, the basis is rising—which simply means that the spread between spot and futures is widening. At times when the price is falling, the spread between spot and futures is narrowing. Picture a force pushing up or down on the futures price, and the spot price reluctantly follows. It is dragged along by arbitragers. Until Monday October 5. Early in the day, we

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution.

Let’s take a look: It’s remarkable how the basis tracks the price, until Oct 5. When basis tracks price, this means the action is primarily in the futures market. At times when the price is rising, the basis is rising—which simply means that the spread between spot and futures is widening. At times when the price is falling, the spread between spot and futures is narrowing. Picture a force pushing up or down on the futures price, and the spot price reluctantly follows. It is dragged along by arbitragers. Until Monday October 5. Early in the day, we see the basis falling while price is blipping up a bit. This is buying of futures. Then the basis catches up until around noon (London time). Then price continues to rise, but basis does not. From $24.00 to well over $24.40, the basis moved sideways. Buyers of physical silver metal were in the market this day. At the end of the day (Monday Oct 5), the price of silver was a bit higher and the basis—our measure of abundance to the market—was a bit lower. We say “to the market” because people have been accumulating silver for millennia without any apparent limit. So there is no such thing as scarcity or abundance as such in a monetary metal. There is, however, the willingness or reluctance of silver owners to bring it to market. At Monday’s slightly higher closing price, people were slightly more reluctant to bring silver to market compared to last Wednesday’s slightly lower opening price. Supply and demand fundamentals firmed up just a bit. |

Silver Basis and Co-basis and the Dollar Price |

Here Comes the Hate Mail

Every time we write to expose a falsehood proffered by those who claim the prices of gold and silver are suppressed (over a long period of time, by a large dollar value), we get hate mail.

Last week was no exception, as we showed that a criminal conviction for spoofing does not prove that there is a long-term suppression racket. Spoofing does not even help a little, to support the case for price-suppression. We made the analogy of catching a kid stealing candy from the convenience store as not being evidence that his father committed murder.

When we wrote Thoughtful Disagreement with Ted Butler (wow, that was exactly four years ago!) we responded to his collegial tone. And we sought just that: thoughtful disagreement. We presented our data and our argument.

To date, no one has responded substantively. This is the definitive debunking of the claims that banks sell futures short to suppress the price of the metals. And no one has responded.

Aside from cursing, one technique the conspiracy theorists regularly employ is: the pivot.

How They Pivot

We define pivoting as arguing by offering a series of assertions and, when each is refuted, just moving on to the next one. The pivoter has no concern whether his various assertions fit together in a cohesive theory, or even if they contradict each other. The pivoter seems to want to win by sheer quantity, or at least exhaust his opponent. A classic quote fits perfectly:

“Debating creationists on the topic of evolution is rather like trying to play chess with a pigeon — it knocks the pieces over, craps on the board, and flies back to its flock to claim victory.”

When it comes to the persistent belief that gold ought to be $100,000, and the only reason it is a mere $1,900 is manipulation, we have seen this series of assertions:

- Spoofing conviction proves manipulation

- Not-for-profit seller pushes price down, heedless of losses

- For-profit seller pushes price down, to profit from gold owners’ losses

- Sellers sell derivatives

- Sellers sell futures

- Sellers sell actual metal

- Central bank leasing enables selling

- The bigger your position, the more you control the market

- Back in 1960, there was a London Gold Pool

- Back in 1973, a US Treasury official said something

- Keith is just doing some sort of technical analysis

- Keith does not want to know

OK, OK, the last one is not strictly an argument offered to prove manipulation. Though it is offered to defend it, in a sense—“Don’t listen to Keith, he is a benighted fool who doesn’t want to know.”

Even though Keith studied this market for his doctoral work, spent further years developing his theory and model, and money building software to produce the most accurate graphs in the gold market outside a bullion bank (and, we bet, inside a bank too). The Monetary Metals Gold Forward Rate has better than 0.99 correlation to the official London Bullion Market Association GOFO for the years they overlap (1996-2015).

There are some obvious contradictions between a few of the above arguments, such as that short sellers don’t care about profits, but they are doing it to screw gold owners and make $$$.

The claim that they sell actual metal is interesting, because the central banks don’t have any silver. So if this claim were true, they would be able to suppress gold but not silver. In which case, the silver price would be at its rightful level. With gold suppressed, silver would be very high when measured in gold terms. The gold-silver ratio could be 5:1, rather than its recent 120:1 or current 80:1.

Regarding Monetary Metals’ gold basis charts, we must insist that the basis is not technical analysis. Technical analysis purports to predict the future price by looking at past price movement. We are not convinced that this feat of scrying is possible. And it’s certainly not what the basis is about.

The basis is nothing more than the difference between the price of gold in the spot and futures markets.

If gold is priced higher for future delivery than for now, the world is normal. It should cost a bit more to buy gold for December delivery than to buy it for right now—someone has to finance and store it for you in the meantime.

And, importantly to any discussion of manipulation, the most important theory of how they suppress gold is by selling futures. If they are selling futures, then they are pushing down the price of futures. And this is precisely what the basis looks at. Also, if they are selling futures naked, then they have no metal to deliver when the contract reaches maturity.

So, as we previously explained to Mr. Butler, then every other month they would be forced to buy the expiring contract. Then they could short the next one to keep their position.

Buying of expiring contracts is precisely what every contract since 1996 does not show! It is (apologies to Sir Arthur Conan Doyle) the dog that did not bark in the night.

The basis gives insight into supply and demand conditions. Which can help assess the likely direction that prices will move in the future. But it is not technical analysis. The way taking someone’s pulse is not palm reading, though both might predict your future in some way.

Can You Keep a Secret?

Anyone who thinks that it’s possible to maintain secrecy for years (or decades) among a group totaling thousands of people—including bank traders, bank accounting and finance executives, bank internal and external auditors, and a myriad of government regulators—ought to try working on a new movie, car, or electronics product. Leaks and photographs of early prototypes are common.

Heck, when President-Elect Obama met with President Bush before the inauguration, we recall that a detailed list of discussion points was published on the internet before Obama could even get back home. And ths meeting was top secret.

If you have to resort to quoting something a long-dead person said 50 or 60 years ago as your best proof that something is happening today, you are sunk.

Anyways, the point of pivoting is to smoothly flow from one stance to the next, without having to stick around long enough to admit that your king cannot be moved out of jeopardy. Squawk!

We leave with two more quotes:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.” – Upton Sinclair

“It’s Easier to Fool People Than It Is to Convince Them That They Have Been Fooled.” – author unknown, but often attributed to Mark Twain

Tags: Basic Reports,Featured,newsletter