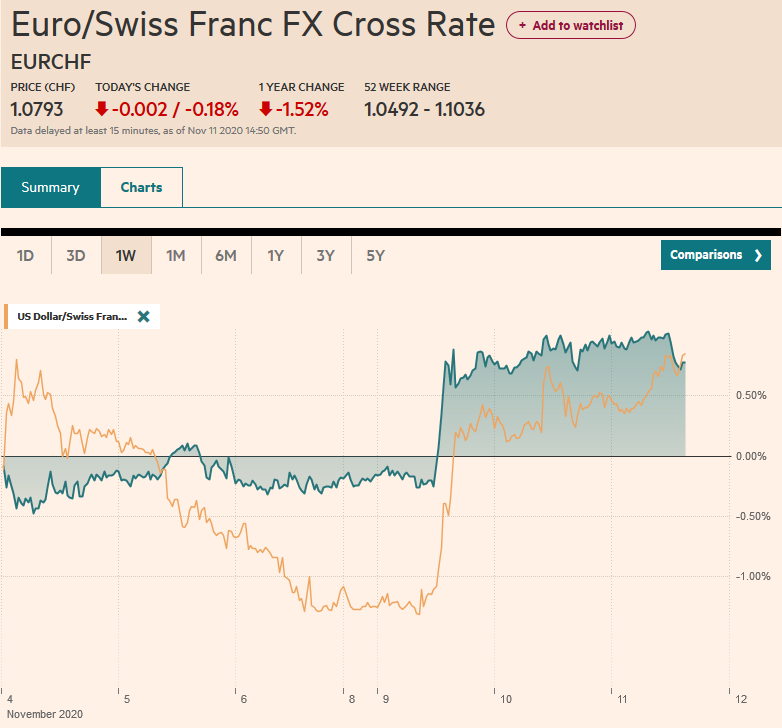

Swiss Franc The Euro has fallen by 0.18% to 1.0793 EUR/CHF and USD/CHF, November 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe. The MSCI Asia Pacific Index rose to new two-year highs in its seventh consecutive advance. During the Nikkei’s seven-day rally, it has gained around 10% to near 30-year highs. Today, Taiwan, South Korea, and Australia rose over 1%, leaving China and Hong Kong in the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, China M2 Money Stock, China New Loans, Currency Movement, EUR/CHF, Featured, New Zealand, newsletter, Turkey, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.18% to 1.0793 |

EUR/CHF and USD/CHF, November 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe. The MSCI Asia Pacific Index rose to new two-year highs in its seventh consecutive advance. During the Nikkei’s seven-day rally, it has gained around 10% to near 30-year highs. Today, Taiwan, South Korea, and Australia rose over 1%, leaving China and Hong Kong in the red. The Dow Jones Stoxx 600 is rising for the eighth session of the past nine, during which time it has risen around 13%. It is at fresh highs since March. US shares are trading firmer, and the NASDAQ is trying to snap a three-day slide. The US cash bond market is closed today, while yields are firmer in Europe and the Asia Pacific. The dollar is mostly firmer, though the Antipodeans are firm, and the New Zealand dollar traded above $0.6900 for the first time since March 2019. Most of the freely accessible emerging market currencies are moving higher, led by the Turkish lira. After falling for the previous six sessions, the JP Morgan Emerging Market Currency Index is higher for the seventh consecutive session. Gold is trading quietly in roughly a $5 range on either side of $1880. Oil is trading higher, and the December WTI contract traded above $42.60 for the first time since early September. If the EIA confirms the API estimate of a five million barrel draw, US inventories would be at their lowest since March. |

FX Performance, November 11 |

Asia PacificThe Reserve Bank of New Zealand offered a new loan facility that will be launched next month (Funding for Lending Program), NZD$28 bln), and left its bond-buying (NZD$100 bln) and cash rate target (25 bp) unchanged. It also delayed the imposition of new capital buffer rules for a second time. The central bank upgraded its economic outlook. The market responded by removing the risk that negative rates are adopted. They had been priced in for next year. Governor Orr was more circumspect. While acknowledging the economy has been more resilient than expected, he was reluctant to eschew any policy option, including negative rates. New Zealand’s 10-year yield jumped nearly 15 bp to 0.85%. The two-year yield jumped 10 bp to 0.18%. The New Zealand dollar’s advancing streak has been extended to the eighth consecutive session. |

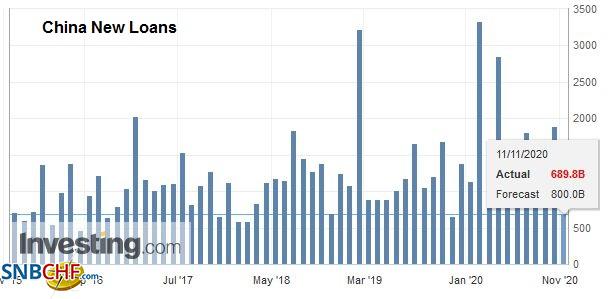

China New Loans, October 2020(see more posts on China New Loans, ) Source: investing.com - Click to enlarge |

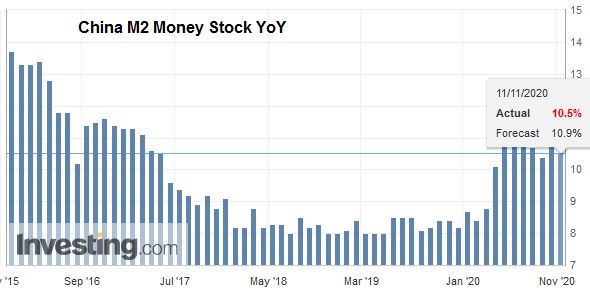

| China’s Single’s Day sales were impressive, but the focus is on the new antitrust action that threatens to curtail the growth of its internet giants like Alibaba. This saw the internet companies sell-off hard today and drag down the major benchmarks. Although Europe and US regulators have begun pushing back against the large US tech companies, Beijing’s actions are catching many investors and observers by surprise. Separately, China reported lending slowed considerably in October. It is difficult to know the extent that the long holiday was the main driver or if the reduced government bond sales part of a larger policy adjustment. |

China M2 Money Stock YoY, October 2020(see more posts on China M2 Money Stock, ) Source: investing.com - Click to enlarge |

A new law in Hong Kong making “patriotism” a requirement for lawmakers disqualified four opposition officials. In response, the entire opposition bloc resigned today. They accounted for 15 seats in the 70-member legislative body. Legislative Council elections were scheduled for this past September but were postponed a year.

The dollar continues to consolidate its large rally on Monday that had carried it to JPY105.65. Today may be the first session in three weeks that the dollar does not trade below JPY105.00. The JPY106.00 area is the next resistance area. On the downside, JPY104.70 corresponds to a (38.2%) retracement objective of Monday’s rally. The Australian dollar is firm, but it is also consolidating and is practically in a 20-tick range on either side of $0.7300. The broader range is marked by Monday’s high (~$0.7340) and yesterday’s low (~$0.7255). The PBOC set the dollar’s reference rate at CNY6.6070, which was in line with expectations. The dollar had fallen to about CNY6.5640 on Monday but, for the most part, has remained above CNY6.60 and below CNY6.64.

Europe

Sterling has been underpinned by the pendulum of market expectations swinging away from negative interest rates. The short-sterling (3-month interest rate futures contracts) futures strip has completely removed negative rates, which previously were seen as likely in Q2 21. UK bills and Gilts out three years still have negative rates. Separately, reports suggest that in a brief call, US president-elect Biden stressed the importance of the Good Friday Agreement and no hard border between Northern Ireland and the Irish Republic. Johnson reportedly pledged to do so, but the Withdrawal Agreement and the new Internal Market Bill would seem to undermine that pledge.

The Recovery Fund has passed a couple of hurdles at the EC and European Parliament. The compromises necessary were mostly anticipated. Now comes the most difficult part. Approval by all the national parliaments is required. The linking aid to the rule of law is clearly targeted at Hungary and Poland, and the former continues to threaten to veto the measure.

Turkey reported a smaller than anticipated current account deficit. The September shortfall was $2.36 bln, about 10% smaller than expected, and the August series was revised to a $4.32 bln deficit from $4.63. Investors are giving the economic team the benefit of the doubt. The lira has recouped about half of yesterday’s losses after the 5%+ rally on Monday in response to the weekend personnel change. The test comes next week when the central bank meets. A hike in the one week repo rather than other funding facilities may be the key to investor sentiment. Dollar support is seen near TRY8.0 and then TRY7.80.

The euro has been sold through yesterday’s low near $1.1780 and continues to look heavy. The $1.1760 area is the halfway point of the rally from the November 4 low near $1.16 to the push to about $1.1920 on Monday. The next retracement (61.8%) is near $1.1725. On the upside, the $1.1810-$1.1830 area offers resistance that may be reinforced by option expirations today. Sterling traded above $1.33 today for the first time since September 4. However, the upside momentum has faded, and a break of $1.3240 could spur a test on the $1.3180-$1.3200 area. Meanwhile, the euro’s losses against sterling have been extended to around GBP0.8865, its lowest level in five months.

America

Although there is much hope in some circles that a Biden presidency would improve the relations with the US traditional allies. We are less sanguine and recognize that substantively there is a bipartisan agreement in several areas. The Airbus-Boeing dispute played out earlier this week, and the EU rejected Germany’s proposal to delay the WTO-approved tariffs. Another bipartisan issue is the opposition to the Nord Stream 2 pipeline. Yesterday, in a rare bipartisan move, the House and Senate agreed to include new sanctions to companies involved with the project (related to insurance and certifications) as part of a defense bill that will be passed by the end of the year.

The US and Canada’s economic calendar’s are light today. While the US equity market and futures are open, the cash Treasury market is closed for Veterans’ Day. The US reports the October CPI and the latest weekly initial jobless claims tomorrow. Mexico reports September industrial production figures today ahead of the central bank meeting tomorrow. Helped by the auto sector’s continued recovery, industrial output is expected to have risen by 0.7% after the heady 3.3% increase in August. The year-over-year contraction may be reduced to -6.2% from -9.0%. Most expect that Banxico will deliver a 25 bp rate cut that brings the overnight target to 4%. Those that do expect a rate cut expect it to be last in the cycle.

The US dollar continues to trade within Monday’s range against the Canadian dollar (~CAD1.2930-CAD1.3070). So far, today is the first session this week that the greenback has not traded below CAD1.30). The better tone in equities and firmer oil prices would usually be supportive of the Canadian dollar, but technically it looks likely to continue to consolidate. During the consolidation, resistance is seen near CAD1.3100. The US dollar is also consolidating against the Mexican peso and remains confined to the range set on Monday (~MXN20.0340-MXN20.5660). The greenback was capped near MXN20.50 yesterday and traded to a low in early Europe near MXN20.2465). Recall that the US dollar spiked to a high last week near MXN22.00. Continued consolidation seems like the most likely near-term scenario.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,China M2 Money Stock,China New Loans,Currency Movement,EUR/CHF,Featured,New Zealand,newsletter,Turkey,USD/CHF