Swiss Franc The Euro has fallen by 0.19% to 1.0688 EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today’s activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei’s 3.5% drop, and South Korea’s 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions. US shares are heavier, with at least a 1.5% loss anticipated at the opening. Bond markets are not responding much to unwind of risk appetites. European

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Japan, China, Currency Movement, Featured, France, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.19% to 1.0688 |

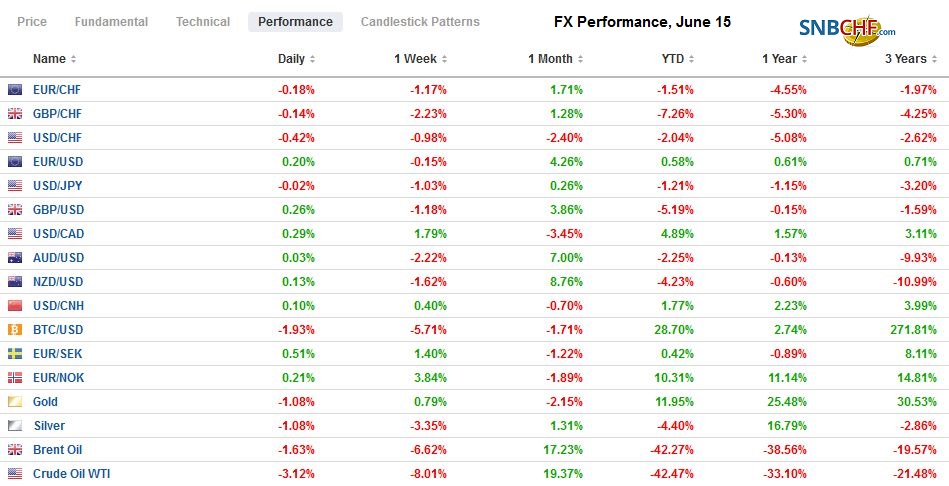

EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today’s activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei’s 3.5% drop, and South Korea’s 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions. US shares are heavier, with at least a 1.5% loss anticipated at the opening. Bond markets are not responding much to unwind of risk appetites. European peripheral yields are off around three basis points and core yields are down around one. The US 10-year yield is 3 bp lower near 67 bp. The dollar is rallying across the board. The yen and Swiss franc are notable exceptions, and the euro is little changed. The dollar-bloc currencies and the Scandis lead the losses, as one would expect in the risk-off mood. Among emerging market currencies, eastern and central European currencies have been aided by the resilience of the euro. The Mexican peso, South Korean won, and South African rand are leading the JP Morgan Emerging Market Currency Index for the fourth loss in the past five sessions. Gold fell to a three-day low near $1710 and the July WTI slipped to a two-week low near $34.35 before steadying. |

FX Performance, June 15 |

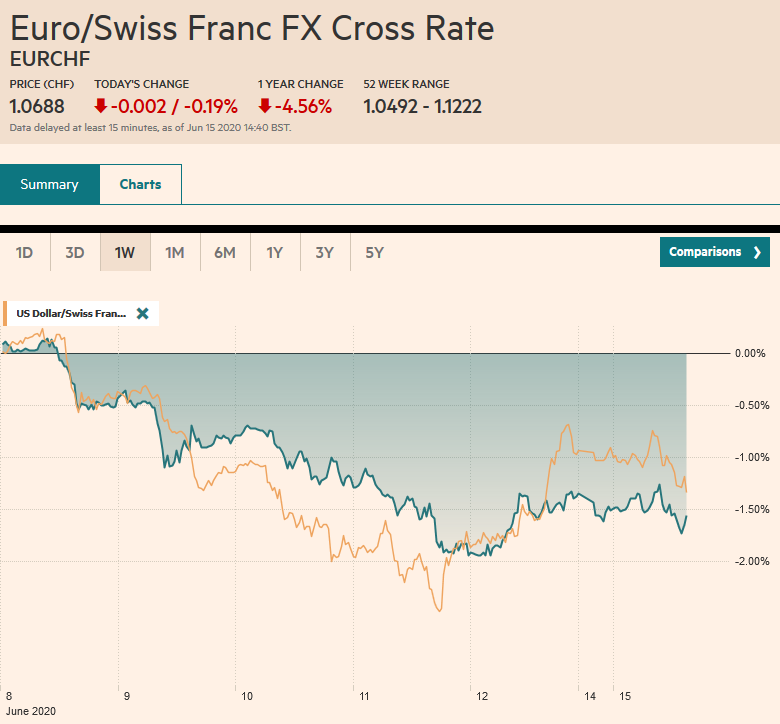

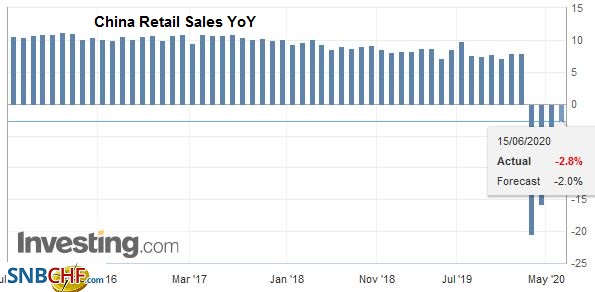

Asia PacificBeijing facing a flare-up in virus cases, closed down the biggest fruit and vegetable supply center and the surrounding neighborhood. Localized lockdowns are more likely than a national shutdown, and various measures show the Chinese economy is recovering. Some economists believe the economy is expanding here in Q2. Nevertheless, more stimulus is expected to be delivered, and its money market operations will be watched closely this week for insight into the setting of the new benchmark, the one-year Loan Prime Rate next week. The PBOC injected funds today via the medium-term lending facility at an unchanged rate of 2.95%, suggesting that officials do not appear to be in a hurry and seem willing to hold off until they believe it can be more effective. In the meantime, lending remains strong as local governments boost infrastructure spending. China’s May economic data showed improvement over April, but the pace disappointed. Industrial output rose 4.4% year-over-year in May, up from 3.9% in April. Economists were looking for something closer to 5%. |

China Industrial Production YoY, May 2020(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

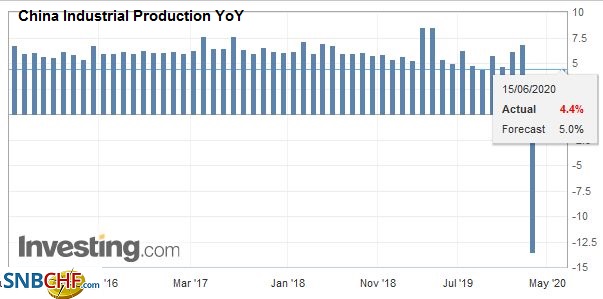

| Retail sales had slumped 7.5% in April and fell 2.8% (year-over-year ) in May. |

China Retail Sales YoY, May 2020(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

| This was a slightly larger decline than forecast. Fixed investment fell 6.3% year-over-year in May after a 10.3% drop in April. Lastly, surveyed joblessness stood at 5.9% after a 6% reading in April. |

China Fixed Asset Investment YoY, May 2020(see more posts on China Fixed Asset Investment, ) Source: investing.com - Click to enlarge |

The Bank of Japan meeting concludes tomorrow. At most, it may boost its support for the corporate bond market. Prime Minister Abe continues to press ahead with fiscal packages incorporate past spending programs as well, inflating the apparent fiscal commitment. Separately, the tertiary index fell 6.0% in April after a 3.8% decline in March. A contraction here in Q2 would be the third consecutive quarter of declining output.

Australia announced it was bringing forward its infrastructure spending. Prime Minister Morrison announced a A$1.5 bln (~1.5% of GDP) new spending, 2/3 of which on shovel-ready programs. The government has previously announced is a A$180 bln 10-year program. This new program is on top of the A$7.8 bln already committed this year.

The dollar recovered from around JPY106.55 to JPY107.60 ahead of the weekend. It pulled back in Asia to test the JPY107.00-JPY107.15 area, where $1.3 bln in options are set to expire today. Buying interest appeared to dry up around JPY107.40. The Australian dollar fell through the trendline off March and May’s lows that came in near $0.6800. It found a bid ahead of the 20-day moving average near $0.6770. The session low does not appear to be in place, and the next target may be near $0.6735. The dollar rose against the Chinese yuan for the third consecutive session, and the PBOC set the dollar’s reference rate slightly lower than the models implied (CNY7.0902 vs. CNY7.0909). Hong Kong Monetary Authority appears to be continuing to intervene to defend the band, and the three and 12-month forward points have edged higher for the third straight session.

EuropeThere are three European highlights this week. First, UK Prime Minister Johnson is to talk with EU President von der Leyen to see if the trade talks can be expedited. Little progress has been reported, and Johnson appears to be renewing his threat to walk away, but rather than now, as has previously been suggested, he will decide again after the summer. Second, this week’s long-awaited TLTRO is at hand. It will make three-year loans for up to minus 100 bp. Negative interest rate loans from the central bank may be a tactic that the BOJ looks at, too, according to reports. The third is the EU Summit, where the EC’s recommendation for a 750 bln euro package of grants and loans will be discussed. Separately, the Norges Bank, the Bank of England, and the Swiss National Bank hold policy meetings. Only the BOE is expected to move, and that is to expand its bond-buying efforts. |

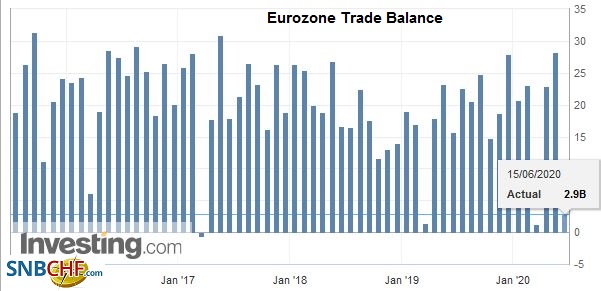

Eurozone Trade Balance, April 2020(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

Italy appears to be under growing pressure to utilize a credit line from the European Stabilization Fund, according to La Repubblica paper. Many Italian officials have weighed in against it because of the conditionality and stigma. However, Prime Minister Conte is seen as having strengthened his hand, and the talk is he could be in a position to negotiate such aid by the end of next month.

France’s Macron made a televised speech to the nation yesterday. No new policies were announced, and the anticipated cabinet reshuffle looks delayed until next month. The government expects the economy to contract by around 11% this year. There have been over 30k fatalities due to the virus as France takes another step toward opening up. Macron apparently was considering calling snap elections, but the latest poll (Elabe) puts his national support at 33%, down from almost 40% in April. Separately, note that after four months, Ireland may have cobbled together a grand coalition (Fine Gael, Fianna Fail, and the Greens).

The euro is consolidating in the lower end of the range seen at the end of last week. It retested the Asian high shy of the $1.1270 level in the European morning and found new sellers. There is a 1.4 bln euro option struck at $1.1260 that expires today. A break of $1.12 targets the $1.1150 area. Sterling extended its pullback and fell to about $1.2455 in late Asia before bouncing almost a cent in early European turnover. The risk is still on the downside, and a break of $1.2450 sees $1.2400 next. The euro is flirting with the upper end of its four-week range against sterling near GBP0.9000, but we suspect it can hold a bit longer.

America

White House economic director Kudlow indicated that the July 31 end date for the $600-a-week extra unemployment compensation will not be extended. This is among the first pieces that mark the peak in fiscal support/income replacement. How this is managed is important for the trajectory of the economy. Fed Chairman Powell made it clear last week the more rather than less support may be required. Still, Kudlow represented a negotiating position. There has been some talk of a bonus payment on the return to work, while others have proposed a reduced amount (~$450).

The first Fed survey for June will be reported today. The Empire State manufacturing survey is expected to rise for a second month but remains well into negative territory. The survey bottomed in April at -78.2 and rose to -48.5 in May. The median forecast in the Bloomberg survey is for -30. It had recorded a low of -34.3 in the Great Financial Crisis. Retail sales and industrial output figures for May are widely expected to show a strong bounce from deep contractions in April. Federal Reserve Chairman Powell begins his semiannual testimony to Congress with the Senate Banking Committee tomorrow. Kudlow, echoing the president’s remarks, said that Powell was “really morose,” and one bank is forecasting a “V” bottom. However, most economists appear closer to the Fed’s view. The Fed’s Kaplan and Daly speak today on the economy.

Canada reports manufacturing sales (April) and existing home sales (May) today. The highlights of the week are CPI (May) in the middle of the week and the retail sales report (April) on June 19. Mexico has a quiet calendar this week. The highlight for Brazil is the central bank meeting (June 17), and a 75 bp cut in the Selic rate (to 2.25%) is likely.

The US dollar’s bullish hammer candlestick on June 10 signaled a low against the Canadian dollar (~CAD1.3315). It finished last week near CAD1.3590 and has seen CAD1.3685 today. This is roughly the (50%) retracement of the greenback’s losses since the May 22 high near CAD1.4050. It is consolidating in the European morning and will likely find support ahead of CAD1.3625. The next upside target is near CAD1.3770 but might have to wait until closer to the middle of the week to see it. The greenback stalled at a similar retracement target against the Mexican peso at the end of last week (~MXN22.92). It is consolidating within the pre-weekend range, but the correction does not look complete, and the next target is near MXN23.25.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Japan,China,Currency Movement,Featured,France,newsletter