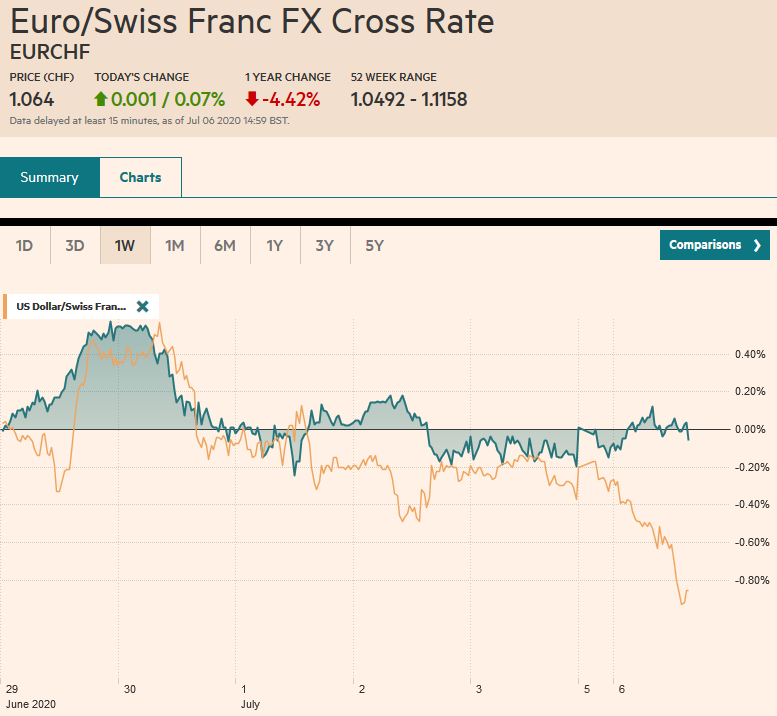

Swiss Franc The Euro has risen by 0.07% to 1.064 EUR/CHF and USD/CHF, July 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new daily high number of contagions globally has been reported, but the risk-appetites have been stoked. Chinese stocks have been on a tear. The Shanghai Composite rallied 5.7% today to bring the five-day advance to 13.6%. Most other regional markets, including Hong Kong, rallied as well (3.8%). Australia was the main exception, and it pulled back by 0.7%. It is still up a solid 3.4% over the past five sessions. European shares are advancing. The Dow Jones Stoxx 600 is up around 1.4% near midday and has gained four of the five sessions last week. US shares are up around 1%,

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Canada, China, China Caixin Services PMI, Currency Movement, Featured, newsletter, RBA, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% to 1.064 |

EUR/CHF and USD/CHF, July 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A new daily high number of contagions globally has been reported, but the risk-appetites have been stoked. Chinese stocks have been on a tear. The Shanghai Composite rallied 5.7% today to bring the five-day advance to 13.6%. Most other regional markets, including Hong Kong, rallied as well (3.8%). Australia was the main exception, and it pulled back by 0.7%. It is still up a solid 3.4% over the past five sessions. European shares are advancing. The Dow Jones Stoxx 600 is up around 1.4% near midday and has gained four of the five sessions last week. US shares are up around 1%, positioning the S&P 500 to open near the pre-weekend highs. Bond markets are little changed. The US 10-year is hovering near 70 bp. Italian bonds are rallying with risk assets, and near 1.22%, the yield is about half of the three-month peak. The dollar is trading lower against nearly all of the currencies. Among the majors, the yen and Canadian dollar are laggards, and in the emerging market universe, the Russian rouble and Indian rupee are heavy. Gold is trading in a narrow band on either side of $1775, and August WTI is straddling $41 a barrel. |

FX Performance, July 6 - Click to enlarge |

Asia PacificPresident Trump has not signed legislation that would sanction Chinese officials involved with the new national security law in Hong Kong. However, the signals from Washington suggest further action will likely be taken in the coming days. Meanwhile, the UK government claims that a turn in the past six months demonstrates the danger China poses and looks to expedite the departure of Huawei from its 5G build-out. Underlying this is the US ban on Huawei, which forces it to use “untested” equipment whose security could be compromised. |

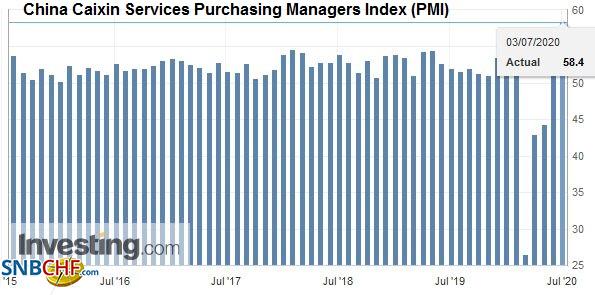

China Caixin Services Purchasing Managers Index (PMI), June 2020(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

The Reserve Bank of Australia meets tomorrow. It is unlikely to take new initiatives. The current policy stance, including targeting the 3-year yield at the cash target rate of 25 bp, appears to be working at the moment. The yield curve control, as has been the case in Japan, seems to require fewer bond purchases than one might have expected to maintain the target.

The dollar continues to find support around JPY107.30. Nearby resistance is seen in the JPY107.80-JPY108.00 area. Three-month implied volatility fell below 6% at the end of last week for the first time in a month before the weekend. There was little reaction to the news that Tokyo Governor and potential Abe successor, Koike, was re-elected to a second term. The Australian dollar is extending its advance for the sixth consecutive session and reached $0.6985, the highest in almost a month. Initial support now is pegged around $0.6950. Last month’s high was set near $0.7060, and its the next important target. The PBOC set the dollar’s reference rate a touch higher than the models suggested. It appears to be a mild attempt to limit the dollar’s decline today. It is off by about 0.5%, which is one of its largest moves in the past three months. Separately, note that China reportedly has tightened the disclosure rules for large withdrawals, a step on the capital control escalation ladder.

EuropeUK Prime Minister Johnson and EU President von der Leyen agreed to accelerated trade talks, but the first round last week ended early. ЕU chief negotiator Barnier cited “serious divergences.” At the same time, BOE Governor Baily warned banks to be prepared in case a negative base rate is adopted. In the middle of the week, the government is likely to announce some new stimulative measures that may include support for the arts and entertainment and, possibly, a temporary cut in the VAT. |

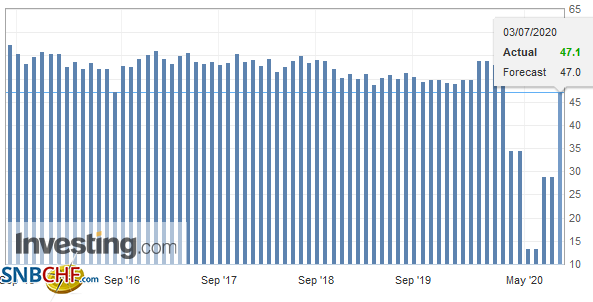

U.K. Services Purchasing Managers Index (PMI), June 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

| German factory orders jumped 10.4% in May after a revised 26.2% drop in April (initially -25.8%). While some observers highlighted that it missed expectations for a 15.4% gain, the broad uncertainty, and the magnitude of changes, which typically as modest, requires wider berth than usual. The takeaway is that the eurozone economy has begun recovering. |

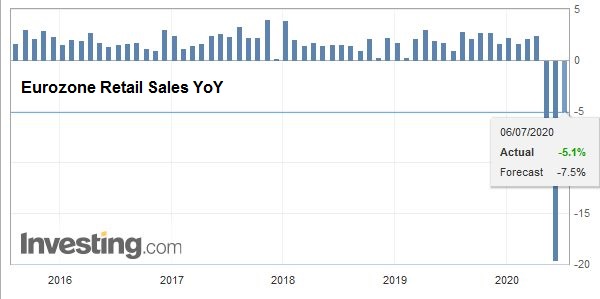

Eurozone Retail Sales YoY, May 2020(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

| It will report industrial production figures tomorrow, and a small double-digit gain is expected. That was the story in Spain, which reported a 14.7% increase in May’s industrial output. It fell 22.1% in April (originally, it was a 21.8% decline). It missed the median forecast on Bloomberg (16.9%), but must still be regarded as a good report. |

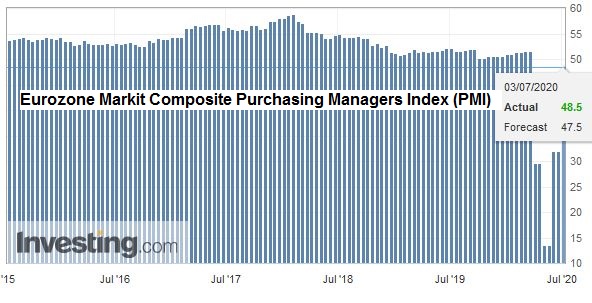

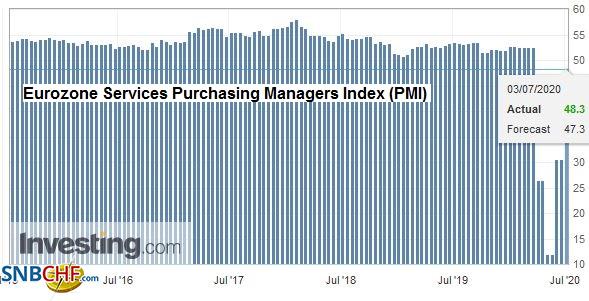

Eurozone Markit Composite Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| The euro poked above $1.1300 as it did on July 2 but again found eager sellers. There did not seem to be any reaction to the new French Prime Minister Castex, who is expected to announce a new cabinet later today. A close above $1.1275 would be constructive from a technical perspective. Above $1.1305, and the next target is near $1.1350. Sterling is continuing to probe the $1.25 area. Last week’s high was about $1.2530, and a move through there targets $1.26. |

Eurozone Services Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

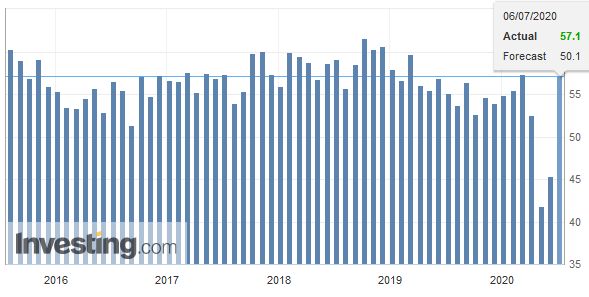

AmericaThe US reports service and composite PMI and the non-manufacturing ISM. The preliminary service PMI rose from 37.5 to 46.7. Another small rise is likely in the final reading. The non-manufacturing ISM is forecast to have returned to 50 from 45.4 in May. The Bank of Canada reports the results of its Q2 business survey, typically not a market mover. Argentina’s government made new proposals over the weekend to restructure $65 bln of dollar debt. It appears to have softened some of its positions to make it a little more attractive for the creditors. The deadline was extended to August. |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Canada’s Trudeau is threatening to skip the USMCA celebratory summit in Washington on Wednesday that Mexico’s AMLO will attend. The virus is one consideration, but the underlying casus belli may be the US threat to reimpose a 10% tariff on imports of aluminum from Canada unless it voluntarily restrains exports.

It is as if the policy response to the crisis has two main challenges: starting them and stoping them. The risk is withdrawing support too early rather than too late. Two fiscal initiatives will expire this month and recall several Fed facilities are to wind down in September. The $600 a week extra unemployment insurance will terminate at the end of July. A week before the moratorium on evictions and foreclosures ends. The House has passed a roughly $3 trillion stimulus bill and an extension of the moratorium through Q1 21. The Senate is on a two-week recess and reconvenes on July 20. While the financial media is giving a broad coverage of the US bank that revised down its Q3 GDP forecast, and it plays on fears that the jobs survey was conducted before the last surge of cases and traffic patterns and credit card usage has subsequently slipped. However, keep in mind the downward revision was from an unrealistic 33% to a still wildly optimistic 25% annualized pace. The NY Fed’s GDP tracker sees a 15.1% contraction in Q2 to be followed by a 10.4% pop in Q3.

The US dollar tested the CAD1.3520 earlier today, its lowest level in a couple of weeks. The greenback bounced in the European morning, but this may provide North American operators with a better level to sell the dollar. Resistance is found near CAD1.3560. The 200-day moving average is a little below CAD1.35, and a break of CAD1.3480 is needed to signal a return to the last month’s low near CAD1.3315. With today’s losses against the peso, the greenback nearly met the (61.8%) retracement objective of last month’s bounce. A break of the MXN22.14 area is needed to maintain the pressure on the US buck. The next immediate downside target is around MXN21.88.

Tags: #USD,Brexit,Canada,China,China Caixin Services PMI,Currency Movement,Featured,newsletter,RBA