If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton. As discussed previously, economic theory always sounds much better than how it works out in reality. The reason is that in “theory,” supply and demand imbalances always revert to previous norms. However, in “reality,” humans rarely act or react, according to theory. We left off in Part-1, discussing the similarities between the U.S. and Japan. Most importantly, while MMT suggests that debt and deficits don’t matter in theory, economic realities have been vastly

Topics:

Lance Roberts considers the following as important: 9.) Real Investment Advice, 9) Personal Investment, Economics, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton.

As discussed previously, economic theory always sounds much better than how it works out in reality. The reason is that in “theory,” supply and demand imbalances always revert to previous norms. However, in “reality,” humans rarely act or react, according to theory. We left off in Part-1, discussing the similarities between the U.S. and Japan. Most importantly, while MMT suggests that debt and deficits don’t matter in theory, economic realities have been vastly different. |

|

The Productive Debt Of WWIILet’s pick up with Ms. Kelton’s views on this issue.

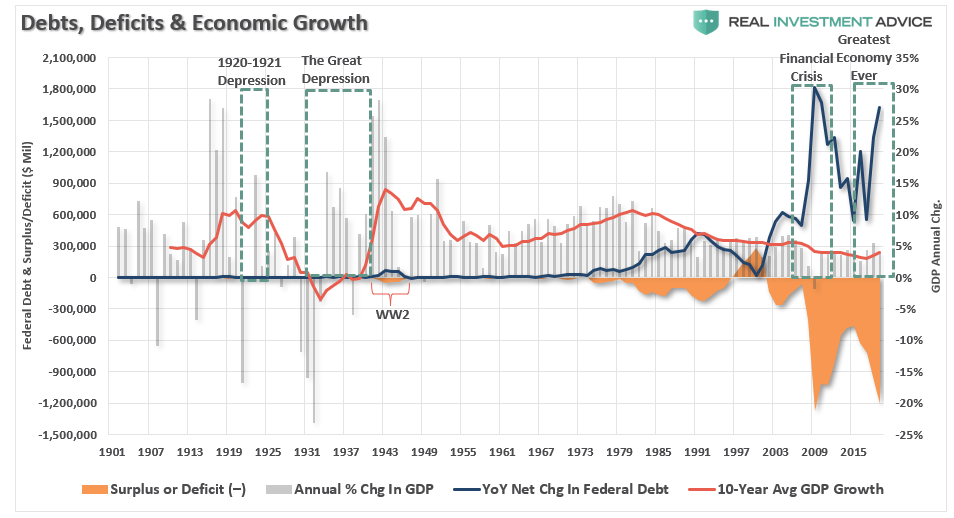

We must address several issues in Ms. Kelton’s recollection of WWII. The first issue is the amount of deficit. If you take a look at a long-term history of our debts, deficits, and economic growth, we can immediately gain some perspective. |

Debts, Deficits & Economic Growth, 1901-2015 |

The Golden AgeAs the U.S. headed into WWII, the Government ran a deficit, which in hindsight is barely visible. Most importantly, the Government did expand its debt burden by selling “War Bonds” to the public. These “War Bonds” were bought by citizens an “investment” to fund the “war effort.” These bonds were a “productive use” of debt. They funded manufacturing and construction projects with every manufacturing facility converted to “war-time” production. Ms. Kelton conveniently forgot to mention that during this period, the 10-year average economic growth ran nearly 15% annualized. Such was not surprising with an entire population with a singular focus of the war effort. While the men signed up to fight overseas, the women left their homes to build planes, trucks, tanks, and jeeps. There was no “excess” consumption as everything from gasoline, to tires, to cheese, was rationed to the general public with everything consumed to feed, clothe, and arm the troops abroad. Ms. Kelton is correct that our grandparents didn’t “squabble” over the debt. There was no need, as the focus of every single worker in the U.S. was “winning the war.” They also knew that when the war was over, the Government would reduce the debts and deficits as it returned to more fiscally responsible measures. Then came the “Golden Age” as the “boys of war” returned home. Following World War II, America became the “last man standing.” After the war, the devastation of France, England, Russia, Germany, Poland, Japan, and others, left them crippled. It was here America found its strongest run of economic growth in history as the “boys of war” returned home to start rebuilding a war-ravaged Europe. But that was just the start of it. The Leap Into SpaceIn the late ’50s, America embarked upon its greatest quest in human history as humankind took its first steps into space. The space race, which lasted nearly two decades, led to leaps in innovation and technology that paved the wave for the future of America. These advances, combined with the industrial and manufacturing backdrop, and low debt ratios, fostered high levels of economic growth, increased savings rates, and capital investment. Currently, the U.S. is no longer the manufacturing powerhouse it once was, globalization has sent jobs to the cheapest sources of labor. Technological advances continue to reduce the need for human labor and suppress wages by increasing productivity. Most importantly, households are highly indebted, and use that debt primarily for non-productive uses. While Stephanie certainly makes a case of running deficits, the evidence is abundantly clear the approach is misguided. Still, the abuse of debt is economically destructive. |

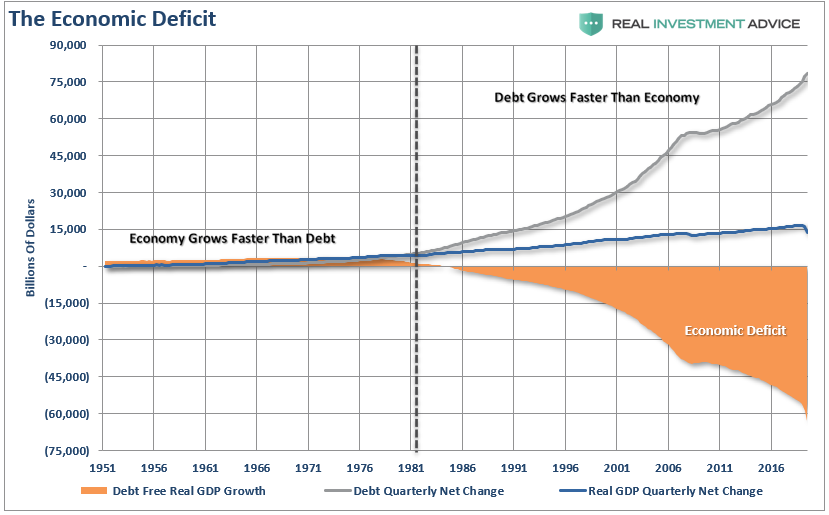

The Economic Deficit, 1951-2016 |

Where The Theory Falls Apart

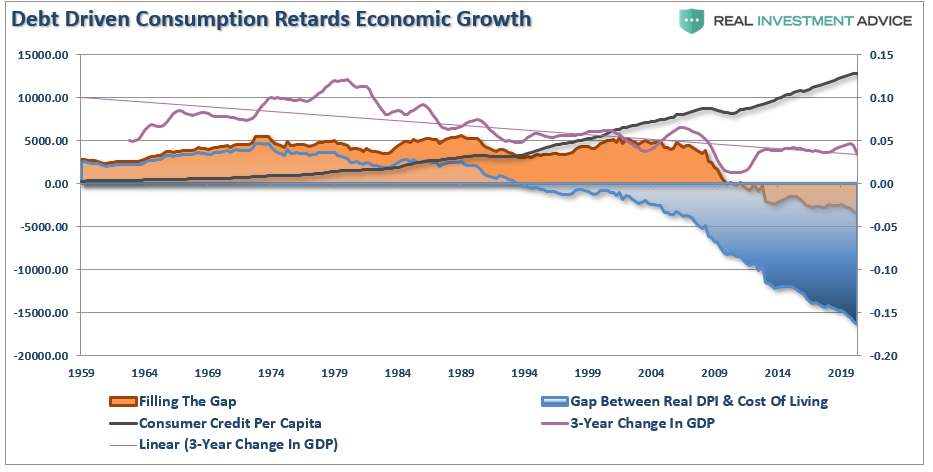

Such is the entire problem with MMT in a nutshell. On the one hand, as noted in Part-1, under the MMT theory, you can run debts and deficits as long as “inflation” is not a problem. However, for the theory to work, you must have a measure of inflation, which is both accurate and not subject to manipulation. Currently, we have neither. Mind The GapHowever, where Ms. Kelton, and almost all economic theories are misguided, is there is a vast difference between “economic theories of inflation” and “actual inflation.” With economic theories continuing to weigh on the economic prosperity of the masses, their ability to absorb higher “costs” has continued to erode over the last 30-years.

|

Debt Driven Consumption Retards Economic Growth, 1959-2019 |

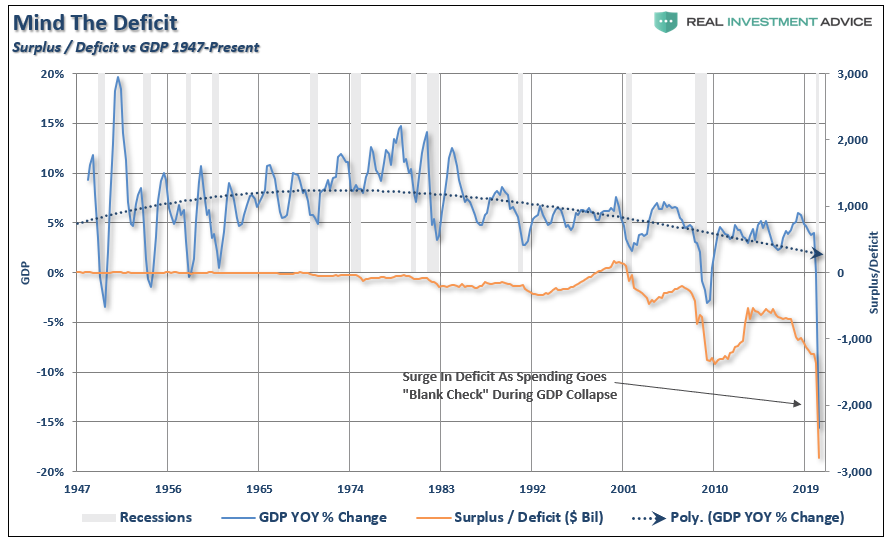

MMT Is Already HereThen, as with all economic theories, you need an “out clause” to continue to justify “socialistic spending.” In this case, Kelton completely contradicts her theory by stating that in the pursuit of your spending goal, “inflation” doesn’t matter. The reality is that MMT is already here. |

Mind The Deficit, 1947-2019 |

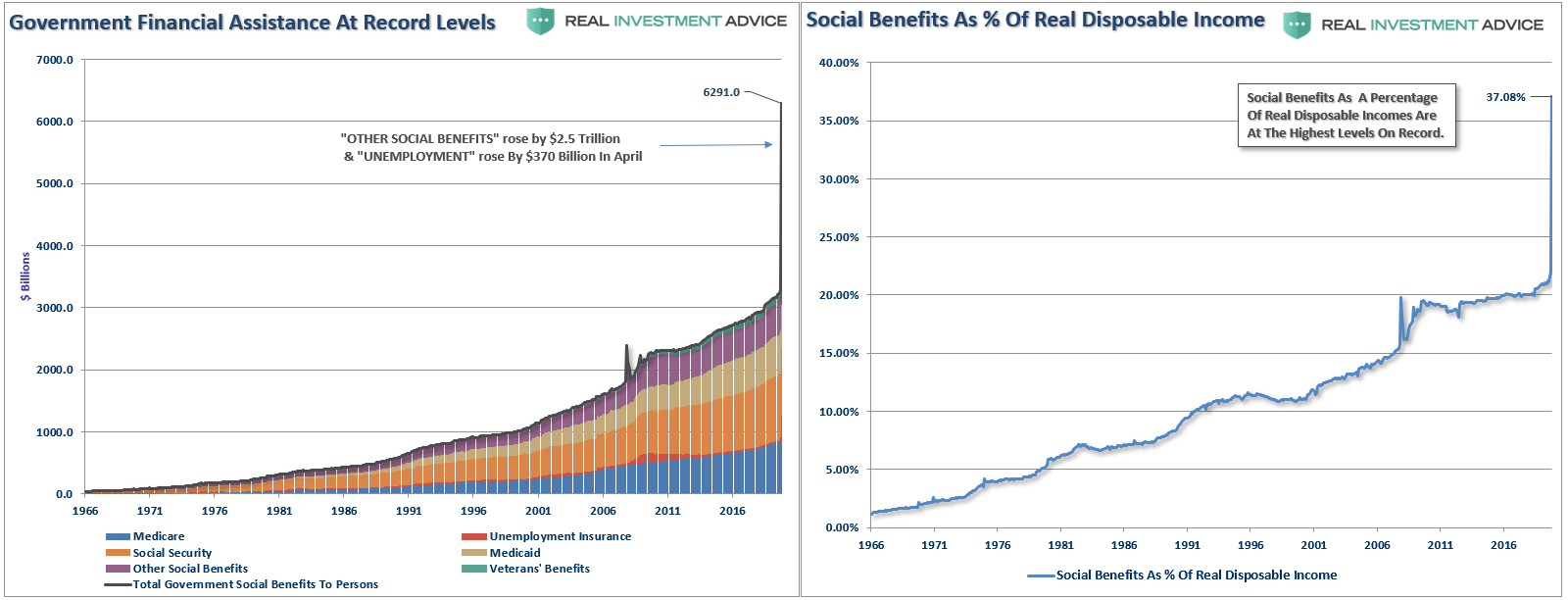

Breadlines In The MailDuring the “Great Depression,” the economically devastated masses would form “breadlines.” Today, the economic devastation is just as real, it is just that the “breadlines” are at the mailbox as the rise of “Social Assistance” skyrockets.

Without government largesse, many individuals would be living on the street. The chart above shows all the government “welfare” programs and current levels to date. The black line represents the sum of the underlying sub-components. Since the onset of the “pandemic,” both unemployment insurance and “other benefits” have surged by $3 trillion along with continued rises in all other benefits, like social security, Medicaid, and Veterans’ benefits. Importantly, for the average person, these social benefits are critical to their survival. Government assistance now makes up ~38% of real disposable personal incomes. With more than 1/3rd of incomes dependent on Federal assistance, it should not be surprising the economy continues to struggle. Recycled tax dollars used for consumptive purposes, has virtually no impact on increasing economic activity. |

Government Financial Assistance At Record Levels / Social Benefits As & Of Real Disposable Income |

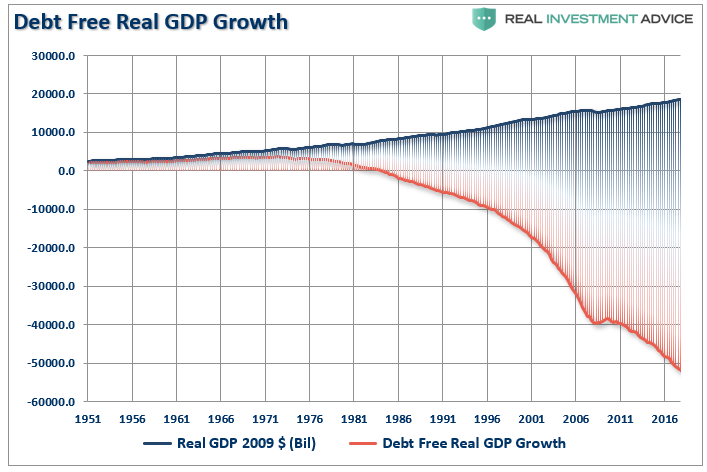

Time To Wake UpMMT is not a free lunch. Individuals pay for it through a reduced value of the dollar and ergo your purchasing power. MMT is a hidden tax paid for by everyone holding dollars. As Michael Lebowitz outlined in Two Percent for the One Percent, inflation tends to harm the poor and middle class while benefiting the wealthy. The inflation problem is masked by the inability to calculate inflation in one meaningful number accurately. Even if you believe everything about MMT, how can you practice it without an accurate reading on its most crucial gauge, inflation? For the last 30 years, each Administration and the Federal Reserve have continued to operate under Keynesian monetary and fiscal policies believing the model worked. However, the reality has been most of the aggregate growth in the economy has been financed by deficit spending, credit expansion, and a reduction in savings. In turn, the reduction of productive investment into the economy has led to slowing output. As the economy slowed and wages fell, it forced the consumer to take on more leverage, which also decreased savings. As a result of the increased leverage, it diverted more of their income into servicing the debt. Without debt, there has been no actual organic growth since the 1970’s. Secondly, most of the government spending programs redistribute income from workers to the unemployed. Such, as Keynesians argue, increases the welfare of the many hurt by the recession. What their models ignore, however, is the reduced productivity that follows a shift of resources toward redistribution and away from productive investment. |

Debt Free Real GDP Growth, 1951-2016 |

MMT Sounds Great In Theory

In its essential framework, MMT correctly suggests debts and deficits don’t matter as long as the money borrowed is spent for productive purposes. Such means that the investments made create a return higher than the carrying cost of the debt used to finance the projects.

Again, this is where MMT supporters go astray. Free healthcare, education, childcare, living wages, etc., are NOT productive investments that have a return higher than the carrying cost of the debt. In actuality, history suggests these welfare supports have a negative multiplier effect in the economy.

Most telling is the inability of the current economists, who maintain our monetary and fiscal policies, to realize the problem of trying to “cure a debt problem with more debt.”

The Keynesian view that “more money in people’s pockets” will drive up consumer spending, with a boost to GDP being the result, has been wrong. It hasn’t happened in 30 years.

Conclusion

MMT supporters believe that if the Government hands out money, it will create more robust economic growth. No evidence supports such is the case.

We fear that MMT, which promises “free everything” with no consequences, instead delivers inflation, generates further income inequality, and ultimately higher social instability and populism. Such was the result in every other country which has run such programs of unbridled debts and deficits.

While MMT sounds excellent at the conversational level, so does “communism” and “socialism.” In practice, the outcomes have been vastly different than the theory.

As Dr. Brock suggests:

“It is truly ‘American Gridlock’ as the real crisis lies between the choices of ‘austerity’ and continued government ‘largesse.’ One choice leads to long-term economic prosperity for all; the other doesn’t.”

The post The Theory Of MMT Falls Flat When Faced With Reality (Part II) appeared first on RIA.

Tags: Economics,Featured,newsletter