Swiss Franc The Euro has risen by 0.08% to 1.0617 EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After shunning risk yesterday, investors re-entered the fray today, and the animal spirits returned. The MSCI Asia Pacific Index snapped a four-day slide, and China’s markets were among the few losers in the region today. Europe’s Dow Jones Stoxx 600 recovered yesterday’s losses in full and is again at record highs. US shares are also trading firmer and are poised to recoup yesterday’s decline. Benchmark bond yields are narrowly mixed today with the European periphery outperforming, as one would expect in a risk-on mood. The US 10-year yield is near 1.54%. In the foreign exchange

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, newsletter, trade, Turkey, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.08% to 1.0617 |

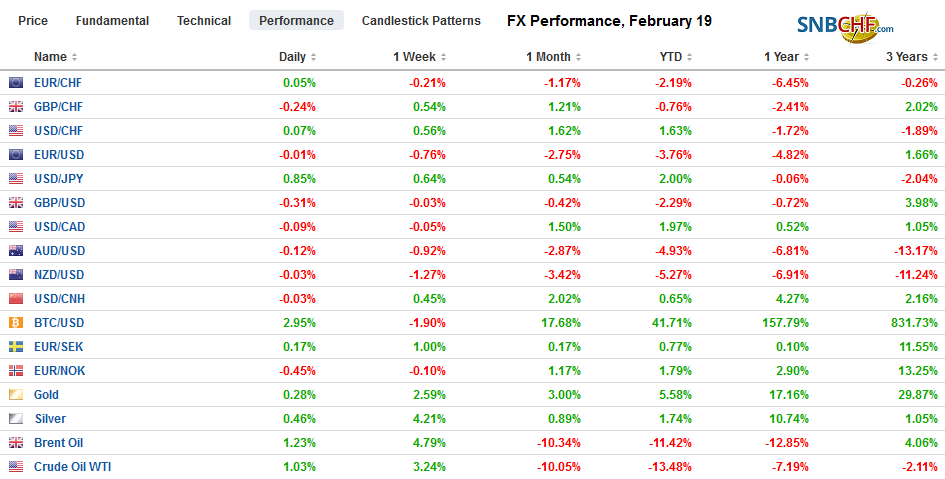

EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After shunning risk yesterday, investors re-entered the fray today, and the animal spirits returned. The MSCI Asia Pacific Index snapped a four-day slide, and China’s markets were among the few losers in the region today. Europe’s Dow Jones Stoxx 600 recovered yesterday’s losses in full and is again at record highs. US shares are also trading firmer and are poised to recoup yesterday’s decline. Benchmark bond yields are narrowly mixed today with the European periphery outperforming, as one would expect in a risk-on mood. The US 10-year yield is near 1.54%. In the foreign exchange market, the dollar is a little heavier against most of the major currencies but the yen and Swiss franc. Emerging market currencies are mostly higher, and the JP Morgan Emerging Markets Currency Index gaining for the first time this week. Gold soared yesterday ($20.5), and it is pushing higher today to its best level since 2013, which seems somewhat incongruous with the risk-on sentiment. Oil prices recovered from early weakness yesterday and are building on those gains to help the April WTI contract reach new highs for February near $52.90. |

FX Performance, February 19 |

Asia Pacific

As reports continue to track a slowing of the rise of new infections of Covid-19, the re-opening of the Chinese economy is being closely scrutinized. Given that the Lunar New Year usually disrupts activity for about a week, some observers think that the virus has meant a tripling or quadrupling of the shutdown. Indeed, varying by industry and province, estimates suggest the country is operating at 25%-40%. This may understate the disruption as reports indicate that small and medium-sized businesses’ ability to pay workers who do return has been severely compromised. There is more talk that the Chinese economy will contract here in Q1.

The first time in about two months, the PBOC set the dollar’s reference rate above CNY7.0. The CNY7.0012 fix was a little above where the bank model’s projected (~CNY6.9988). However, the greenback’s gains were pared, and it finished the mainland session near CNY6.99, which is about 0.1% lower than it settled yesterday.

China’s airlines have been struck hard as both cargoes and passengers have been dramatically reduced. Reports indicate the government is considering injecting cash into the companies and/or promoting consolidation. This is one example of how the virus may change the structure of the Chinese economy. Separately, the government is waiving or cutting social security obligations for firms in the coming months. Small and medium businesses will get a complete waiver for February through June, and large companies are given a 50% reduction until April.

Japanese January trade figures showed improvement from December. Exports fell 2.6% year-over-year after a 6.3% decline in December. Economists had forecast a 7% fall. Imports did not improve as much as expected. After declining by 4.9% in December, imports were forecast to fall by only 1.8% in January but instead contracted by 3.6%. The result was a wider seasonally-adjusted deficit (JPY224 bln vs. JPY107 bln).

The dollar is pushing above JPY110 and to challenge last month’s high near JPY110.30. There are options that expire today and tomorrow at JPY110 ($1.1 bln and $2.5 bln, respectively). The push above there appears to be acting as if stops were triggered. A 4.5-year trendline comes in near JPY111, which may offer the near-term technical target. The Australian dollar is trading inside yesterday’s range (~$0.6675-$0.6715). It is hovering around $0.6700, where an A$2.4 bln option will expire today. There is an A$1.8 bln option expiring there tomorrow too. A move above $0.6750 may be needed to stabilize the technical tone, but it does not look likely today.

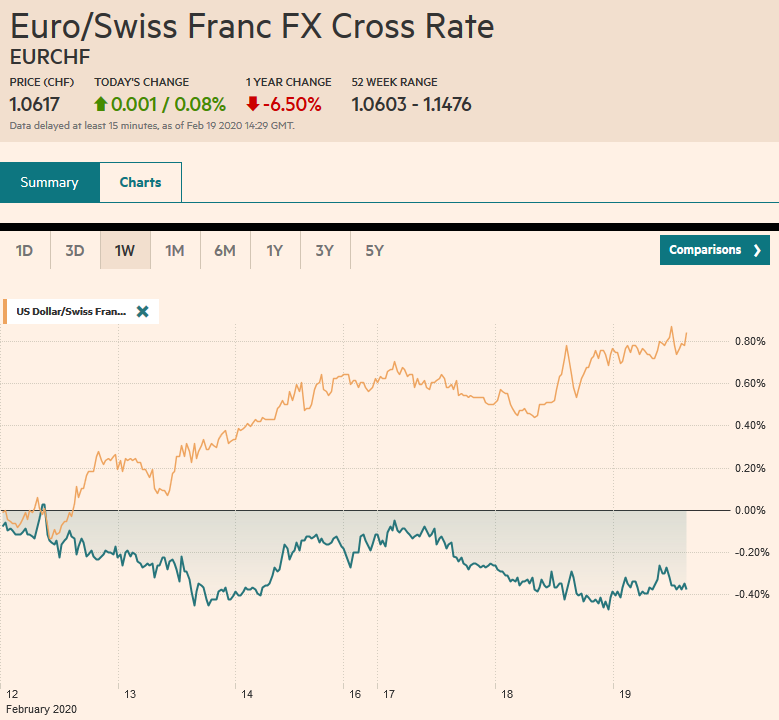

EuropeUK January CPI was firmer than expected. Coupled with ideas that the budget (still to be delivered on March 11) and the resilience of the labor market (though not wages) have reduced the likelihood of a BOE rate cut in the coming months. Remember, Carney, steps down next month. The preferred CPIH, which includes owner-occupied housing costs, rose to 1.8% from 1.4% at the end of 2019. |

U.K. Consumer Price Index (CPI) YoY, January 2020(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

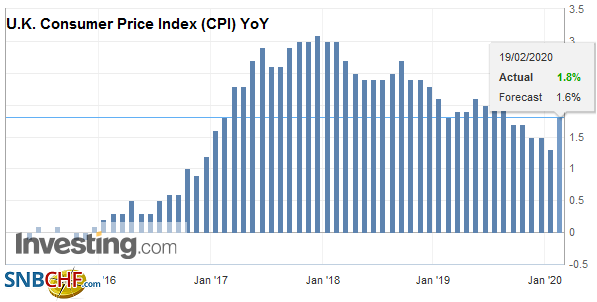

| Much of this is due to the base effect. Consider that CPI itself fell 0.3% on the month, but the year-over-pace increased to 1.8% from 1.3%. The core rate edged up to 1.6% from 1.4%. All these readings were slightly higher than expected. Tomorrow the UK reports January retail sales figures and recovery from December’s declines are forecast. |

U.K. Core Consumer Price Index (CPI) YoY, January 2020(see more posts on U.K. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The EU is trying to reach an agreement on its new seven-year budget, and a decision is hoped for tomorrow. A handful of northern EU countries want to cap it at 1% of gross national income, while the EC has recommended 1.1%, and most countries favor 1.3%. The main economic report of the week is Friday’s flash PMI readings. Sentiment readings had generally been improving, but the significant drop in the December industrial production figures may mean that investors will need something more tangible. That suggests the risk of an asymmetrical response–where investors react more to a disappointing report and than one that is better than expected. |

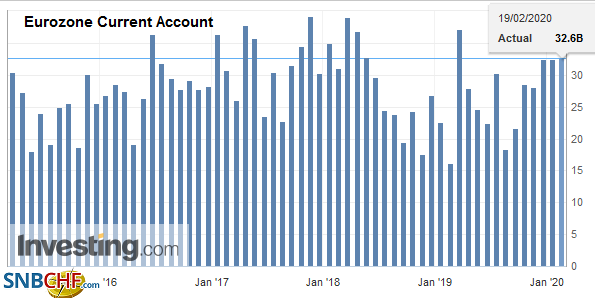

Eurozone Current Account, December 2019(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

Turkey’s central bank delivered its sixth rate cut in the sequence. The 50 bp move (to 10.75%) brings the rate cuts to 13.25%. President Erodgan has consistently called for single-digit rates. The challenge comes from inflation. It is rising. Headline CPI stood at 12.15% in January. It has steadily increased since reaching 8.55% in October. Negative real rates threatened to fuel inflation and a weaker currency. The lira sold off on the news, with the dollar reaching almost TRY6.08. It finished last month near TRY5.96. The lira is off about 2.0% this year, after losing 11% last year.

The euro is in less than a 10-tick range on either size of $1.08. Watch the 5-day moving average (~$1.0820). The euro has not closed above it since February 3. On the downside, the focus remains the lower end of the gap created by the first round of French election results in 2017, near $1.0740. Today there is an expiring option at $1.0785 for 1.2 bln euros that might be in play. North American participants seem to be more euro-bearish than Europeans judging from recent price patterns. For the fourth consecutive session, sterling is recording lower highs. It has not been able to push above $1.3025 today and is struggling to maintain a toehold above $1.30. A break of $1.2950 likely signals a retest on last week’s low near $1.2870.

America

China’s Xi seems to understand what some US officials are still in denial about. Tariffs are paid by importers. China announced it will allow importers to apply for exemptions for nearly 700 types of goods from the duties imposed on the US. The products include farm and energy products (e.g., soy, beef, pork, LNG, and oil) and some medical equipment. The exemptions will be effective for a year. These go beyond the halving of some duties at the end of last week that was in line with the Phase 1 agreement. China has also lifted its ban on importing live poultry from the US. A ban had been in place since the Avian flu (2015). After culling its swine herd last year, millions of chickens are being killed. The lack of food shipments is the main problem, leading to an estimated loss of 1% of the 9.3 bln grown chickens expected.

Meanwhile, the US looks for new ways to limit disengage from China. New restrictions contemplated on Huawei, for example, seemed to have as great, if not greater, impact yesterday than Apple’s warning. The US also announced that five Chinese news agencies were so closely tied to the government that going forward, they will have to operate under the rules that apply to embassies and consulates. Separately, President Trump pushed back against hardliners in the administration, seeking to block the sale of plane engines from a GE-Safran joint venture for single-aisle planes. Trump specifically cited not wanting to overuse the national security “excuse.” He was quoted on the newswires: “I mean, things are put on my desk that have nothing to do with national security, including with chipmakers and various others. I’ve been very tough on Huawei. But that doesn’t mean we have to be tough on everybody that does something.”

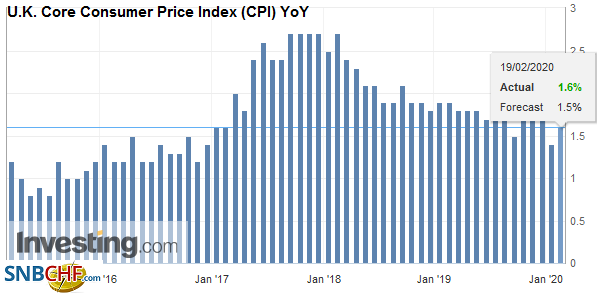

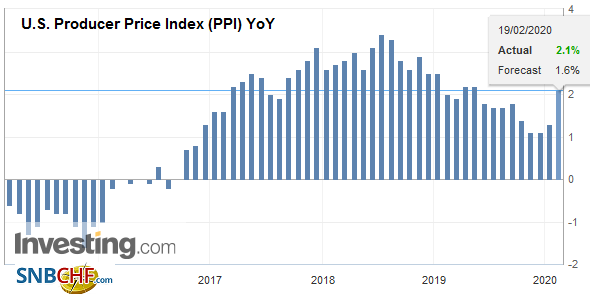

| The US reports January housing starts and permits. There is expected to be pay-back from the nearly 17% increase in December housing starts. Permits, which fell in December, are likely to have bounced back. January headline and core producer prices are expected to have firmed. Late in the session, the FOMC minutes from last month’s meeting will be published. Despite official reassurances that the economy is in a “good place,” the market continues to discount not just one rate cut but is roughly halfway toward pricing in a second one this year. Five Fed officials are also speaking today. Canada reports January CPI figures today. Firm inflation is one of the considerations discouraging the Bank of Canada from cutting rates. No relief is likely with today’s report. The derivatives market anticipates a cut in Q3. |

U.S. Producer Price Index (PPI) YoY, January 2020(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

From a technical perspective, the Canadian dollar looks poised to recover after testing the lower end of a six-month trading range. Today, the US dollar has given back yesterday’s gains, leaving the greenback poised to test the 200-day moving average near CAD1.3215. Below there, initial support is seen near CAD1.3185. The Mexican peso remains resilient. Yesterday’s dip was bought. The dollar is roughly in the middle of the MXN18.52-MXN18.66 range seen in the last couple of sessions. The high real and nominal rates continue to attract carry strategies.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,China,Currency Movement,Featured,newsletter,Trade,Turkey