Markets are reacting badly to upward revisions to coronavirus cases in China The euro fell to the weakest level since mid-2017 against the dollar UK housing data adds to relatively upbeat figures since the December elections Malaysia’s government is joining in the counter-cyclical fiscal effort The dollar is mixed on the day. The yen is 0.3% stronger, briefly trading above the ¥110.0 level on negative headlines about China’s coronavirus infections. The euro and pound are little changed while the Norwegian krone is underperforming (-0.3%) with oil around 2% below yesterday’s highs. Equity markets are lower across most Asian countries, but not dramatically so. The Shanghai Comp was down 0.5% and the Nikkei less than that. The EuroStoxx 600 is down 0.5% and US

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Markets are reacting badly to upward revisions to coronavirus cases in China

- The euro fell to the weakest level since mid-2017 against the dollar

- UK housing data adds to relatively upbeat figures since the December elections

- Malaysia’s government is joining in the counter-cyclical fiscal effort

| The dollar is mixed on the day. The yen is 0.3% stronger, briefly trading above the ¥110.0 level on negative headlines about China’s coronavirus infections. The euro and pound are little changed while the Norwegian krone is underperforming (-0.3%) with oil around 2% below yesterday’s highs. Equity markets are lower across most Asian countries, but not dramatically so.

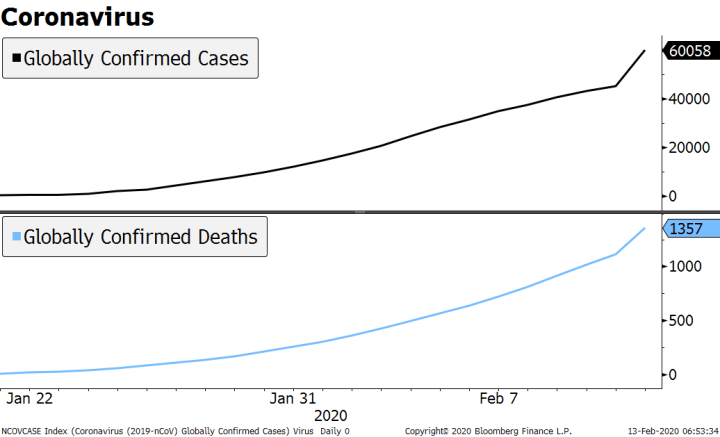

The Shanghai Comp was down 0.5% and the Nikkei less than that. The EuroStoxx 600 is down 0.5% and US futures are 0.7%. US Treasury yields are down 5-7 bps while bund yields are falling some 4 bps. Sentiment took a turn to the worse after a methodology change revealed that Coronavirus cases in Hubei province are much higher than previously thought. This meant an increase of nearly 15K new cases (to around 60K in China) and an additional 242 deaths (now at 1.3K). The silver lining here is that the spike in cases seems to be more about accounting for previous patients rather than an acceleration of the current infection rate. Of note, the Center for Disease Control warned the spread of the disease in the US was “likely,” with now 14 confirmed cases. |

Coronavirus |

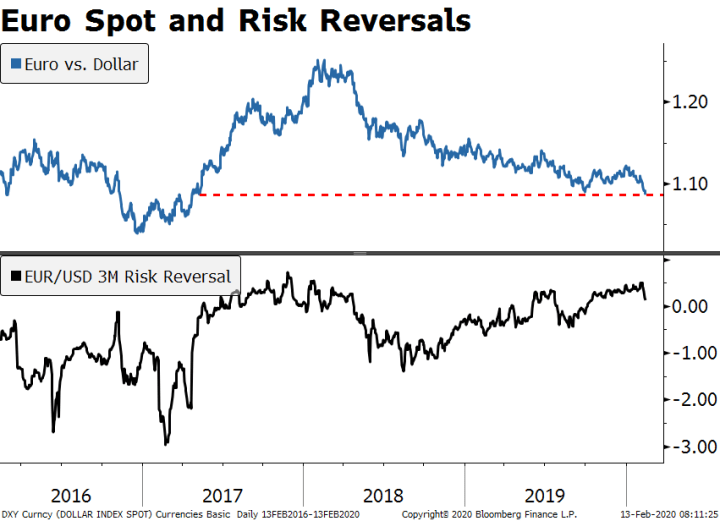

| The euro fell to the lowest level since mid-2017 yesterday, depreciating 3.0% year to date. Despite the impressive price action, options markets are by no means reflecting strong directional views. The 3-month risk reversal, for example, is close to flat, suggesting demand for upside protection against outsized euro moves is about balanced with that for downside.

AMERICAS January CPI will be reported today. Headline inflation is expected at 2.4% y/y vs. 2.3% in December, while core inflation is expected at 2.2% y/y vs. 2.3% in December. PPI will be reported next week, yet we feel that the inflation data is pretty much inconsequential as policymakers face deflationary risks from the coronavirus. Weekly jobless claims will also come out, expected at 210k. The Senate holds confirmation hearings for Fed nominees Judy Shelton and Christopher Waller today. The former is an unorthodox choice, while the latter is very orthodox. Given her past statements on Fed independence and a return to the gold standard, we suspect that Shelton’s path to the Board will not be as smooth as Waller’s. Each will have only one vote on the FOMC, but some believe that President Trump is maneuvering Shelton to be a potential replacement for current Fed Chair Powell. Separately, Fed’s Williams speaks today. |

Euro Spot and Risk Reversals, 2016-2019 |

| Banco de Mexico is expected to cut rates 25 bp to 7.0%. CPI rose 3.24% y/y in January, slightly lower than expected but still the highest since July. Regardless of inflation, growth concerns are likely to drive the policy rate lower this year.

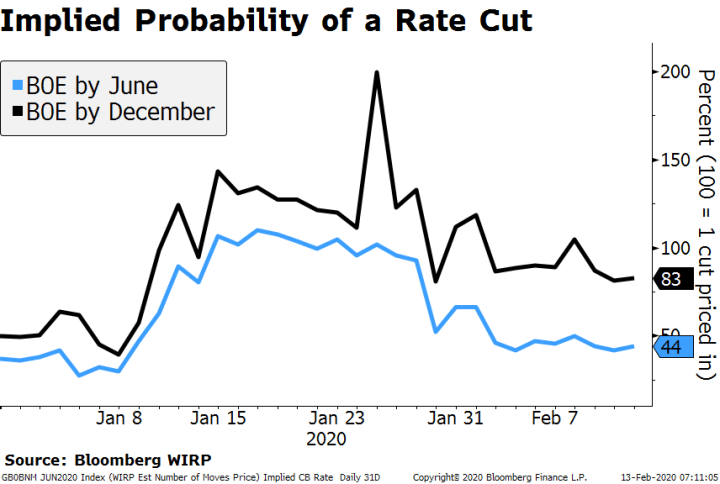

Peru central bank is expected to keep rates steady at 2.25%. CPI rose 1.9% y/y in January, the lowest since September 2018 and in the lower half of the 1-3% target range. The bank last cut rates 25 bp in November. If the impact of the coronavirus intensifies, we look for another cut this year. EUROPE/MIDDLE EAST/AFRICA British house prices rose at the fastest pace in nearly three years (+17% vs expected 3%), continuing the string of relatively upbeat data. The figure confirms that the December elections is leading to a rebound in consumer sentiment. This is in line with our long-held view that despite cautious communication by the BOE, the odds of a cut this year are being overestimated. Implied rates have trimmed some of those cuts, as we had expected, but with nearly a full rate cut priced in for December 2020, there may be still more to go. |

Implied Probability of a Rate Cut |

Elsewhere on the data front, we got better-than-expected jobs data from France and stable GDP growth from the Netherlands. France’s unemployment rate fell to a 10-year low of 7.9% q/q and 8.1% y/y. Netherland’s Q4 preliminary GDP came in at 1.5% y/y, a touch weaker than forecasts and below last quarter’s 1.7% figure, but still holding up relatively well.

ASIA

Malaysia’s government is joining in the counter-cyclical fiscal effort. Reports claim that there will be a new spending package coming early next month to counteract the impact of the coronavirus. The measures will focus on industries such as tourism and manufacturing that have taken a hit from the disruption. The ringgit is little changed today and down 1.2% against the dollar this year – a middle-of-the-pack performance compared to its Asian peers.

Tags: Articles,Daily News,Featured,newsletter