Swiss Franc The Euro has fallen by 0.06% to 1.0513 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares are also trading firmer. Asia Pacific 10-year benchmark yields eased. European yields are little changed, but Italian bonds have rallied after the premium over Germany approached a one-month high yesterday near 235 bp (from 194 bp at the end of last week), apparently triggering a stronger official

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Canada, Currency Movement, Eurozone Industrial Production, Featured, Germany Consumer Price Index, Mexico, newsletter, Oil, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

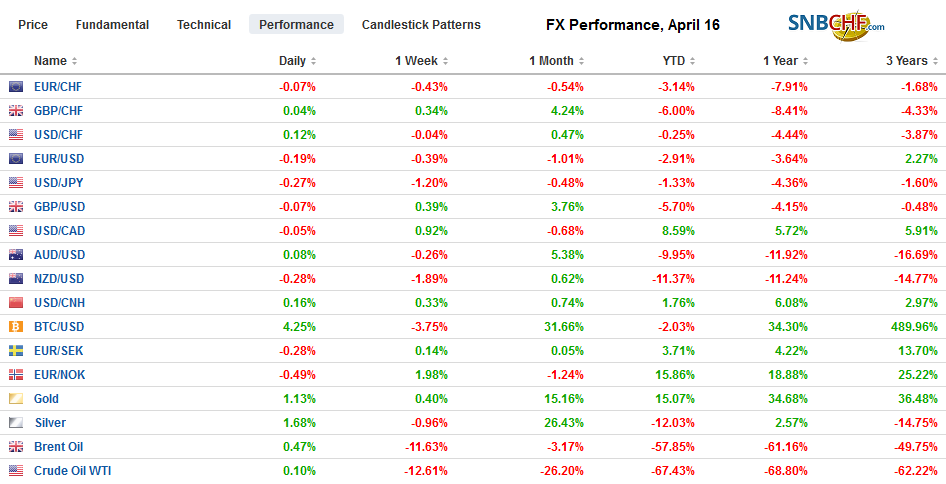

Swiss FrancThe Euro has fallen by 0.06% to 1.0513 |

EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares are also trading firmer. Asia Pacific 10-year benchmark yields eased. European yields are little changed, but Italian bonds have rallied after the premium over Germany approached a one-month high yesterday near 235 bp (from 194 bp at the end of last week), apparently triggering a stronger official response. The US 10-year yield is holding below 65 bp. The dollar firmer against most of the currencies. The Canadian dollar and Norwegian krone are the best performers at little changed levels. Most major currencies are off around 0.25%-0.30%. Among emerging market currencies, the Russian rouble and South African rand are resisting the dollar’s pull, while Mexican peso is nursing losses following the downgrade by Fitch late yesterday. Gold is firm, but within yesterday’s ranges and May, WTI is hovering around $20. |

FX Performance, April 16 |

Asia Pacific

South Korea President Moon Jae-in led his progressive party and allies to a landslide victory, projected to win around 180 seats of the 300-member parliament on strong turnout. It is the first majority in 12-years. Markets were closed yesterday for the election, and there is some catch-up today, accounting for the weaker equity market. There is also some concern that the government will be emboldened to reduce the use of nuclear energy.

Japan is considering extending its state of emergency to a few more prefectures as the contagion rises. Prime Minister Abe appears to be one of the few national leaders of a G7 country that has seen his support falter during the crisis. Moon’s victory in South Korea may encourage Abe to strengthen the government’s response to the crisis.

Australia reported an unexpected increase in jobs in March, defying forecasts for a 30k drop. The country added nearly 6k jobs; all were part-time positions. The participation rate was unchanged at 60%, but the unemployment rate ticked to 5.2% from 51.%. The market seemed to see the data as a bit of a statistical fluke, and the equity market and currency are weaker. Separately, the RBNZ Governor Orr noted that its asset-purchase program can be increased, and he would not rule out negative interest rates. So far, no country with a current account deficit has adopted negative interest rates.

The dollar briefly traded below JPY107 yesterday but recovered today and poked above JPY108 in the middle of the Tokyo session. An option for about $1.9 bln struck there expires today. Above there, resistance is seen near JPY108.15. It may require a push through JPY108.50 to lift the tone, and there is a $2 bln option there that also will be cut today. The Australian dollar’s rally ran out of steam yesterday ahead of $0.6450 and is extending the pullback to around $0.6265 today. A close below there today would signal a deeper correction that could initially target another cent decline. The US dollar’s strength is helping Chinese officials guide it back into the CNY7.05-CNY7.12 range that has dominated activity over the past months.

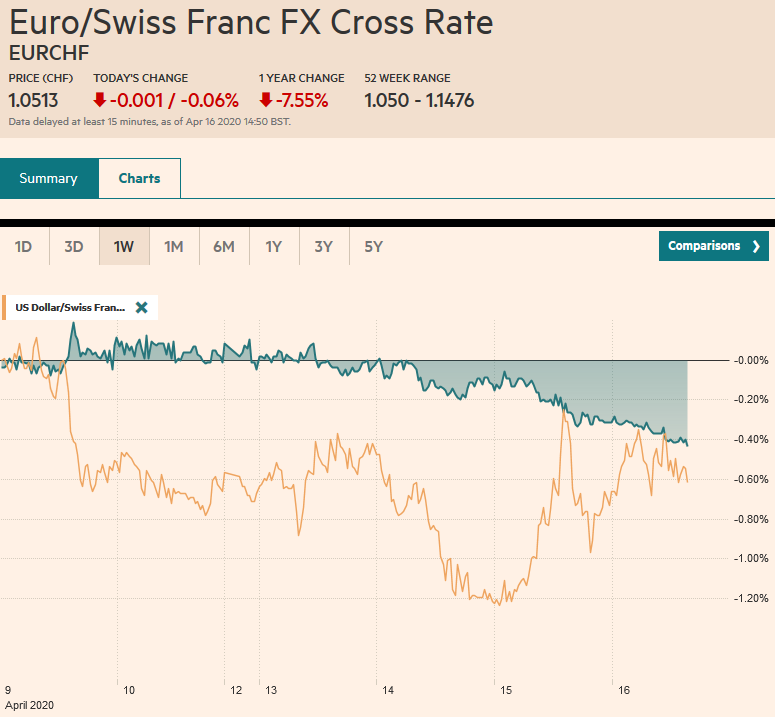

EuropeDespite large bond purchases, the Eurosystem is struggling to contain the Italian yield premium over Germany. The premium rose by nearly 20 bp over the past two sessions to 235 bp, the most since March 18. The yawning premium at the shorter end of the coupon curve was even more dramatic. The three-year premium finished last week near 137 bp and widened to 187 bp yesterday. The dramatic moves appeared to spur official action today, and the three-year spread narrowed to about 166 bp now. The 10-year premium is about 220 bp. |

Germany Consumer Price Index (CPI) YoY, March 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The latest data is riveting. It took about four months to reach one million contagions, and it took about a dozen days to reach the second million. The curves seem to be plateauing in many European centers. The UK is expected to announce shortly it will extend the shutdown into early May. Germany may allow some small shops to re-open next week. |

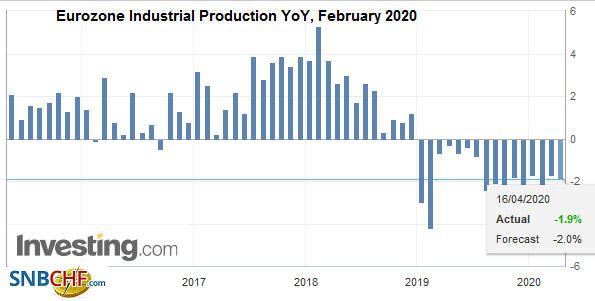

Eurozone Industrial Production YoY, February 2020(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

The euro is in the lower half of yesterday’s range, spending most of the session so far below $1.09. The single currency may be trapped between two sets of large option expirations today. The first set is at $1.0840-$1.0850 for around 1.6 bln euros, and the other is $1.0875-$1.09, which holds roughly 3.9 bln euros. Sterling tested its 200-day moving average (~$1.2655) on Tuesday and tried again yesterday before turning lower. It is consolidating yesterday’s decline that brought it to around $1.2440. Initial resistance in North America may be seen near $1.25.

America

The US reports weekly jobless claims, which continues to be the closest real-time economic read of the world’s largest economy. Delays and overwhelmed state systems suggest a backlog of applications. The Bloomberg survey found a median forecast of another 5.5 mln increase, though the whisper number, as it were, is for over 6 mln. After the markets close, the Federal Reserve will report is custody holdings for foreign central banks. The Treasury holdings have fallen for the past six weeks through April 8. The average weekly decline in March was almost $30 bln a week. In the first two reporting weeks in April, the Fed’s Treasury custody holdings have fallen on average by about $22 bln. Yesterday’s TIC data showed foreign ownership of US Treasuries reached a record high of $7.067 trillion, jumping nearly $210 bln in February.

The EIA estimated that US oil reserves surged by 19.2 mln barrels last week. It was the third week of more than 10 mln barrel build, and US stocks have risen by about 48 mln barrels over this run. Gasoline inventories are also rising strongly. Over the past three weeks, gasoline inventories rose by around 23 mln barrels. Cushing had seen about a third of the new oil holdings flow to it, and industry reports warn it could be maxed out in early May. The OPEC+ agreement does not begin until next month, so Saudi Arabia and maybe some others are trying to get as much into the market as they can before the new output cuts take effect. At the same time, refinery runs are slowing. The Trump Administration renewed its threat to slap tariffs on Saudi oil. Note that other Middle East Oil producers reduced their official selling prices after Saudi Arabia did earlier this week. Taking out a page from a policy used to support farmers, the Trump Administration also suggested that it could consider paying oil producers to leave the oil in the ground. The number of drilled but uncompleted wells has been increasing, and this speaks to the speed to which they could respond to higher prices.

The Bank of Canada extended its asset purchase program to include corporate bonds, provincial debt, T-bills. It offered a sobering assessment of the economy, which it says by the end of Q2, output could be 30% lower than at the end of last year. The government is putting together a package to support industry. Bank of Canada Poloz’s term ends in June, giving him one more meeting. Canada seems to emphasize continuity, and the leading contender is a current deputy (Wilkins) or two former deputies and now no longer at the central bank.

Fitch cut Mexico’s sovereign rating to BBB-, the lowest of investment grades. The outlook remains stable. It is the lowest of the big three rating agencies. S&P had cut to BBB and a negative outlook last month. Moody’s is the outlier. Its A3 rating is the equivalent of A-. Its most recent review was last June.

The poor equity performance yesterday, the drop in oil prices, and the somber outlook of the Bank of Canada as it expanded its operation saw the Canadian dollar slump. The greenback rose to about CAD1.4130 from about CAD1.3860. It is consolidating in a narrow range now. A move above CAD1.4165 would likely target the CAD1.4265 area initially. The Mexican peso remains under pressure, and the US dollar rose to about MXN24.43 to extend yesterday’s recovery (from about MXN23.37) following the downgrade. Nearby resistance is seen near MXN24.52.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Canada,Currency Movement,Eurozone Industrial Production,Featured,Germany Consumer Price Index,Mexico,newsletter,OIL,South Korea